DeFi lending platform Liquity Protocol has secured $6 million in Series A funding to expand its on-chain borrowing services, underscoring the continued growth of cryptocurrency loans. The funding round was led by Pantera Capital, a crypto-focused venture capital firm, with additional contributions from Nima Capital, Alameda Research, Greenfield.one and IOSG, the company announced Monday. Angel investors including Meltem Demirors, David Hoffman and Calvin Liu also contributed to the raise. Liquity has raised $6M in Series A funding led by @PanteraCapital. Read the full announcement here: https://t.co/OhqrKT8N9x — Liquity (@LiquityProtocol) March…

Tag: funding

China Evergrande Group to Raise $2B in Pre-IPO Funding for Its Fangchebao (FCB) Unit

According to the company, the proposed $2 billion to be raised for the Fangchebao unit will be used to bolster its financial positioning. China’s second-largest property developer China Evergrande Group (HKG: 3333) has revealed it will be selling a 10% stake in its Fangchebao (FCB) unit, its online real estate, and automobile marketplace ahead of an anticipated Initial Public Offering (IPO), in a so-called pre-IPO round. As reported by Reuters, the proposed stake will be sold to 17 investors in a deal that is expected to bring in about HK$16.35…

Avanti Financial Raises $37M in Series A Funding Round Ahead of Its Launch

Avanti Financial Group seeks to become the second crypto company after Kraken Financial to acquire a full banking charter in the United States. Avanti Financial Group, a digital asset bank, announced on Thursday that it has completed its Series A funding round with $37 million, bringing its total raised capital since inception to $44 million. According to the company, the funds will be used in various projects including regulatory compliance, operational expenses, and also engineering services. Avanti Financial CEO Long on the Funding In a statement during the announcement, Caitlin…

Crypto-focused software firm Lukka raises $53M in funding round

Just a few weeks before the filing deadline for U.S. taxpayers, cryptocurrency accounting and data company Lukka said it had raised an additional $53 million in a new funding round. In an announcement today, Lukka said it had completed a $53 million Series D funding round led by Soros Fund Management — a fund created by billionaire investor George Soros — S&P Global, and accounting advisor CPA.com. Lukka said it planned to add additional features for customers dealing in derivatives, DeFi products, and other products of the crypto space. “Innovation…

