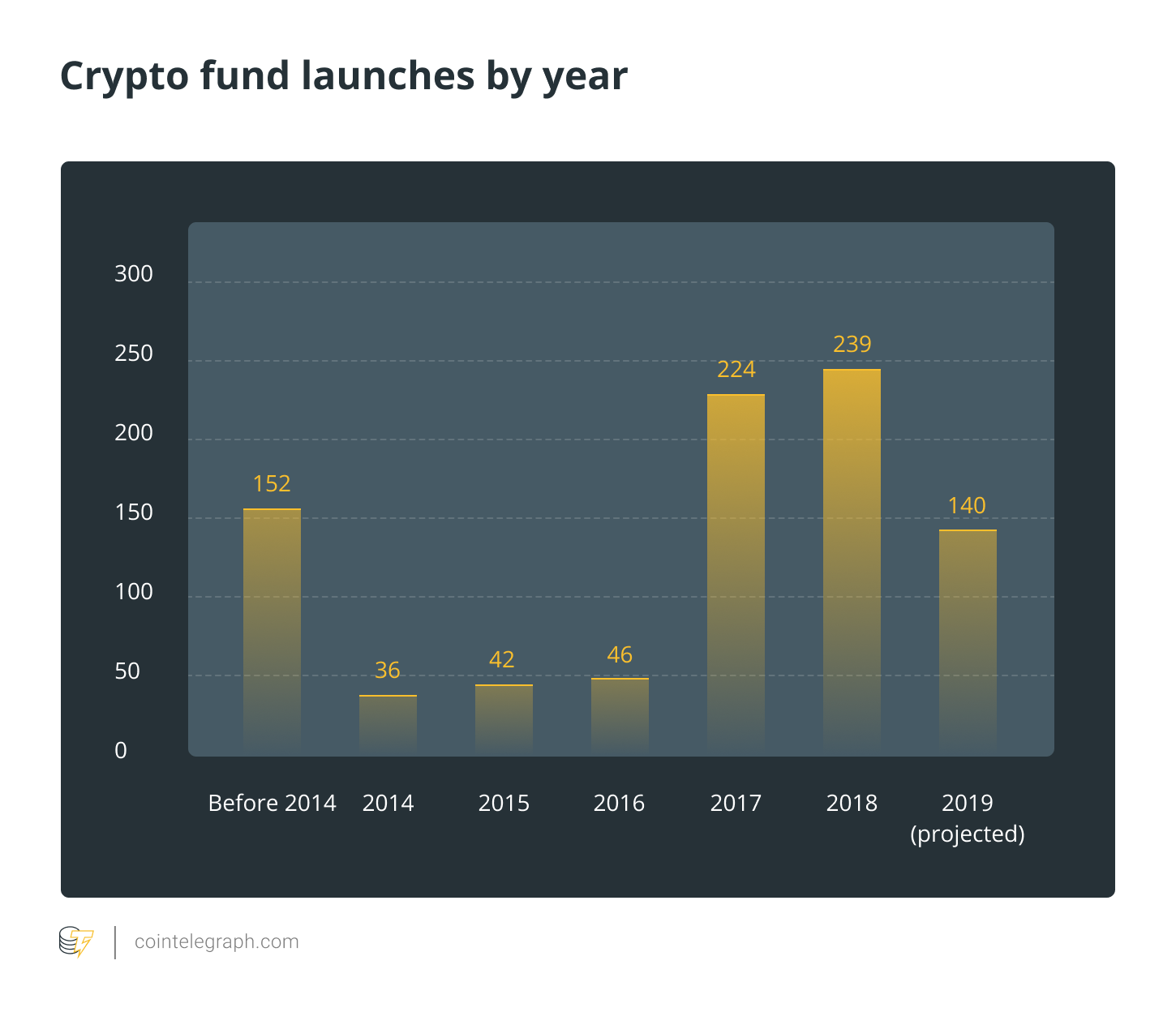

The explosive growth of crypto funds is a compelling story, especially when you consider that the concept has only been around for six years. Today, crypto funds have become the engine powering the thriving crypto industry. Compared to the 224 funds launched in 2017, 2018 showed unprecedented growth as 239 new crypto funds entered the fray.

