Russia’s president, Vladimir Putin, says the trend toward multipolarity is inevitable and will only intensify. “Those who do not understand this and do not follow this trend will lose,” the Russian president warned. Putin on Multipolarity Trend Escalating Russian President Vladimir Putin talked about a global trend towards multipolarity at a recent meeting of the Council for Local Self-Government Development. Putin said: This trend — the trend toward multipolarity in the world — is inevitable. It will only intensify. And those who do not understand this and do not follow…

Tag: News

Treasury Secretary Yellen Warns US Could Default on Its Debt by June 1 – Economics Bitcoin News

U.S. Treasury Secretary Janet Yellen has warned that the Treasury will not be able to pay all of the government’s debt “as early as June 1, if Congress does not raise or suspend the debt limit before that time.” Yellen also cautioned that the U.S. defaulting on its debt obligations “would produce an economic and financial catastrophe.” U.S. Debt Default Could Happen by June 1, Says Yellen United States Secretary of the Treasury Janet Yellen warned Monday that the U.S. government may default on its debt by June 1, which…

US Court Orders Operator of South African Bitcoin Ponzi Scheme to Pay Over $3.4 Billion – Regulation Bitcoin News

Johann Steynberg, the founder and CEO of Mirror Trading International, has been ordered to pay over $1.73 billion in restitution to victims of his bitcoin ponzi scheme. The court has also ordered Steynberg to pay a civil monetary penalty of a similar amount. The Commodity Futures Trading Commission (CFTC) conceded that orders requiring payment of funds “may not result in the recovery of any money lost because wrongdoers may not have sufficient funds or assets.” ‘Largest Fraudulent Scheme Involving Bitcoin’ in the History of the CFTC A United States Federal…

Mawson Infrastructure Group Expands to New Bitcoin Mining Site in Ohio, Plans to Boost Hashpower by 1 EH/s – Mining Bitcoin News

Mawson Infrastructure Group announced on Monday that the company has secured a new mining site in Corning, Ohio. The bitcoin mining firm, on May 1, 2023, unveiled its plans to set up its miners at the new location by Q3 of this year, with an aim to raise the operation’s hashpower by 1 exahash per second (EH/s). Bitcoin Miner Mawson Acquires 24 MW in Ohio With Room for Expansion On May 1, 2023, Mawson Infrastructure Group revealed it has signed an agreement for a new site in Ohio. This development…

