The exploiters utilized a “donation” attack to manipulate certain markets offered by the platform, stealing various tokens before being interrupted. The incident occurred on Sonne’s platform on the Optimism blockchain. The Base blockchain version was not affected. (Think of this as a mobile application getting hacked on Apple iOS, but remaining safe on Android.) Source

Tag: Token

dYdX Trading Inc Founder Antonio Juliano Steps Down As CEO, Token Takes a Hit

Antonio Juliano, the founder of dYdX Trading Inc., has announced his decision to “step down” as Chief Executive Officer (CEO), citing a mix of “personal and professional reasons.” This move marks a significant change for the company behind the decentralized derivatives exchange dYdX. Juliano will transition to the roles of Chairman and President, with Ivo Crnkovic-Rubsamen set to take over as CEO. Related Reading Juliano Reflects On His Tenure And The Evolution Of dYdX Juliano’s tenure as CEO saw dYdX grow into a prominent player in the decentralized finance (DeFi)…

EigenLayer’s Exclusive $15 Billion Token Launch: Who’s In And Who’s Out?

The crypto world is currently abuzz with the launch of EigenLayer’s new token, EIGEN, which has quickly become one of the year’s most anticipated digital asset events. According to Bloomberg, the project has attracted significant attention for its approach to decentralized finance (DeFi) and its “controversial” decision to exclude users from certain jurisdictions, including the US, China, and Canada, from participating in the token distribution. EigenLayer Challenges And Opportunities in Token Distribution EigenLayer, a DeFi protocol based in Seattle, has made waves in the industry by introducing a concept known…

EigenLayer Opens Claims for Airdrop of EIGEN Token, Though It's Non-Transferable

Perpetual futures markets price the fully diluted value of the token at around $15 billion. Source

Influencer-Investors Get Special Treatment in Token Deals

KOL arrangements are “a win for protocols, a win for KOLs, but a heavy loss for retail,” said Muur, the influencer who said she doesn’t take these deals. “These deals are not properly disclosed in most cases, so the community doesn’t know about KOL rounds and its vesting terms,” she lamented, expressing a sentiment echoed by other insiders. Source

Crypto Markets Under Pressure as $2B Worth of Altcoin Token Unlocks and $11B Bitcoin Distribution Loom

Investors should brace for waves of fear, uncertainty and doubt – or FUD – over the next few months, a K33 Research analyst said. Original

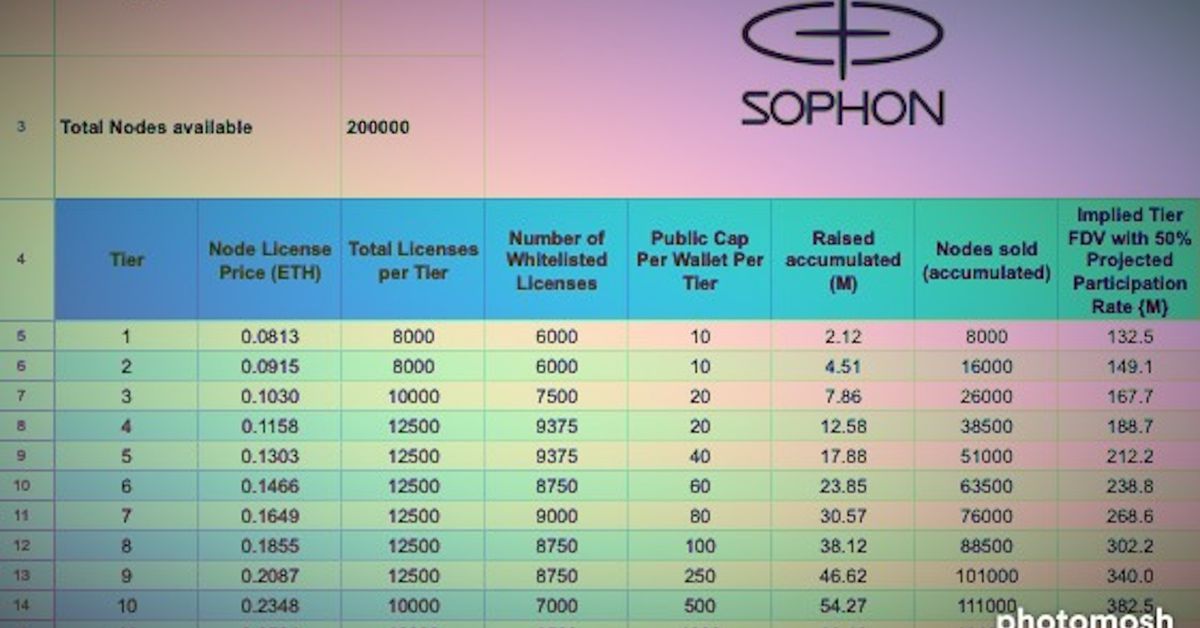

It's Not a Token Offering, It's a 'Node Sale': Sophon Blockchain Raises $60M

The blockchain project’s founders aren’t even publicly named, but they’ve enjoyed remarkable success in fundraising, partly thanks to this increasingly popular fundraising method, where the longer you wait, the higher price you pay. Source link

Ethena (ENA) Price Jumps as Bybit Endorses USDe Token as Collateral for Crypto Derivatives Trading

The protocol’s USDe token, often referred to as “synthetic dollar” instead of a stablecoin, is a structured finance product wrapped in a token. It offers steady yields to investors by using ETH liquid staking derivatives such as Lido’s stETH as backing assets, pairing them with an equal value of short ETH perpetual futures position on derivatives exchanges to keep anchored at $1 price. This strategy is also known as a “cash and carry” trade, which harvests derivatives funding rates for a yield. Source

Network Fires Back at Token Supply FUD

Sui, the year-old Layer-1 blockchain darling, is facing a harsh reality check. While celebrating its first anniversary on May 3rd, 2034, the network finds itself embroiled in a controversy surrounding its tokenomics, the design and distribution of its cryptocurrency, SUI. SUI Supply: Cause for Concern? The fire was ignited by Justin Bons, founder of Cyber Capital, who tweeted concerns about the SUI token supply being overly concentrated in the hands of the founders and early contributors. Bons pointed to a potential 80% allocation – 160 million out of a total…

STYLE Protocol Building to Empower Gamers Closes $2.5M Seed and Lists Token on Major Exchanges

PRESS RELEASE. MAY 6, 2024 — Switzerland. STYLE Protocol, which transforms NFTs into 3D assets that can be used in any game or metaverse, has listed its native utility token on major exchanges. The cutting-edge digital asset — $STYLE — made its debut on Bitget and MEXC, and is also available on the decentralized exchange […] Source