- Tesla stock rallied above $2,100 on Wednesday.

- Jeffries more than doubled their TSLA price target to a new high of $2,500

- What’s really going on in this incredible stock?

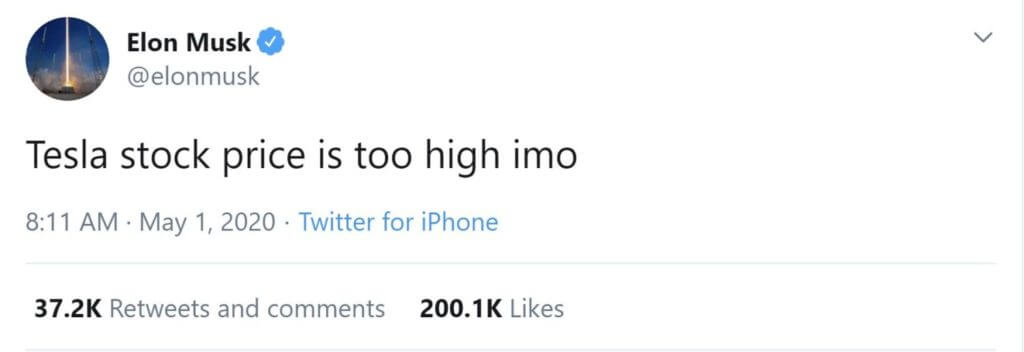

If Elon Musk thought Tesla (NASDAQ:TSLA) stock was too high at $750, what are Wall Street analysts doing calling for $2,500? The answer is fueling a speculative bubble, and desperately marketing a stock split to feed the retail crowd.

Tesla Booms as Bull-Bear War Rages

Tesla is on a historic run. After plumbing the depths of despair earlier in the year, bulls have seen their investment more than quadrupled from its lows. Currently trading above $2,100, Elon Musk’s electric-vehicle giant enjoys a market cap of almost $400 billion.

It’s pointless talking about fundamentals. If you consider Tesla a car company, it’s grossly overvalued. If you are in the tech, “true believer” crowd, then almost no valuation seems too high for a company that’s about to change the world.

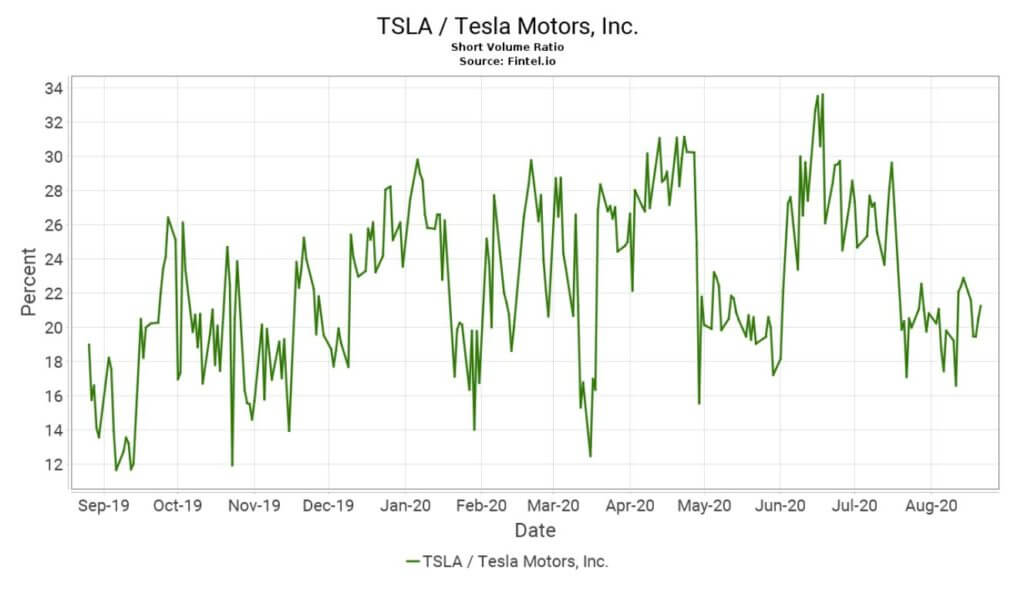

For once, let’s completely ignore this war and focus entirely on price. Tesla has been the most shorted stock in the U.S. for most of 2020, and it is very likely that the constant flow of bearish bets is squeezing prices higher in a bull market.

Ultimately, the bears aren’t what’s fueling this intense speculation. Instead, the upcoming stock split has been the significant driver.

Wall Street is masterful at capitalizing on trends, and seeing a retail boom has prompted Tesla (and Apple) to slice up shares to make them more affordable. Front-running investors are getting in ahead of what they anticipate is a massive flood of buying from small investors.

Wall Street Will Squeeze Every Drop Out of This Retail Madness

How do we know the marketing machine is in full swing? When we see incredibly bold bullish analysts calls. Watch the video below.

The latest was an extravagant (more than) doubling from Jeffries, from $1,200 to a target of $2,500.

Analyst Philippe Houchois had the difficult task of justifying such a dramatic change in Tesla’s forecast.

While Mr. Houchois said it’s tough to understand what has caused the wild moves in TSLA, the company’s superiority in the EV market over conventional car markers is the leading edge. Out-performance during the pandemic is also a significant strength:

Tesla has executed much better than anyone expected through the course of 2019, but also through the pandemic. I think all those things together will continue to support the valuation.

Forecasts like this will help squeeze every ounce of juice from a stock its CEO called “too high” when Tesla was less than half the current price.

Ultimately, that’s why Musk pushes back against TSLA’s valuation. Yes, it makes him rich, but he doesn’t want to lose fans of his company if the price were to crash.

Wall Street doesn’t care; they’ll keep stomping the grapes in this one for as long as they possibly can.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author holds no investment position in the above-mentioned securities.