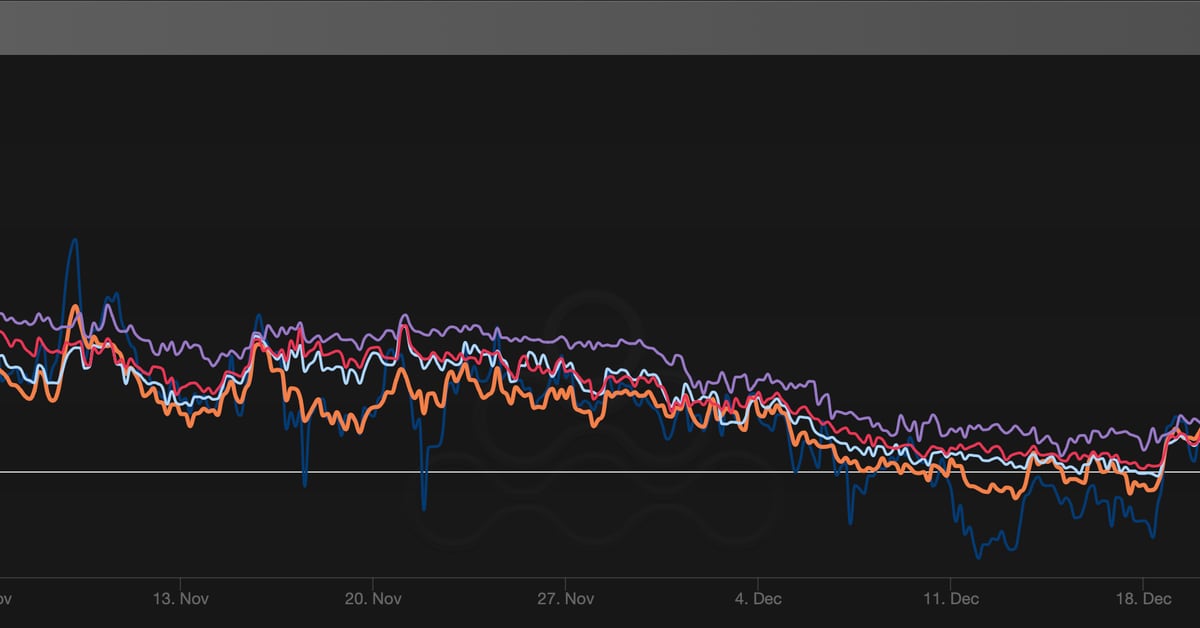

The 10-year Treasury yield, the so-called risk-free rate, has risen by 15 basis points to 4.05% since Friday, also a sign of traders reassessing dovish Fed expectations or the possibility of the central bank delaying the rate cut. The benchmark yield fell by nearly 80 basis points to 3.86% in the final three months of 2023, offering a tailwind to risk assets, including bitcoin, thanks to expectations for aggressive Fed rate cuts and lesser-than-expected bond issuance by the U.S. Treasury. Original

Tag: Pare

Bitcoin Traders Pare Bullish Bias as Spot ETF Deadline Nears

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In November 2023, CoinDesk was acquired by Bullish group, owner of Bullish, a regulated, institutional digital assets exchange. Bullish group is majority owned by Block.one; both groups have interests in a variety of…