However, many have projected that the number will drop in 2019. Yet, according to proprietary research by Crypto Fund Research, there are reasons to believe that the crypto fund industry will continue to make strides, even as the crypto market recovers from a grueling bearish run.

As expected, the rise of crypto funds has directly impacted the crypto space, with several talking points trailing its emergence as a crucial part of the crypto economy.

Crypto funds are typically crypto hedge funds or venture capital funds

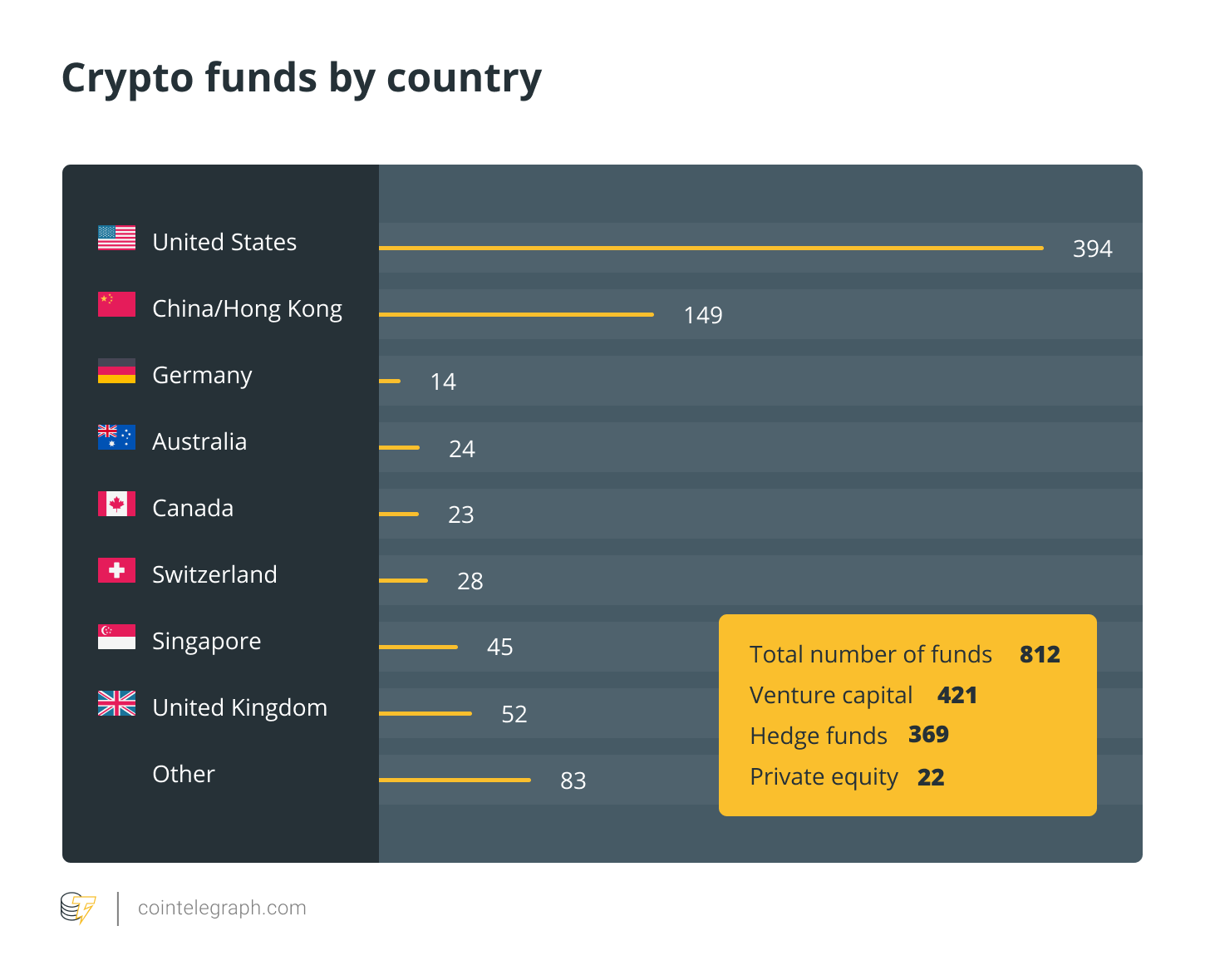

According to the same research, the 812 crypto funds presently operating across the world comprises of 369 crypto hedge funds and 421 venture capital funds, while the remaining are either crypto exchange-traded funds (ETFs) or private equity funds. One could argue that the influx of venture capitalist funds has translated to more funding options for blockchain startups, as it is now a common trend for traditional VC firms to launch blockchain funds.

While this is a given, the growing and maturing blockchain/crypto landscape has attracted private equity funds to crypto investment funds. On the part of crypto hedge funds, it’s a matter of maximizing all the investment opportunities made available by the volatile nature of the crypto market. And so, they mostly function as hybrid funds that invest in Initial Coin Offerings (ICOs) and cryptocurrencies. As such, they employ long-term investment strategies with longer lockup periods — similar to how venture capitalists operate.

