- Investors are overlooking the risks of a Democrat sweep in November.

- A Democrat victory means Trump’s tax cuts would be rolled back.

- It could trigger a stock correction come November.

New polling data is starting to show that President Trump’s grip on the White House is slipping away.

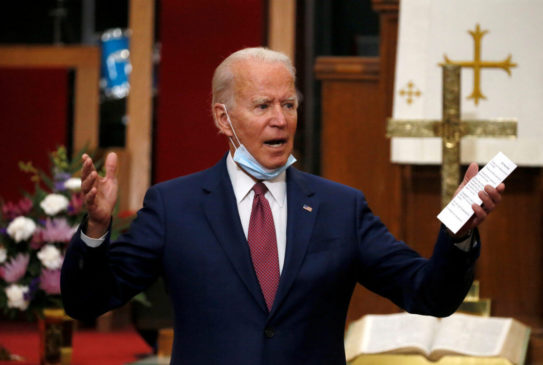

Amid civil unrest and unprecedented pandemic, Democratic nominee Joe Biden is starting to gain traction. But the power shift hasn’t made so much as a ripple in the U.S. stock market.

That suggests investors either don’t realize or don’t care about the implications a Biden presidency would have on corporate America. But they should.

Biden is Coming Out on Top

Joe Biden’s lead over Trump grew to 10 percentage points, according to a Reuters/Ipsos poll out this week. That marks the first time the former Vice President has lead Trump by such a wide margin.

Biden has long been considered the most conservative of the Democrats’ potential candidates, so it makes sense that markets aren’t panicking about his possible White House takeover.

In many ways, investors are likely comparing what happens under Biden to what could have happened under a more progressive candidate like Bernie Sanders, who wanted to overhaul corporate taxes and healthcare.

‘Blue Wave’ Will Hurt the Stock Market

But Biden at the top will have consequences for corporate America, especially if this year’s election manages to put Democrats in power in all three branches of government. For now, Republicans have control of the Senate, but some are forecasting a power shift there as well.

That scenario makes Biden a much more threatening candidate for corporate America because it means progressive legislature would have far less resistance.

According to Goldman Sachs’ Cole Hunter, that outcome would almost certainly mean Donald Trump’s sweeping corporate tax reform would be rolled back. No matter how you slice it, that’s bad for big businesses.

Why the Stock Market is Indifferent to Joe Biden

So why hasn’t the stock market started to wobble over the news? There could be several explanations.

The most likely is simply that the election data aren’t taking top billing in the current news cycle. The world’s exit from lockdowns continues to be the main focus for most investors as they try to forecast the shape of the U.S. economy. From investors’ point of view, it doesn’t matter who the president is if there’s no economic recovery. It’s a more immediate threat.

It’s also possible that people simply don’t care. As Goodbody’s Joe Prendergast pointed out, the president’s political affiliation doesn’t necessarily have a significant impact on financial markets. That’s truer now when you consider the other market-moving events impacting investor sentiment:

Beyond possible sectoral effects, history suggests the election will not have any major market impact — at least not against the simply huge changes in interest rates and discount rates surrounding the pandemic policy response

Prendergast’s explanation is supported by polling data showing that more self-described investors are planning to vote for Biden than Trump. An Investors Business Daily poll showed that Biden has a two-percentage-point lead over Trump among investors despite the stock market’s epic rally.

Either these investors are shorting stocks, or they don’t think the market’s gains have much to do with Trump himself.

Stock Market Correction in November

But Goldman Sachs’ top equity strategist Peter Oppenheimer has warned that the election could ultimately trigger a stock market correction.

November is a long way away and by then the stimulus spending excitement will likely have faded, giving way to concerns about a shift in power in Washington:

As more of the recovery is priced in and as time goes on and focus shifts to political issues I think that will be much more of a constraint and possibly even the trigger for a correction in risk assets.

While many consider Joe Biden to be a relatively ‘safe’ Democrat candidate, Oppenheimer pointed out that some of his proposed changes could have a massive impact on the stock market.

It is important for all kinds of reasons but also the democratic candidate talks about the possibilities of reversing the tax cuts of 2017. If that happened, it would hit profit forecasts and expectations for next year and could trigger a de-rating.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com.

This article was edited by Sam Bourgi.

Last modified: June 6, 2020 1:53 PM UTC