This week saw more exchange drama rock the crypto markets.

OKEx, one of the industry’s largest crypto-fiat exchanges, suspended all cryptocurrency withdrawals, saying one of the exchange’s key holders has “been out of touch” with the exchange because they are “currently cooperating with a public security bureau in investigations.”

Coming hard on the heels of the BitMEX indictments from a couple of weeks ago, this surely will focus the market’s attention on the security of the withdrawal protocols of large exchanges.

At the time, concerns surfaced that withdrawals might be halted from BitMEX, one of the largest derivatives exchanges in the industry. The withdrawal protocol needed a certain number of authorized signatures, and one of the authorized signatories had been arrested. The concerns turned out to be unfounded, withdrawals continued without a hitch, but the possibility, combined now with OKEx’s reality, highlights how unique crypto asset market infrastructure is.

Traditional market-infrastructure businesses are not exempt from regulatory risk. But in traditional markets, customers don’t deposit their funds directly on exchanges; they do so via brokers. Even if a broker were to go bankrupt, for instance, segregation of funds means the broker’s bank could return funds to clients.

Crypto markets don’t work that way. Brokers are not yet a feature, and customer funds are usually held by the exchange platform. When it comes to crypto holdings, there isn’t even a bank that can take over at the behest of the authorities to return funds.

This also highlights the irony that an industry born with a decentralized ethos is dominated by centralized businesses, with centralized vulnerabilities. While exchanges often have multi-sig protocols in place (which allowed BitMEX’s withdrawals to proceed even when one signatory was unavailable), it appears that not all do.

And while traditional markets have participants operating in lightly regulated jurisdictions, these businesses do not dominate their market segment, as they do in crypto.

Another issue it raises is that of jurisdiction. OKEx is based in Malta, which is part of the European Union, but headquartered in Hong Kong, with offices in Singapore and San Francisco. After CryptoX’s initial report came out, Chinese media reported that the founder Star Xu had been released from police custody in Shanghai. The exact charges are still unclear, and the company has said in an emailed statement that they are nothing to do with OKEx. Rumors (not yet corroborated) have surfaced that it is to do with money laundering – were they to be true, which jurisdiction should press charges, and to what extent should Malta be involved?

Chinese media also reported that the detention of Xu was the result of an investor dispute over forced liquidations, a systems crash and OKEx’s handling of the situation. The company has claimed it is not aware of such a problem.

What’s more, the corporate structure of OKEx is frustratingly confusing – Xu is also the founder of OKCoin which is based in China, as well as the CEO of OK Group, and, according to his LinkedIn profile, he’s based in San Francisco. Some reports say Xu was not detained by the police, that he had asked for their protection. Others say he was detained two weeks ago, and has not been since. OKEx maintains that Xu no longer represents the firm, which was spun out from OK Group earlier this year. This then leaves unexplained the suspension of withdrawals.

By the time you read this, more news will probably have emerged to clarify the legal situation and the withdrawal schedule. Or perhaps we’ll be even more confused. Meanwhile, the company insists customer funds are safe.

This situation highlights both the relative immaturity of crypto markets as well as how far they’ve come. It reminds us that the markets are still immature, in that on many systemic platforms there are still relatively few customer protections in place. The market is still largely retail, which has fueled the growth of platforms that do not meet the rigorous compliance and accountability requirements of institutional investors.

Yet this also reminds us of how far crypto markets have come in terms of resilience and adaptability. The bitcoin (BTC) price initially fell just over 2% on the news, less than the almost 4% drop on the back of the BitMEX indictment news on Oct. 1. As I type, it shows signs of holding steady in the $11,300-$11,350 range.

Looking forward, developments like this will accelerate a trend that has already started: the growing interest on the part of centralized exchanges (not just in the crypto industry) in decentralized applications. Earlier this week, at our Invest: Ethereum event, Binance founder CZ repeated that he sees decentralized finance, or DeFi, as a complement rather than a competitor to the more traditional structure.

Indeed, the price of $UNI, the token of the decentralized liquidity provider Uniswap initially fell on the shock of the news but then rebounded almost 15% as investors started thinking through the potential impact.

Meanwhile, tokens issued by more centralized crypto exchanges such as Binance (BNB) and FTX (FTT) fell by 5% and 3% respectively, and at time of writing have yet to rebound.

It’s not often you get to watch market infrastructure dynamics shift before your very eyes. But, as we say in our industry, a year in crypto is like 10 years in traditional finance.

The crypto market is broader and more interesting than most realize

We had our first Ethereum-focused event this week, which brought together investors, analysts and builders from all corners of the industry to discuss the second-largest crypto ecosystem by market cap, and its upcoming technology change.

I hosted a panel of crypto market-infrastructure leaders to talk about the financial off-chain aspects of Ethereum – its markets, traded products, investors and outlook. We didn’t have time to go into all that I would have liked, but here are some of the key takeaways:

Ethererum is becoming an on-ramp

Bitcoin (BTC) is still the main crypto asset on-ramp for investors, as it is the most liquid and has the greatest number of venues and trading opportunities. Yet according to Michael Sonnenshein, managing director of Grayscale Investments, a growing number of traditional investors are attracted by the potential of decentralized finance and Ethereum’s value proposition as a platform for innovative market applications. ETH is becoming an on-ramp.