Crypto funds are not as big as their traditional counterpart

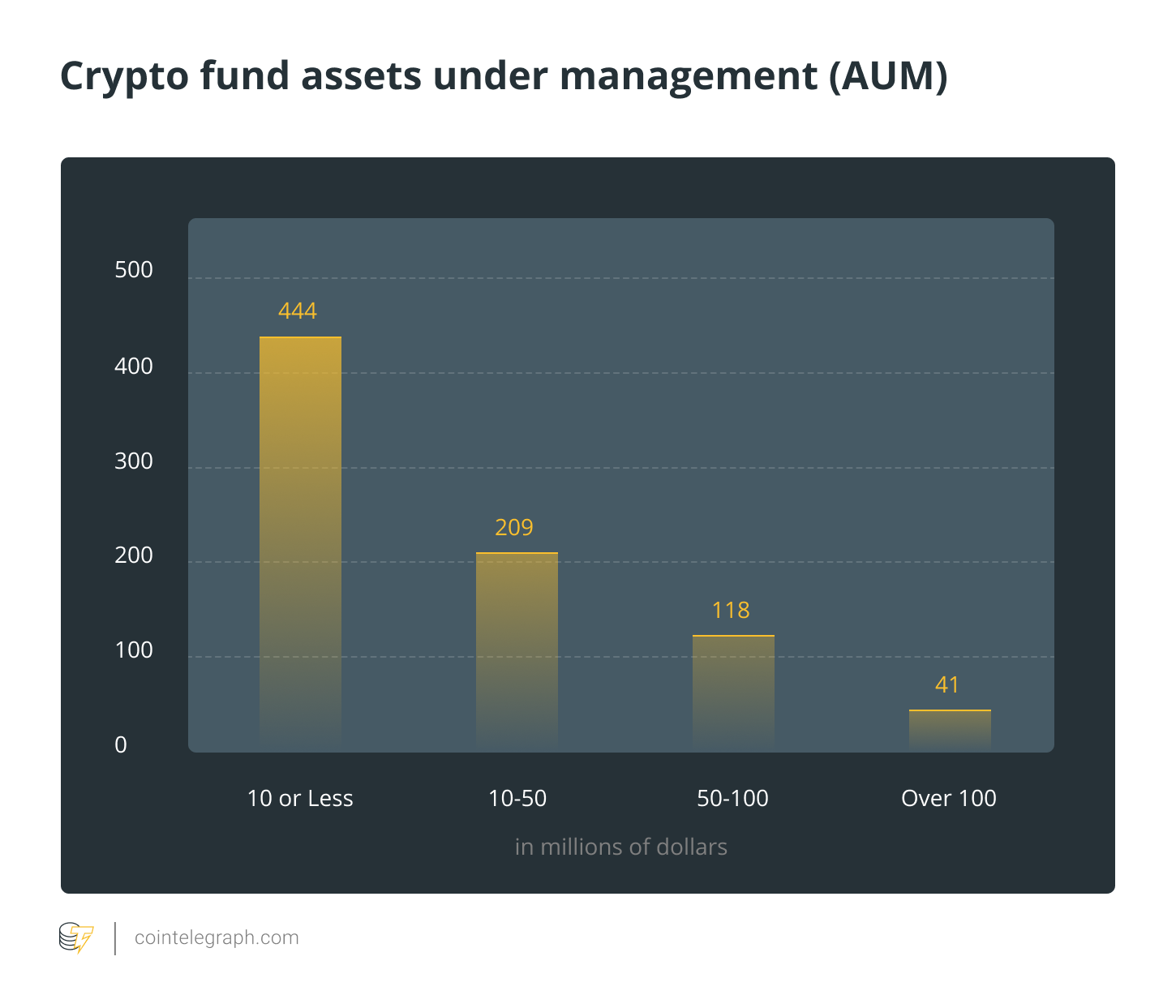

Although crypto funds are on the rise, a PwC and Elwood joint 2019 report shows that over 60% of existing crypto funds have assets under management (AUM) that is less than $10 million. Therefore, this means that many crypto funds are small-scale firms with fewer than five employees. However, top crypto funds which have more than $50 million in AUM do exist, and only two funds have AUM that is worth $1 billion and above.

As impressive as these stats are, they do not even come close to the value of assets that traditional hedge funds control. All crypto fund assets combined represent a meager 1% of hedge funds assets.

