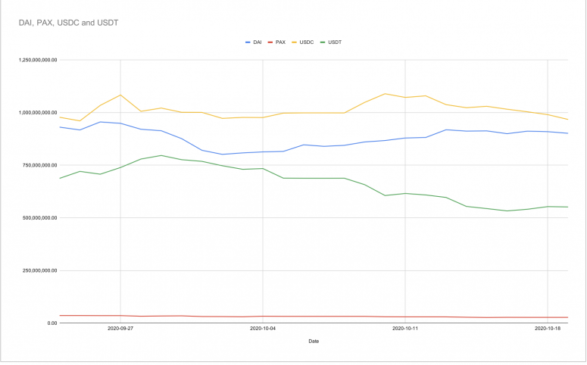

While tether (USDT), with a market cap surpassing $16 billion, continues to hold the lion’s share of stablecoins in circulation, two smaller rivals are trouncing it in crypto’s hottest market this year, decentralized finance (DeFi).

Measured by the total value locked in six of the most popular DeFi protocols – Compound, Maker, Uniswap, Curve, Aave and Balancer – USD coin (USDC) is in the lead among stablecoins followed by dai (DAI), the native stablecoin to MakerDAO. That’s according to data compiled by Flipside Crypto as of Oct. 19.

USDC and DAI have market caps of $2.74 billion and $608 million, respectively. Yet, unlike on centralized exchanges, where tether is the go-to stablecoin in dollar-based crypto trades, USDC and DAI seem to have found their niche as the preferred stablecoins in decentralized trades.

In an interview with CryptoX, Jeremy Allaire, peer-to-peer payments company Circle’s co-founder, attributed USDC’s success in DeFi to his company’s early efforts in building relationships with the DeFi communities. The fact the two companies that co-founded USDC’s governing Centre consortium, Circle and crypto exchange Coinbase, are both registered financial entities in the United States may also have something to do with USDC’s recent upturn. According to Allaire, USDC is preferred by institutional investors for being “safe, trusted and regulated.”

Authorities around the globe are giving more direction on how cryptocurrencies should be used and regulated. In late September, for instance, the U.S. Office of the Comptroller of the Currency (OCC) published its first regulatory guidance for stablecoins, clarifying that national banks can provide services to stablecoin issuers in the U.S.

“Having guidelines creates more certainty, which makes mainstream market participants ready and willing to engage in it,” Allaire told CryptoX.

In contrast to USDC, dai is a decentralized stablecoin that in theory does not have a centralized issuer and is censorship-resistant. Niklas Kunkel, the head of backend services at MakerDAO, told CryptoX DAI’s decentralization core has made it more popular than most of its competitors. He sees its decentralization as a good thing for regulators.

“One advantage you have from a decentralized stablecoin is that everything is completely transparent,” Kunkel told CryptoX in an interview. “So from a regulatory point of view, this is almost like their dream scenario, right? Because they can see exactly how many dai are in existence and in circulation and they can see in real time.”

“Dai is not the antithesis to regulation and regulator,” he added. “If anything, it’s the opposite.”

For stablecoin king tether, more than a few market participants question whether it is as transparent as the company claims. Tether the company has been battling multiple lawsuits accusing it of not properly backing its currency with collateralized reserves. Tether has declined to answer CryptoX’s questions on the lawsuits. However, in an email, Chief Technology Officer Paolo Ardoino called tether “the most stable and liquid stablecoin.”

That assertion is challenged by at least some of its competitors.

Read more: ‘No Other Option but More Collateral’: The Short- (and Long-) Term Fixes for Dai’s Broken Peg

“Tether is not fully backed with dollars and there is very little transparency into their reserves,” the head of strategy at Paxos, Walter Hessert, wrote in an email response to CryptoX. “That’s ok for some crypto traders because there are very liquid markets today. However, mainstream investors and institutions prefer stablecoins they can trust.”

According to Tether’s website, its USDT stablecoin is backed by cash and equivalents “and, from time to time, may include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities.”

Paxos’ stable of stablecoins, including Paxos standard token (PAX), Binance USD (BUSD) and Huobi (HUSD), are all approved by regulators and are fully backed on a one-to-one basis with U.S. dollars, according to Hessert.

Tether’s first-mover advantage may have been the leading reason for its overall dominance, but even in Asia, which has historically driven demand in USDT, traders are beginning to turn to other stablecoins for liquidity.

“We have seen a lot of guys in Asia are starting to trade more BUSD and USDC instead of tether,” Darius Sit, co-founder of Singapore-based crypto trading firm QCP Capital, told CryptoX in an interview. “USDC is more fungible, meaning that it can be exchanged one to one anytime. The spread is tighter.”

The total stablecoin supply in the third quarter nearly doubled from the second quarter, and the total market capitalization of stablecoins has also breached $20 billion at press time, according to data from CoinGecko. That’s still relatively smaller than what’s found in traditional finance, a fact giving optimism to many in the stablecoin business hoping to overtake tether.

“When you think about the size of dollar money markets, it’s like four trillion” dollars, Allaire said. “So clearly, tokenized dollars that are used in a really wide variety of applications should be eventually [worth] hundreds of billions or even trillions of dollars.”