By CCN: Bitcoin price predictions are a dime a dozen. They can go anywhere from zero to over a million dollars. Some bettors like John McAfee are so confident that they are ready to go through absurd lengths (such as consuming their own member) to show their conviction. Do these crazy predictions hold ground?

We scoured the web and discovered that John McAfee is not alone in his prediction that the king of cryptocurrencies will reach a million dollar valuation. Here are the most insane bitcoin predictions bravely shared by reputable financial figures.

Jesse Lund, Former VP of Blockchain and Digital Currencies for IBM

The former IBM executive is a bitcoin bull after stating during an interview that the price of BTC will eventually tap $1 million. In the interview, Lund says that at $1 million, a Satoshi would equal one U.S. penny. He also noted that liquidity would skyrocket to over $20 trillion if one bitcoin is valued at $1 million. In his view, the $20 trillion liquidity would be a massive game-changer in the global financial services sector.

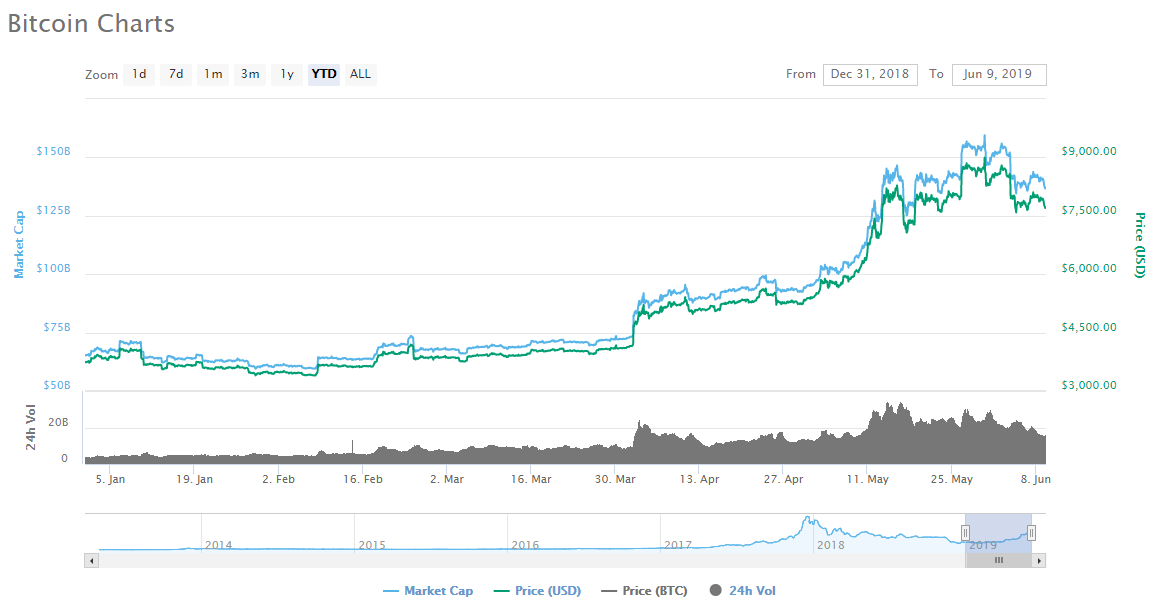

The bitcoin price is up by a triple-digit percentage year-to-date. | Source: CoinMarketCap

Wences Casares, Member, PayPal Board of Directors

Casares also hopped on the bitcoin $1 million valuation, but his prediction comes with a somewhat reasonable timeframe. According to the newest addition to PayPal’s board of directors: “One bitcoin may be worth more than $1 million in seven-to-10 years.” In his forecast, Casares emphasized stats that are often overlooked such as:

- Ten years of uninterrupted progress

- Over 60 million holders

- 1 million new holders each month

- Global transactions of over $1 billion per day

Julian Hosp, Author and Crypto Analyst

Like Casares, Hosp is also a big believer that bitcoin will hit $1 million in the next decade. To make this prediction, he relied on the metric called the stock-to-flow ratio. The metric computes the current supply of the asset and divides it by the annual amount produced to estimate future valuation. Using this ratio to compute for bitcoin’s future value, the limited supply of 21 million coins will eventually play a huge factor.

According to Hosp, the stock-to-flow ratio has a 95% accuracy as it foretold the “2014 bubble, 2016 undervaluation, 2017 bubble, and undervaluation in summer 2018.” He also says that bitcoin’s price will range between $100,000 and $300,000 by the 2020 halvening.

Zhu Fa, Poolin Co-Founder

The crypto mining pool co-founder recently expressed his bullish view on bitcoin. On Feb. 10, Zhu Fa predicted that bitcoin would climb as high as 5 million Chinese yuan. That’s equivalent to about $740,000. At the time, bitcoin was trading just above $3,500 and the overall sentiment was extremely bearish.

On his WeChat post, he said:

“Bitcoin price will be in the range of 500,00 yuan – 5,000,000 yuan ($74k – $740k) in the next round of the bull run… Likes and comments on crypto posts in the community keep going low these days, it now feels more like a bear market.”

While Fa’s forecast is not in the million-dollar mark, $740,000 is still a mind-numbing increase of over 9,200% from the current price of bitcoin at $7,950.

Oliver Isaacs More Down to Earth Target Price

Oliver Isaacs is a big Blockchain enthusiast and influencer advisor well respected in the crypto community. In his very recent interview with Independent, Oliver Isaacs pointed out:

“I believe bitcoin has the potential to hit $25,000 by the end of 2019 or early 2020.”

This is nothing compared to the other predictions in this article. However, it may still be hard to imagine that bitcoin’s price will triple in price in the next six months or so.

Bottom Line

Our research shows that McAfee is not alone in his million-dollar bitcoin price prediction. Other respected figures in the industry are also predicting a similar outcome. What does this mean for the average investor? Buy and hold. We may not see bitcoin rise to $1 million by 2020, but quite a few experts believe that we’ll get there in as little as 10 years.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN Markets.