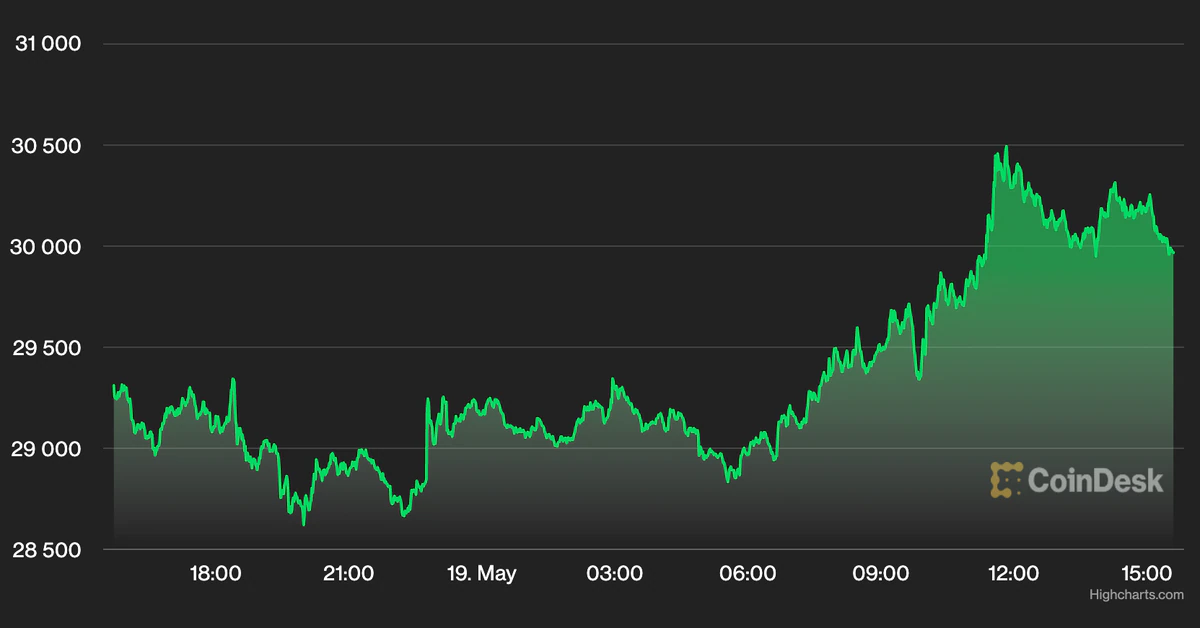

Bitcoin Dips Below $30K to Lowest Since Late June as Altcoins Pare Gains From XRP Lawsuit

XRP, SOL and LDO lost more than 5% in the last 24 hours. Original

Crypto Stocks Pare Off Losses in Wake of Broader Industry Revival

The digital currency ecosystem is a very volatile one, and what seems to constitute the basis for the current growth trend today may not necessarily be fueling the market momentum tomorrow. Many crypto stocks are seeing an impressive start to the year, riding on the back of the sustained rally in the broader digital currency ecosystem. The combined market capitalization of the cryptocurrency industry is currently pegged at $995.26 billion, up 0.67% in the past 24 hours after surging as high as $1.03 trillion earlier this week. Crypto stocks including…

DeFi Coins Outperform Bitcoin, Ether as Traders Pare Bets on Jumbo Fed Rate Hike

While cryptocurrency lending platform Aave’s native coin AAVE was up 15% at $91, decentralized exchange Uniswap’s UNI traded at $7, representing a 13% gain, CoinDesk data shows. Bitcoin (BTC), the biggest cryptocurrency by market value, changed hands at $20,660, up 3.5%, while Ethereum’s ether (ETH) token was priced at $1,200, up 8%. Other notable gainers were programmable blockchain Solana’s SOL cryptocurrency, privacy-focused coin monero, Polygon’s MATIC, cosmos and algorand. Source

Cryptos Pare Earlier Losses; Bitcoin Outperforms

Some alternative cryptos (altcoins) rallied on Tuesday, albeit within a six-month downtrend. For example, Solana’s SOL token rose by as much as 2% over the past 24 hours, compared with a 3% rise in BTC over the same period. Still, SOL is down by 50% over the past month, compared with a 35% drop in ether (ETH) and a 27% decline in BTC. Original

Bitcoin Price Briefly Revisits $40,000 as Bulls Pare Week’s Losses

Bitcoin has rallied nearly 15% in the past 24 hours. Ether hits $1,200. Original