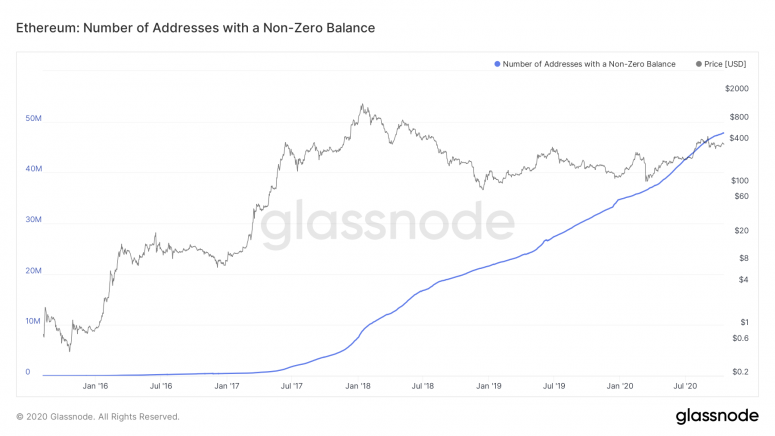

The growth in ETH investors can be seen in the number of addresses with a non-zero balance, which is up almost 40% since the beginning of the year.

Volatility is a feature not a bug

Many investors cite volatility as a barrier to crypto asset investment. Some regulators use it as an excuse to limit access for retail investors who may face unexpected risk. Indeed, crypto assets are more volatile than most traditional assets – but that is more a feature than a bug.

Both Sonnenshein and Thomas Chippas, CEO of crypto asset platform ErisX, pointed out that their client bases represent a wide variety of investment strategies, including risk arbitrage trades. This is no doubt a feature across the market, as traders and quant funds search for greater volatility than they can find in traditional markets since, harnessed well, it can provide superior returns. The growth of liquidity in the crypto derivatives market, both in volumes and in range of products and maturities, shows that hedging strategies are becoming more sophisticated, which enables return-enhancing volatility trades.

The institutions are already here

The “great wall of institutional money” that some crypto market commentators were breathlessly awaiting a couple of years ago did not materialize. But that does not mean “the institutions” aren’t already here.

All three panelists acknowledge that crypto markets are still largely retail, but that institutional investors are playing an increasing role in liquidity and in shaping the development of market infrastructure.

Grayscale Investments (a subsidiary of CryptoX’s parent DCG), whose clients are mainly institutional and professional investors, announced earlier this week their best quarter ever, with over $1 billion raised in three months, more than 4x the amount for Q3 2019.

Also this week, PricewaterhouseCoopers (PwC) released a report that shows that over $1.1 billion of institutional money flowed into the industry in the form of venture capital investments. And JPMorgan published an investment note on bitcoin for its institutional clients.

A growing ecosystem in terms of maturity and opportunity

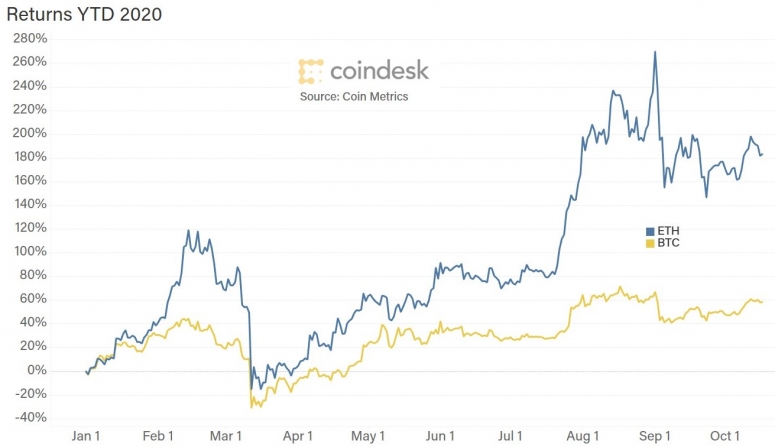

Overall, the event highlighted that the crypto asset ecosystem is about so much more than bitcoin. While that may be the largest and most liquid cryptocurrency, the innovation, building and emerging structure around other crypto assets such as ETH is bound to attract attention of a broader range of investors – not just those who want to diversify their crypto holdings (ETH has outperformed bitcoin so far this year, +194% vs +60%), but also those who take the time to understand the value proposition of alternative assets as individual opportunities.

In other words, investors will increasingly come to realize that crypto assets are much more than an alternative asset group. They are a collection of compelling ideas that respond to unusual market dynamics to create a unique opportunity to witness not only the birth of a new type of value exchange, but also the emergence of new valuation techniques and portfolio strategies.

Anyone know what’s going on yet?

