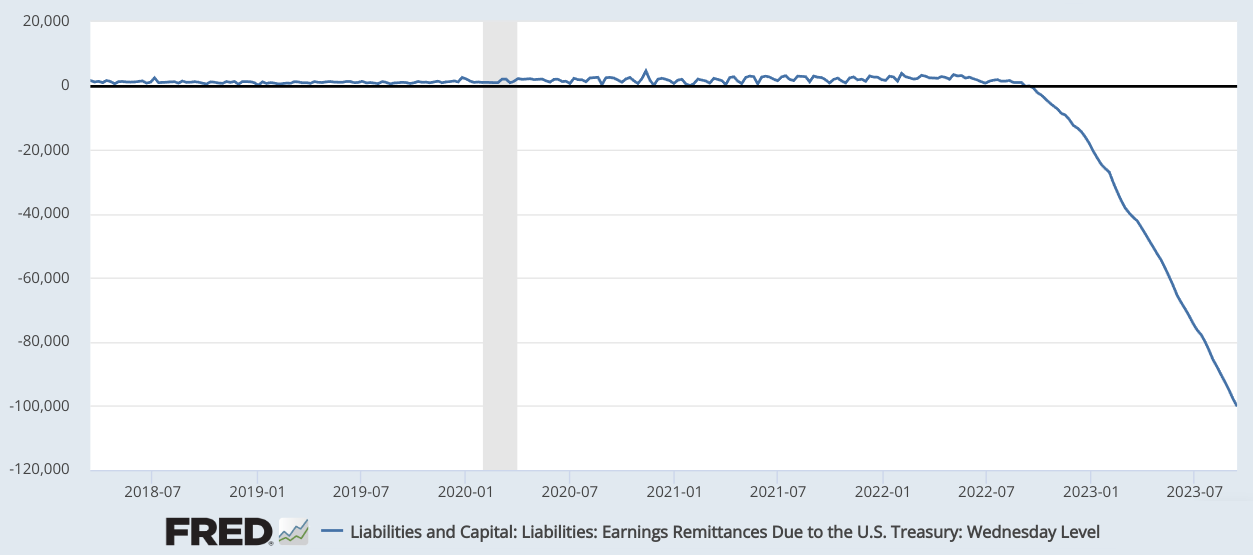

The U.S. Federal Reserve made a significant announcement on Sept. 14, revealing accumulated losses of $100 billion in 2023. What’s more, this situation is expected to worsen for the Fed, according to Reuters. But for risk assets like Bitcoin (BTC), this may actually be a blessing in disguise. The Fed in the red The primary reason behind this financial setback is that the interest payments on the Fed’s debt have surpassed the earnings generated from its holdings and the services it provides to the financial sector. As a result of this…

Tag: Investors

3 steps crypto investors can take to avoid hacks by the Lazarus Group

Cryptocurrency users frequently fall prey to online hacks with Mark Cuban being just the latest high-profile example how nearly a million dollars can leave your digital wallet. It is possible to substantially bolster the security of your funds by heeding three simple guidelines that will be outlined in this article. But before delving into these, it’s crucial to understand the type of threat that exists today. FBI has clear evidence on the Lazarus Group The Lazarus Group is a North Korean state-sponsored hacking group, known for their sophisticated attacks linked to…

Investors exiting LidoDAO and ApeCoin to explore new crypto project

From early September, LidoDAO (LDO) prices fell. ApeCoin (APE) followed suit but more investors are exploring a new crypto project, Domini.art (DOMI). LDO drops following contract exploit On Sep. 10, blockchain security firm SlowMist revealed that Lido’s code doesn’t follow the guidelines set by the ERC-20 token standard, allowing users to conduct transactions despite a lack of funds. Experts believed this loophole made LidoDAO vulnerable to hacks. In response to SlowMist’s post, LidoDAO assured users that their LDO and sETH tokens were safe and secure. Following this news, LDO dipped…