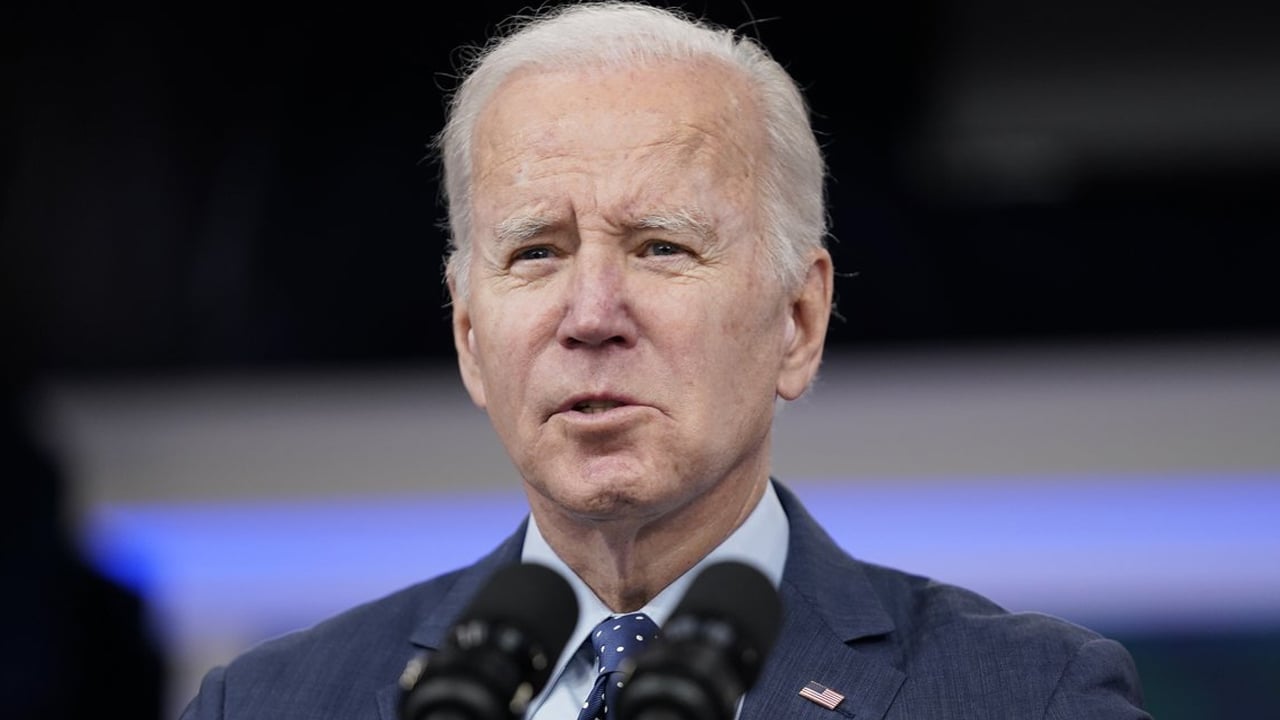

Biden Reassures Public Amid First Republic Bank Collapse, but Warns of National Debt Default – Bitcoin News

Amid the collapse of the second, third, and fourth largest banks in American history, U.S. president Joe Biden reassured the public that the country’s banking system remains sturdy. However, the president also acknowledged the “threat by the speaker of the House to default on the national debt.” Biden Expresses Confidence in American Banking System Despite First Republic Bank Collapse Biden’s recent statements were made following California’s financial regulators seizing First Republic Bank and placing it under the control of the U.S. Federal Deposit Insurance Corporation (FDIC). After the bank’s seizure,…

Ethereum Network Fees Surge 153% in 30 Days, While Arbitrum Daily Transactions Outpace ETH Following Shapella Upgrade – Bitcoin News

Ethereum network fees have experienced a significant upswing following the implementation of the Shapella upgrade on April 12th. In the last 30 days, onchain fees have soared by over 153%, from a prior rate of $4.65 per transfer to a current average of $11.80 per transaction. The data highlights a substantial surge in the costs associated with Ethereum network transactions, indicating a notable increase in onchain activity. Onchain Fees on Ethereum Network Soar by 153% in a Month, While Arbitrum’s Daily Transactions Exceed ETH Post-Shapella Upgrade Over the past month,…

Paysenger Launches IDO as the Platform Looks to Solve the Challenges of AI-Generated Art – Press release Bitcoin News

press release PRESS RELEASE. The rise of AI-generated art has created ethical concerns and challenges within the art community, as many artists perceive these tools as undermining their skills and exploiting their work for profit. Paysenger, a groundbreaking blockchain-based collaboration platform for content creators, fans, and brands, is poised to tackle these issues with its native token, EGO, and AI integration. Paysenger introduces a personalized AI model that allows artists to create unique, AI-generated art in their distinctive style. This exclusive, artist-specific AI model uses the artist’s social account for…

LTC Back Under $90.00, as SOL Extends Declines – Market Updates Bitcoin News

Litecoin fell below the $90.00 level on Monday, as sentiment in cryptocurrency markets remained mostly bearish. The global market cap is down 1.87% at the time of writing, which seems to be a result of the upcoming Federal Reserve interest rate decision. Solana was also in the red today. Litecoin (LTC) Litecoin (LTC) was down for a second straight session on Monday, as markets prepared for the upcoming United States Federal Reserve policy decision. LTC/USD dropped to low at $86.83 earlier in today’s session, which comes 24 hours after trading…

Charlie Munger Raises Concerns Over Troubled Commercial Property Loans at US Banks – Bitcoin News

Charlie Munger, the vice chairman of Berkshire Hathaway, stated in a recent interview that American banks are burdened with poor-quality commercial real estate loans. His comments arrive amid the collapse of three major U.S. banks and the expected seizure of First Republic Bank by the federal government. Despite the potential challenges, Munger emphasized that the current situation is not as severe as the 2008 financial crisis, stating that “it’s not nearly as bad as it was in 2008.” U.S. Banks Saddled With Poor-Quality Commercial Real Estate Loans, According to Charlie…

JPMorgan Chase Assumes Control of First Republic Bank Following Seizure by California Regulators – Bitcoin News

On May 1, 2023, the California Department of Financial Protection and Innovation (DFPI) seized First Republic Bank, placing it into Federal Deposit Insurance Corporation (FDIC) receivership. According to reports, this move came after the bank’s financial troubles made it insolvent and unable to meet its obligations. Following the seizure, JPMorgan Chase submitted the winning bid to assume control of First Republic Bank’s deposits, including uninsured deposits. California Regulator Seizes First Republic, JPMorgan Takes Over Bank’s Assets From the first week of March, four major banks — Silvergate Bank, Silicon Valley…