Crypto funds outperform Bitcoin

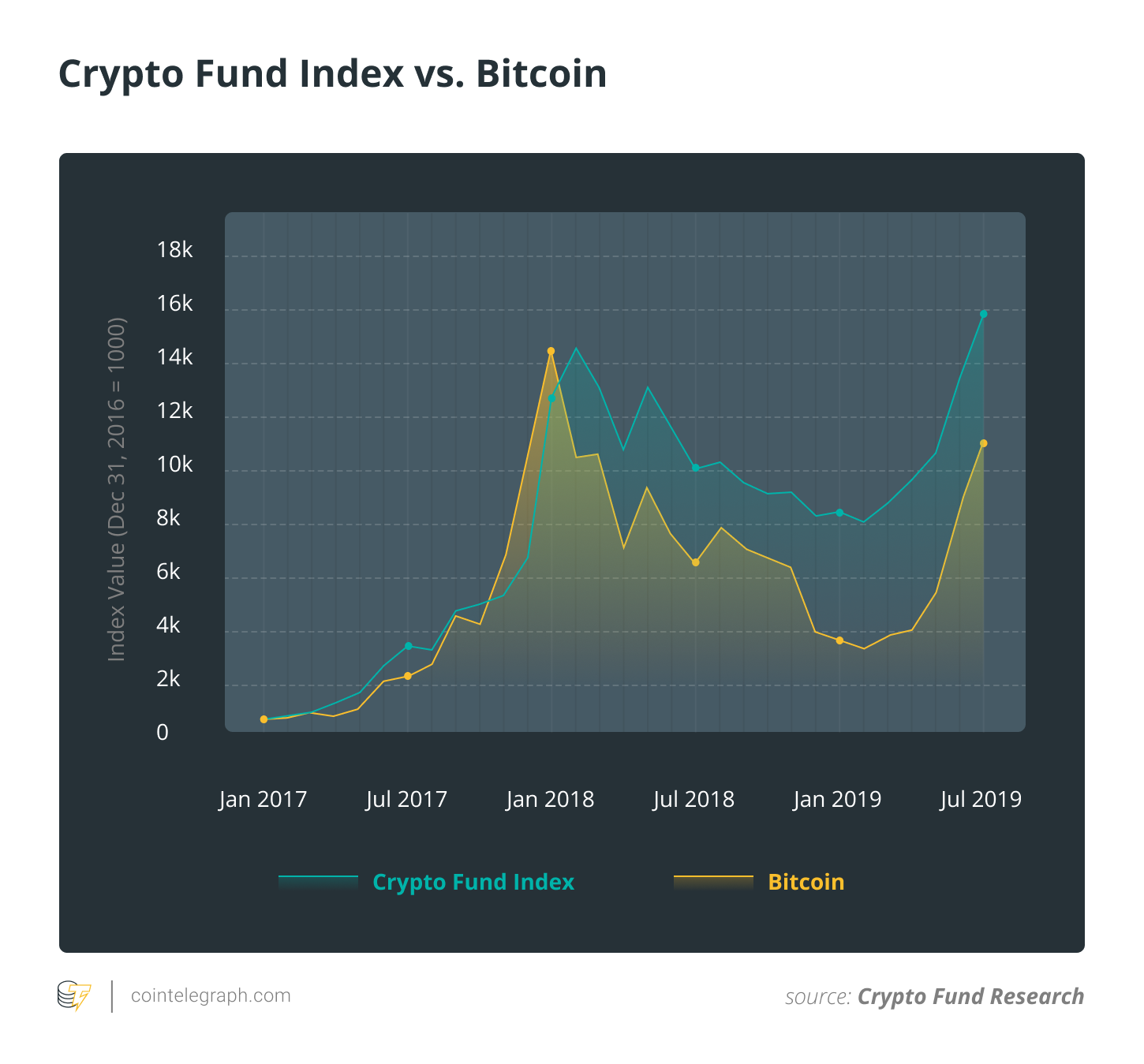

It is not every day you see hedge funds outperforming their benchmarks. A reality that holds in the traditional asset markets is redundant in the digital assets market, as crypto funds continue to perform beyond expectations. The Crypto Fund Research Cryptocurrency Fund Index (CFR Crypto index), which tracks over 40 crypto funds, managed to outperform the 100% increase experienced in the Bitcoin market from January 2017 to June 2019, gaining more than 1400% during the same period.

Related: Biggest Crypto Hedge Funds and What They Tell About the Market

The data from CFR Crypto index is more impressive when considering that crypto funds lagged behind many of the single digital assets performance in 2017 and overtook the market at a time when many feared the worst — the bear market. Nonetheless, this does not mean that investors did not lose money, rather that crypto funds returning -46% in 2018 compared to the -76% return of Bitcoin is, in itself, a success.

Crypto funds and bear market

The gruesome effect of 2018’s bear market — after the leading cryptocurrency’s price hit record highs at around $20,000 per coin — would have crippled the development of the crypto space if not for the unwavering optimism of crypto funds. Venture capitalists and crypto hedge funds utilized this period to pick out interesting blockchain projects and fund them. There is no doubt that without this funding, developments would have stalled.

Experience is one factor that should determine the profitability of investment funds, right? This belief is less potent in the hedge fund industry according to a recent Loyola Marymount University (LMU) report showing that hedge funds’ performance dipped as they aged. The research stated that the average age of conventional hedge funds is 52 months, and returns in the first year of operation are more than triple that of the fifth year. For crypto funds in the CFR index, their median age is 16 months. Applying the information garnered in the LMU report, one could argue that crypto fund managers are currently in their prime, and this has helped them generate fantastic returns.

America is still home to a large percentage of crypto funds

According to PwC and Elwood’s joint 2019 crypto fund report, 64% of crypto funds are based in the United States. Other countries that boast a booming crypto fund space are the Cayman Island, the United Kingdom, Singapore, