Correction: This article has been corrected to note that Temasek Holdings did not play a role in the investment, as was initially reported. Vertex Ventures is a limited partner with Temasek. The Vertex Ventures network, global group of venture funds has invested in the world’s largest cryptocurrency exchange. The Vertex Ventures network, a 30-year-old group of venture capital funds, have made a strategic investment in Binance and will work with the exchange to set up a new branch in the city-state, they announced Tuesday. The centerpiece of the plan is the…

Tag: funding

‘Too Many Disappointing ICOs’. Crypto Payment Startup Launches With ‘No Funding’ Strategy

The team behind a new cryptocurrency platform designed to transfer the way consumers and businesses are paid, says it is putting its money where its mouth is – and has managed to launch without the need for an initial coin offering (ICO). BLOC argues that too many ICOs have been popping up in the crypto world – disappointing users by failing to offer real products at their conclusion. By contrast, the startup says its platform already boasts “an exclusive set of mining tools, world-first features, and an unrivaled ecosystem to connect buyers…

Blockchain Finance Startup Clearmatics Raises $12 Million in New Funding

Blockchain finance firm Clearmatics Technologies has raised over $12 million in a Series A funding round led by venture capital firm Route 66 Ventures. Additional investment in the funding round came from private equity firm TNF Capital and XTX Ventures, the venture capital arm of electronic market-making firm XTX Markets. As part of the arrangement, Samir Khosla, a managing partner at TNF Capital, will join Clearmatics’ board of directors. Khosla said his company was pleased to deepen its commitment to Clearmatics and praised “its exceptional team under the leadership of Robert…

United Arab Emirates to Allow ICOs as Corporate Funding Option

The United Arab Emirates (U.A.E.) has announced plans to introduce new rules that would permit initial coin offerings (ICOs) as a fundraising method for domestic companies. Intended for introduction in 2019, the new rules would allow firms to raise capital via crypto token sales as an alternative to traditional methods such as IPOs, according to a Reuters report published Monday. The news was revealed by the head of the U.A.E.’s securities watchdog, Obaid Saif al-Zaabi, who said at a seminar today: “The board of the Emirates Securities & Commodities Authority has approved…

Most ICOs Didn’t Take Funding Hit Despite Ether Price Decline: Research

Despite the big drops in cryptocurrency prices since late last year, ICO projects haven’t lost money on average, according to new research from BitMEX. The research team from the cryptocurrency trading platform published the new work Monday, having teamed up with crypto data cruncher TokenAnalyst to track the ethereum (ETH) balances of 222 ICOs over time. Specifically, the researchers looked at the amount of ETH raised by the projects and the U.S. dollar value of the gains and losses that arose from the cryptocurrency’s price shifts. The researchers say that the fall in the…

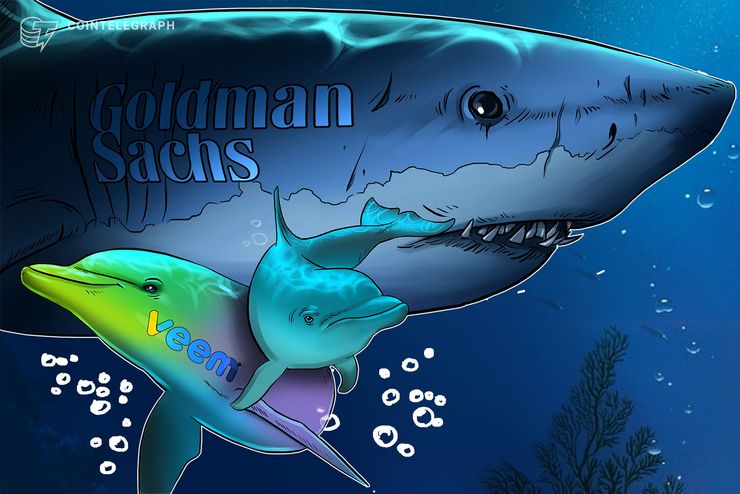

Goldman Sachs Leads $25 Million Funding Round for Blockchain Payments Startup Veem

U.S.-based banking giant Goldman Sachs has led a $25 million strategic funding round for blockchain payments startup Veem, with participation also confirmed to Cointelegraph from Silicon Valley Bank on September 27. Veem, which utilizes digital ledger technology to increase the efficiency of small business payments, noted in their press release that the funding round also received participation from GV (formerly Google Ventures), Trend Forward Capital, Extol Capital, Kleiner Perkins, and Pantera Capital, among others investors. Forbes notes that Goldman Sachs invested through its Principal Strategic Investment Group, and that Rana…

Galaxy Capital Leads $16 Million Funding for Crypto Project Caspian

Institutional traders simply need better crypto tools. That’s the driving idea behind a union between Kenetic, a crypto firm based in Hong Kong, and Tora, a trading systems firm that already supplies order execution, portfolio management, risk assessment and compliance services for well-established asset classes. Announced today, both companies are teaming up to create Caspian, a project that has raised $16 million in funding via a token presale. Investors in the round include Kenetic, Galaxy Investment Partners, Octagon Strategy, Techemy Capital, Global Advisors and Bletchley Park, according to David Wills of Kenetic. Wills called…

Galaxy, BlockTower Lead $16 Million Funding for Crypto Project Caspian

Institutional traders simply need better crypto tools. That’s the driving idea behind a union between Kenetic Capital, a crypto hedge fund based in Singapore, and Tora, a trading systems firm that already supplies order execution, portfolio management, risk assessment and compliance services for well-established asset classes. Announced today, both companies are teaming up to create Caspian, a project that has raised $16 million in funding via a token presale. Investors in the round include Kenetic, Galaxy Investment Partners, BlockTower Capital, Octagon Strategy, Techemy Capital, Global Advisors and Bletchley Park, according to David Mills of…

Crypto Exchange Offering CFTC-Regulated Derivatives Raises $15 Million in Funding Round

Boston-based alternative investment firm Bain Capital Ventures has led a $15 million funding round for an institutional cryptocurrency exchange Seed CX, according to an official announcement published September 12. Seed CX is a Bain Capital Ventures backed, licensed digital asset exchange for both spot market and U.S. Commodities and Futures Trading Commission(CFTC)-regulated derivatives. Per the announcement, Seed CX’s total funding has reached more than $25 million following the latest $15 million Series B funding round. The exchange will use the recent investment to improve its physical trading infrastructure, expand its…

Research: ICOs See Lowest Funding Level in 16 Months

Funding for Initial Coin Offerings (ICOs) has seen its hardest slump in 16 months, Bloomberg reported September 10. Analysis from Autonomous Research shows that in August, startups raised $326 million, which is the smallest amount since May 2017. According to Autonomous Research, Ethereum (ETH) blockchain-based ICOs have been recognized as the spark for the ETH price surge in 2017. However, they are currently the purported reason for the currency’s price slide, as some projects cash out to cover expenses amid concerns over a bearish market. The new analysis comes as…