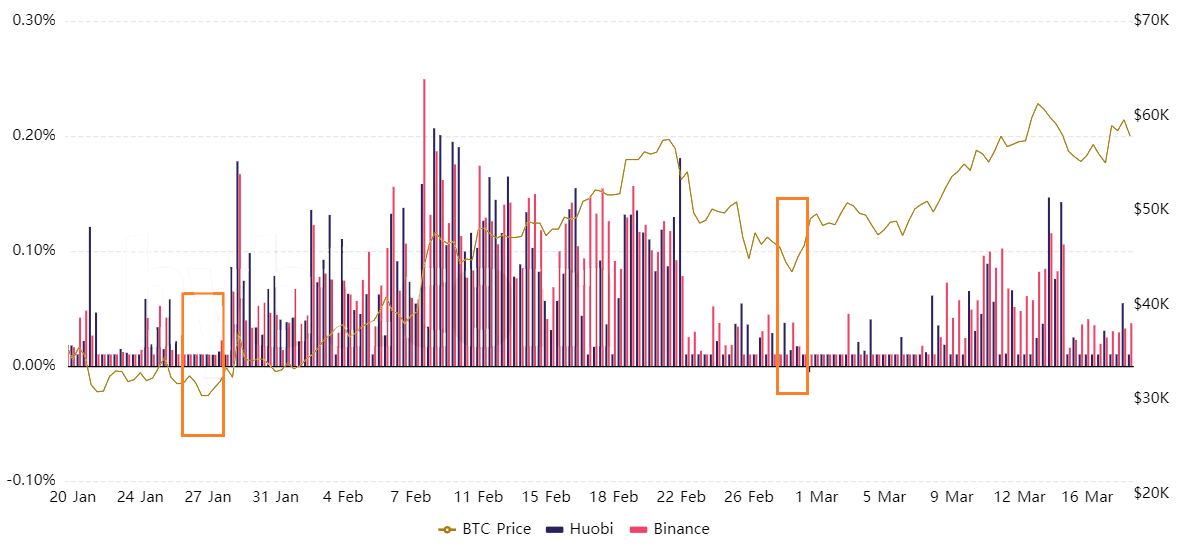

3 reasons why Bitcoin traders keep a close eye on the futures funding rate

Futures contracts trading has grown immensely over the past year, and proof of this comes from the total rise in open interest. Open interest is the total number of outstanding contracts, and the figure has risen from $3.9 billion to the current $21.5 billion in six months, a 450% increase. Sometimes traders assume that a high or low funding rate and soaring open interest indicate a bullish market, but as Cointelegraph has explained before, this is not the case. This article will take a quick look at the funding rate…

OpenSea Raises $23M in Funding Round, Set to Expand Its Global NFT Marketplace

According to OpenSea, the NFT marketplace they manage has no items belonging to the company. Non-Fungible Token (NFT) marketplace OpenSea has announced it raised the sum of $23 million led by new investors including Andreessen Horowitz (a16z), Naval Ravikant, and Mark Cuban amongst others in a Series A funding round. The blockchain technology and cryptocurrency world has evolved in the past decade, ushering in a host of disruptive innovations including decentralized finance and NFT as we have it today. The aim of this tech though diverse in nature has an…

Fireblocks crypto startup raises $133M in funding round with BNY Mellon

According to a March 18 report by the Wall Street Journal, cryptocurrency startup Fireblocks has raised $133 million in a Series C funding round featuring BNY Mellon as well as hedge-fund firm Coatue Management, venture-capital firm Ribbit Capital, and Stripes. BNY Mellon’s strategic investment in Fireblocks is reportedly part of the bank’s plans to implement Fireblocks’s technology in its upcoming crypto custody platform. As previously reported, BNY Mellon officially announced the formation of a dedicated digital asset unit to create a multi-asset custody and administration platform for traditional and digital…

Bitpanda Raises $170M in Series B Funding, at $1.2B Valuation

Now Bitpanda is going to expand its offerings beyond cryptocurrency trading, serving as a one-stop platform for anyone looking to trade digital securities. Vienna, Austria-based cryptocurrency trading platform Bitpanda has completed its Series B funding round, raising $170 million from both old and new investors. As reported by TechCrunch, the latest capital support for the firm was lead by the company’s old partner, Valar Ventures, a Peter Thiel-backed fund, as well as new investors from DST Global. Per the latest cash inflow, Bitpanda has attained the status of an Austrian…

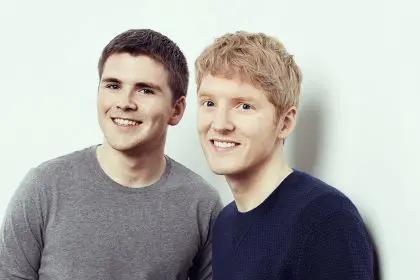

Stripe Becomes Most Valuable Startup in US, $600M Funding Pushes Its Valuation to $95B

Stripe plans to use the funds to expand its European headquarters business and its general businesses in Europe as well. Financial services company Stripe has recorded $95 billion in its valuation after raising $600 million in a recently-concluded funding round. Now, the payments company has become the most valuable startup in the US after previously valued at $35 billion. Stripe New Valuation after Funding Round Stripe announced its new secured funds on the 14th of March. The Irish-American financial services provider named Sequoia Capital and Fidelity Management and Research Company as…

Crypto lending firm BlockFi raises $350M in new funding round

Bain Capital Ventures, Pomp Investments, Tiger Global, and partners of DST Global have led investors in a $350 million series D funding round for the crypto lending firm BlockFi, according to an announcement on March 11. The company indicated that with the addition of these funds, as well as $100 million raised via three earlier funding rounds in the last two years, BlockFi is now valued at $3 billion. The secured funds will reportedly be used to expand the crypto offerings at the firm, including a Bitcoin (BTC) rewards credit card…