- Tesla plunged in pre-market trading and extended its decline after the open.

- Tesla has now officially entered a bear market and will likely fall much further.

- The decline of Tesla stock will be hastened by company selloffs, an underwhelming Battery Day, and its declining market share.

Tesla stock fell by as much as 19.7% Tuesday morning, as the electric-vehicle maker plunged into bear market territory.

The stock bottomed at $335.99 on Tuesday before recovering around $360. Even at this price, TSLA still has a long way to fall. The company remains massively overvalued in relation to its fundamentals. At the same time, investor exuberance is likely to be further damaged by recent shareholder selloffs, Tesla’s waning EV market share, and a possible anticlimax for the upcoming Battery Day.

A Bear Market For Tesla Stock

Having already been in a technical correction for several days, Tesla stock has now entered a bear market. This means its price has fallen by more than 20% from a recent peak.

The S&P 500 is mostly to blame for the recent slump. The committee which finalizes inclusion in the index decided against including Tesla. According to Wedbush analyst Dan Ives, this was because the carmaker’s profitability remains relatively fragile:

The profitability metrics and forecast likely was the swaying factor that might have excluded Tesla this time around. In a nutshell Tesla not getting into the S&P 500 will be a head scratcher to the bulls that viewed this as virtually a lock given all the parameters met.

Many investors had been betting on S&P 500 inclusion as a boost to Tesla’s stock price. Now that the committee has declined to include the carmaker, the confidence of Tesla bulls has been shaken. Coming in the middle of an ongoing Tesla correction, the market has taken the rejection badly.

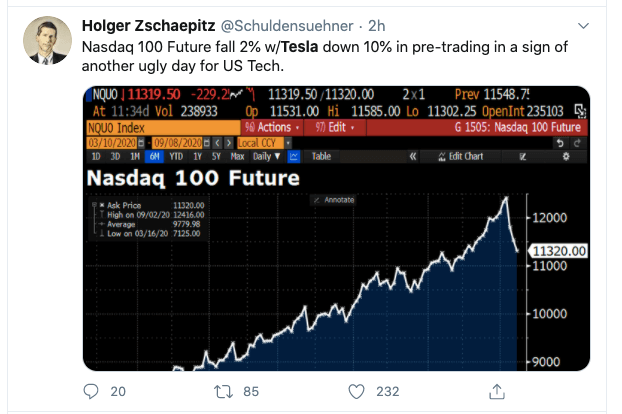

Stock Market Sliding Down

Tesla’s situation is made worse by the fact that the stock market as a whole is becoming more bearish. The S&P 500 has fallen by 4% since Wednesday, while the Dow is down by 3.3%. The Nasdaq is also down, indicating that now is not a good time for tech stocks.

It’s not only waning market sentiment that will bring down Tesla’s sky-high price, but also Tesla itself. The company recently announced a selloff of $5 billion in shares, indicating that it thinks its stock price has peaked. Its biggest independent shareholder has also reduced its stake in the company, from 7.6% to 4.25%.

Tesla has its annual Battery Day event coming up on Sept. 22. Bulls have been hyping up the event for weeks, yet there’s a good chance it will be underwhelming, as was the case with the recent Neuralink demo.

The End of the Honeymoon

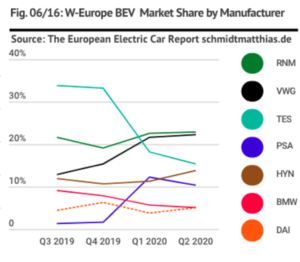

This will further demoralize Tesla bulls looking for something to maintain their exuberance. But if that weren’t bad enough, there’s also the regularly incoming data on Tesla’s waning market share.

European electric vehicle sales rose 34% in H1 2020 (compared to a year ago), but Tesla sales fell 18% over the same period.

As more manufacturers make EVs, Tesla’s position will only weaken. And that most likely means a much lower stock price.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.