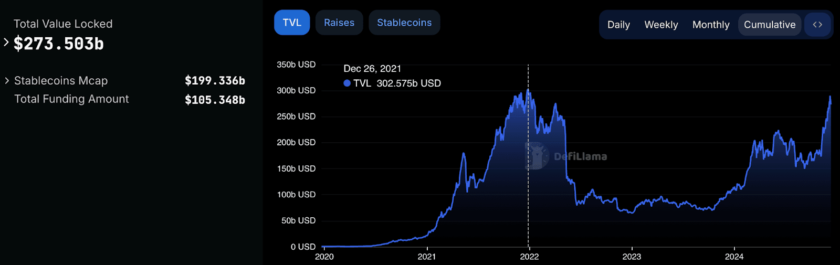

The growing interest in DeFi is unprecedented. It has pushed daily ETH transactions high, fueled by liquidity mining or yield farming. Stablecoin transactions are also a significant contributor. Realizing the potential and importance of DeFi, fintech firms are bringing more value, therefore more liquidity.

The article will explore how well-positioned Ethereum is to draw more projects and who can dethrone it.

Speed, Scalability, and Transaction Fees

Ethereum

Ethereum uses the Proof-of-Work consensus algorithm called Ethash. Though secure, it’s limited to 15-20 TPS, and it doesn’t scale well either – a big problem for DeFi growth. Ethereum plans to switch to the Proof-of-Stake consensus algorithm with Ethereum 2.0. Further delayed, the launch may not happen before Q1 of 2021.

Admitting scalability bottlenecks because of nearly-filled Ethereum, Vitalik Buterin said, “If you’re a bigger organization, the calculus is that if we join, it will not only be more full but we will be competing with everyone for transaction space. It’s already expensive and it will be even five times more expensive because of us. There is pressure keeping people from joining.”

Though the average transaction fee is about $6, some users reported it to climb up to $99!

Cardano

Cardano uses Ouroboros, a Proof of Stake consensus protocol that enables stakeholders to pool their resources into a single stake pool. Launched on July 29, 2020, its Shelley mainnet (hard fork) removes stake dependency. Here, the community decides on block validators by staking.

Cardano offers 50-250 TPS on layer-1. Ouroboros Hydra, a layer-2 off-chain protocol that incorporates sharding, will allow it to scale horizontally. With each head offering up to 1,000 TPS, adding more nodes (hardware) can theoretically contribute one million TPS. Cardano’s 4th Basho phase improves scalability.

Trading at $0.11, Coinswitch expects Cardano’s ADA price to rise to $2 by 2023. The minimum fee for every transaction is 0.155381 ADA (about $0.017), plus an extra cost of 0.000043946 ADA per byte of transaction size.

Algorand

To adopt a more egalitarian ecosystem to neutralize the wealth gap, Algorand employs Pure Proof-of-Stake, a stake-independent algorithm. Its cryptographically verifiable lucky draws ensure inherent security that gets stronger as the network grows.

Algorand’s mainnet offers 1,000 TPS. Being independent of each other, multiple lotteries run on layer-1 concurrently, with each taking one microsecond. This allows Algorand to scale horizontally and linearly.

With ALGO costing around $0.6, Algorand’s transaction fee is 0.001 ALGOs which translates to $0.0006. Algorand’s account requires a minimum refundable balance of 0.001 ALGOs for transactions.

Smart Contracts and The Development Language

Ethereum uses stateful smart contracts where state condition is not supplied within transactions but stored somewhere else. Using a Turing-complete Ethereum Virtual Machine on nodes, it enables users to create highly flexible and complex smart contracts.

Ethereum offers Solidity to write smart contracts that get compiled to bytecode. Though it offers multiple programming benefits, the (C++ and Java-influenced) language is unfriendly as it requires developers’ solid understanding of the underlying Ethereum system and its different intricacies.

Cardano

Cardano will launch its third phase called Goguen by the end of 2020. Here, Cardano will implement smart contracts and enable DApps for creating a versatile financial operating system. Cardano CEO Hoskinson claims their Hydra off-chain protocol will allow fast and inexpensive transactions with lower latency than Ethereum.

To develop smart contracts, Cardano uses a purpose-built language called Plutus based on the functional programming language Haskell. To help non-technical users, Cardano is also developing Plutus-based high-level language Marlowe. Both having on and off-chain capability, this is geared towards enterprise-grade DeFi solutions.

Algorand

Algorand uses stateless smart contracts (state data supplied within transactions) that offer fast transactions with extremely low fees. On 18 August 2020, it also deployed stateful contracts at layer-1 with fee and scalability remaining intact. Having both on layer-1 allow Algorand to offer both fast transaction and customizability with cheap fees – an enterprise-grade solution for DeFi.

Algorand offers PyTEAL for writing smart contracts. Developers can write both smart contracts in popular Python language and PyTEAL will compile it in its proprietary TEAL opcode.

Block or Staking Rewards

Ethereum

The current block rewards in Ethereum is $2 per block mined. The latest Ethereum Improvement Proposal to reduce it by 75% i.e. to $0.5 has met with sharp criticism from miners.

To be a validator, Ethereum 2.0 requires a minimum investment amount of 32ETH i.e. $12,800 with an ETH value of $400. Accounting for the $180 validation cost, a 5% average (1.56%-18.1%) reward suggested by Ethereum developer Justin Drake means around $190 annual profit. Below 32ETH stake value will cost the validator right. A workaround is to create a staking pool through staking-as-a-service providers like Poloniex or Bitfienx for a small percentage of the reward earned.

Cardano

Cardano offers two options for earning through staking – either to run your own ADA stake pool or delegate your ADA to a stake pool run by someone else (easier). According to stakingrewards.com, the former option offers an annual adjusted reward of about 4.82% and the latter gives around 3.65%. The delegated stake option charges a 14.91% default provider fee.

To make their pool attractive, pool operators may optionally pledge some or all of their stakes. Every 5 days, 0.3% incentive from 13.8 billion reserved ADA is distributed among all.

Algorand

Algorand offers staking rewards to anyone holding at least 1 ALGO irrespective of they are online or offline i.e. participating in cryptographic sortition protocol. It’s a very easy process offering a 0.19% adjusted annual reward. In the future, Algorand may raise the reward for online stakers.

For every 500,000 block period, 13 million ALGOs are distributed between June 1 – October 6, 2020.

Important Points

Ethereum

- Many quality DeFi projects including Maker, Compound, Aave

- Worth $2 billion of ETH locked for DeFi

- High ETH liquidity

- Most popular platform with 2.0 update coming

Cardano

- Peer-reviewed research and highly-tested code

- Just in 3rd phase of development, yet bagged USDC, a few lending platforms, and DEX

- Enterprise-focused DeFi

- Ethereum co-founder Charles Hoskinson

Algorand

- ASA for tokenization, Atomic Swap, smart contracts – all implemented on layer-1 offers speed

- A DeFi multi-bagger within just 2 years – USDT, USDC, a CBDC, DeFi infra-building

- Clockwork-like update adding capabilities

- Enterprise-grade solution for DeFi

- Turing-award winning cryptographer Silvio Micali

Conclusion

With each having something special to offer, who the DeFi space puts a bet on – the giant weighing down under its own weight (for now), the most promising challenger, or the rising DeFi star.