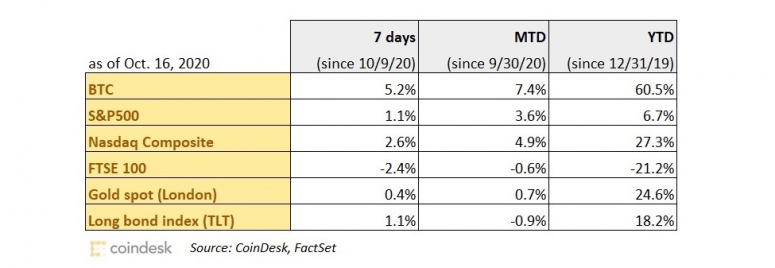

As if proof were needed that crypto markets can move fast, the healthy outperformance shown in the chart below was reduced in a matter of minutes when crypto exchange OKEx announced an indefinite suspension of withdrawals (which might have been restored by the time you read this).

With that price dip, which was relatively muted compared to what it would have been a year ago, say, we still have markets moving in a steady band, awaiting further signs of vaccine/stimulus optimism, or pandemic/recession/inflation pessimism.

CHAIN LINKS

At our Invest: Ethereum Economy event this week, our Chief Content Officer Michael Casey chatted to Heath Tarbert, chairman of the U.S. Commodity Futures Trading Commission (CFTC), about the regulator’s view on Ethereum and its asset, ether (ETH). TAKEAWAY: What stuck out from the conversation was how much thought Chairman Tarbert has put into Ethereum and its potential applications, as well as the upcoming technology shift to Ethereum 2.0. Among the takeaways to keep an eye on:

- Staking yields could perhaps be considered income, which could make ETH a security, although this would be the purview of the U.S. Securities and Exchange Commission (SEC). The decentralized nature of the Ethereum network is a factor in that equation, and could push the classification towards that of commodity.

- He was surprisingly accepting of the idea that decentralized finance will disintermediate the financial system from traditional players.

- Enforcement actions against crypto exchanges are likely to continue as long as there are exchanges flouting U.S. laws. Chairman Tarbert sees this as necessary for the U.S. to lead in digital assets.

A report by PwC shows that dollar amount of crypto M&A deals in H1 2020 exceeded the amount for all of 2019. Also, the average size of private equity investments grew from $4.8 million in 2019 to $6.4 million in the first half of 2020. TAKEAWAY: Not only is the report illuminating in terms of the number of deals done – where the deals are concentrated is also interesting. The uptick in deals involving crypto asset exchanges and trading companies reveals a growing interest in crypto asset market infrastructure, which signals that institutional investors expect institutional investors to show even more interest in the industry.

Digital asset manager Grayscale Investments* reported Q3 figures, which showed investment inflows of over $1 billion, vs. $255 million in Q3 2019. TAKEAWAY: Not all of this inflow is new institutional money, as many investors recycle their investments – they sell in the market when the lock-up expires (now at six months) at a significant premium, and then re-invest the proceeds in new trust share issuance. Still, the figure is representative of institutional interest, and indicates significant growth in demand for bitcoin as an investment. (*Grayscale Investments is owned by CryptoX’s parent DCG.)

The Ethereum Trust managed by Grayscale Investments (a subsidiary of CryptoX’s parent, DCG) has become a Securities and Exchange Commission (SEC) reporting company, a move that increases the trust’s transparency – and potentially its liquidity. TAKEAWAY: This potentially increases the trust’s liquidity by reducing the mandatory holding period for qualified investors from 12 months to six. It will also increase transparency around the funds flowing through the investment vehicle, per SEC filing requirements.

Investment bank JPMorgan issued a research note on bitcoin that stressed the “vote of confidence” from Square’s recent treasury purchase of $50 million worth of BTC, and the payments company’s growing revenue from crypto asset sales. TAKEAWAY: The analysts seem to be focusing more on demographic sentiment and corporate precedent than fundamental valuations, which is itself a notable shift from other investment bank-sponsored reports. Could it be that traditional finance is finally getting that fundamentals are not the only value drivers?

Institutional asset manager Stone Ridge Holdings Group has purchased 10,000 BTC as a “primary treasury reserve asset,” which it is holding with its crypto subsidiary NYDIG. TAKEAWAY: This adds to the list of non-crypto companies using bitcoin as a hedge against inflation and dollar debasement. Emphasizing the vote of confidence in the ecosystem that this represents is NYDIG’s new $50 million funding round, backed by Fintech Collective, Bessemer Venture Partners and Ribbit Capital.

Bitcoin’s hashrate (an indicator of how much computing power is dedicated to maintaining the Bitcoin network) rose to a record high this week. TAKEAWAY: Remember the Bitcoin halving, just five months ago, when the miner subsidy of new bitcoin was cut by 50% and some predicted that mining would become unprofitable for many? This would then theoretically weaken the network’s security by centralizing mining power in the hands of a few large pools that could enjoy economies of scale. Well, rather than dwindle, it continues to climb. This shows that mining costs are coming down largely due to lower energy prices and more efficient machines. It also shows that the network’s security depends on more factors than just the bitcoin price (which determines the value of the miner subsidies) – technological changes also matter.

On Oct. 1, Diginex became the first crypto exchange operator to list on a U.S. exchange. CryptoX Research presents a look at the company’s financials and prospects, in the light of declared information, rare in crypto market infrastructure businesses.