Cardano expands, investors eye Domini.art’s growth

Cardano’s scaling solutions and proof-of-stake approach serve as a model for projects aiming for long-term stability and success. The crypto market, which has been moving sideways for the better part of August and September, is now recovering and Cardano’s ADA seems to be riding this wave. Similarly, Domini.art (DOMI), a project focused on the art market, aims to decentralize access and open up the industry to millions. DOMI is gaining traction with an increasing number of investors in its ongoing presale. While ADA might be available at bargain prices, considering…

BNB and Uniswap fall, investors considering Pomerdoge

The crypto market is volatile and bearish, with Binance Coin (BNB) and Uniswap (UNI) posting deep losses. Amid this crash, Pomerdoge (POMD) is being explored, attracting investor attention. BNB trades above $200 support Binance, the largest centralized crypto exchange, remains unfazed by increasing regulatory pressure. Bifinity, the crypto-to-fiat processing unit of Binance, records show, is Lithuania’s second largest corporate taxpayer, with over $45 million paid, excluding VAT, in 2022. BNB Chain Labs also recently launched a new layer-2 network, opBNB. Despite supportive fundamental factors, BNB is under pressure, recently falling…

Why Are Japanese Investors Choosing XRP Over Bitcoin?

A recent study has revealed that Japanese investors are choosing to invest in Ripple’s XRP over the world’s flagship cryptocurrency, Bitcoin. XRP Over Bitcoin And Ethereum In contrast to the treatment Ripple and the XRP token are receiving in the US, Japan seems more welcoming to the crypto asset, according to a research paper by the Department of Economics and Finance at the City University of Hong Kong. According to the report, XRP is preferred over the biggest cryptocurrencies by market cap, Bitcoin and Ethereum. It referenced a survey conducted…

Here’s What Crypto Investors Should Know

SEC Chairman Gary Gensler is on the hot seat as the Senate Banking Committee demands answers and clarity on a range of topics including the commission’s ongoing investigations in the crypto space and Gensler’s belief that cryptocurrencies should be regulated under the securities law. Senate Banking Committee Grills Gensler Gary Gensler, Chairman of the United States Securities and Exchange Commission (SEC) was cross-examined by the Senate Banking Committee on Tuesday, September 12. The committee probed the SEC boss for clarification on the commission’s complex rules changes and the ability of…

Institutional Investors Flee Ethereum Amid Plunge Toward $1,500

Institution crypto investors have been pulling out of the market for the better part of this year, especially as the bear market has taken hold. However, Ethereum has suffered way more than other assets in this regard with outflows dragging total assets under management (AuM) down. This comes as Ethereum has struggled after falling below the $1,600 support. Institutional Investors Pull Out Of Ethereum In the latest iteration of its Digital Asset Fund Flows Weekly Report, alternative asset manager CoinShares has revealed a growing aversion from institutional investors toward Ethereum.…

Bitcoin data highlights 3 key reasons why investors don’t care about BTC price

Much has been made of Bitcoin’s (BTC) poor price action as of late, with many analysts making the case for further bearish momentum in the weeks ahead. Yet it wasn’t too long ago that many investors and crypto pundits were raving about some note-worthy fundamental metrics that were, and continue to be, quite bullish. Let’s take a look at three Bitcoin metrics that bulls might keep in mind. Bitcoin’s hashrate hovers near a record high Bitcoin’s hashrate, a metric which shows the amount of computing power dedicated to mining BTC,…

Coinbase (COIN) to Face ‘Reality Check’ as Retail Investors’ FOMO Is Fading, Mizuho Says

Mizuho says this indicates potential fatigue among retail customers, and in contrast to previous cycles, fear-of-missing-out no longer “entices investors to trade bitcoin when prices rise,” as it did in prior years. “This could prove problematic for COIN, as it generates around 95% of its transaction revenue from retail trades,” the note said, adding that the year-to-date rise in the shares is unsustainable. “We expect a reality check to follow.” Source