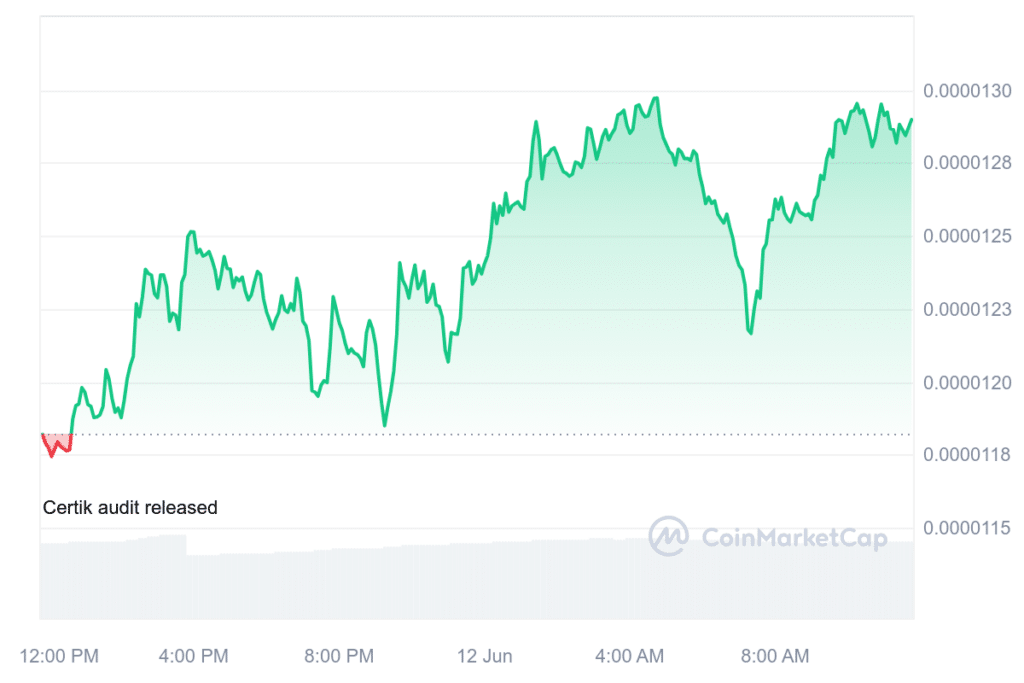

Pepe (PEPE), the popular frog-themed meme coin, has outshined most of the popular memecoins with an 11% surge in the last 24 hours. At the time of writing, PEPE was trading at $0.0000129, with a trading volume of $1.27 billion over the past day. The memecoin has surged by 50% over the last seven days and a massive 1372% over the last year. PEPE 24-hour price chart | Source: CoinMarketCap The crypto asset’s market cap has also risen by 9%, currently holding at $5.43 billion. However, the token is still…

Tag: Market

Ethereum Price Slips: Slow Descent as Market Pressure Mounts

Ethereum price failed to recover above the $3,650 resistance. ETH declined again below the $3,550 level and now shows bearish signs below $3,600. Ethereum started a fresh decline below the $3,550 support zone. The price is trading below $3,550 and the 100-hourly Simple Moving Average. There is a key bearish trend line forming with resistance near $3,650 on the hourly chart of ETH/USD (data feed via Kraken). The pair could extend losses if it stays below the $3,650 resistance zone. Ethereum Price Takes Hit Ethereum price attempted a recovery wave…

Price Turns Red as Market Eyes Fed Decision

Bitcoin price extended losses below $67,500 support zone. BTC tested the $66,000 support zone and is now attempting a recovery wave. Bitcoin started another decline below the $68,500 support zone. The price is trading below $68,000 and the 100 hourly Simple moving average. There is a connecting bearish trend line forming with resistance at $68,650 on the hourly chart of the BTC/USD pair (data feed from Kraken). The pair could recover but the upsides might be limited above the $68,500 level. Bitcoin Price Dives Bitcoin price failed to start another…

Bitcoin Falls Below $67K, More Than 75K Traders Liquidated Amid Market Decline

On Tuesday, the price of bitcoin (BTC) fell to an intraday low of $66,696 per unit, marking a 3.3% decrease over the last 24 hours. This decline resulted in the liquidation of $170.25 million in long derivatives positions, with $50.87 million of this amount comprised of BTC long positions. Bitcoin Shudders Below $67,000 The global […] Original

Bitcoin Crash Below $67,000 Sends Market Spiraling, Here Are The Levels To Watch

The new week has been quite bearish for bitcoin, with the price witnessing major crashes below multiple support levels. After losing its footing above $71,000, it has plunged further below $67,000, signaling the start of a downtrend. Amid the uncertainty, a crypto analyst has presented the important levels to watch as Bitcoin makes it descent, showing a possible direction for the price. Bitcoin Enters Sideways Consolidation In an analysis on the TradingView platform, crypto analyst Bitcoin Signals revealed some important developments for the Bitcoin price. The first observation is the…

$2 Billion Crypto Funds Flow Into Market On Rate Cut Buzz

The cryptocurrency market is buzzing with renewed optimism as investment funds witness a historic inflow surge. CoinShares, a leading digital asset manager, reported a record-breaking $2 billion influx into crypto funds in just one week, surpassing the entire month of May’s net inflows. This positive trend, now spanning five consecutive weeks, has propelled total assets under management (AUM) in crypto funds back above the coveted $100 billion mark, a level last seen in March 2024. Related Reading Bitcoin ETFs Fueling The Fire Bitcoin, the undisputed king of cryptocurrencies, remains the…

Market Expert Reveals Why Now Is The Perfect Time To Invest In These 5 Altcoins

Renowned market expert Michael Van de Poppe has recently shared his insights on the current state of the cryptocurrency market, highlighting potential breakout opportunities for altcoins. As the largest cryptocurrency on the market, Bitcoin (BTC), consolidates in a price range between $67,000 and $70,000, Van de Poppe’s latest market update suggests that this may be the ” final time” to invest in altcoins before a potential breakout. Altcoins Analysis In a series of social media posts, Van de Poppe analyzes specific altcoins, including Sui (SUI), Chainlink (LINK), Floki Inu (FLOKI),…

Stablecoin Issuers Want to Give Something Back in Multi-Trillion-Dollar Market Race

“I think that in a few years from now you’re going to see corporate treasurers keeping liquidity in a money-market fund, and the moment that they need to make a payment, switch that money-market fund to a stablecoin and make the payment, because those are built for purpose,” Fernandez da Ponte said in an interview. Source

Fidelity International Tokenizes Money Market Fund on JPMorgan’s Blockchain

“Tokenizing our money market fund shares to use as collateral is an important and natural first step in scaling our adoption of this technology,” Stephen Whyman, Fidelity International’s head of debt capital markets, said in an email interview. “The benefits to our clients and the wider financial system are clear; in particular, the improved efficiency in delivering margin requirements and reduction in transaction costs and operational risk.” Source

Report: Speculation Returns as Bitcoin Market Shows Signs of Recovery

Glassnode’s latest onchain analysis reveals a resurgence in speculative activity in the bitcoin (BTC) market after months of stagnation. This shift marks a potential change in market sentiment, with both short and long-term holders displaying increased engagement. Mt Gox Preparations Spark New Wave of Bitcoin Speculation Analysts at Glassnode reported the reappearance of speculative behavior […] Original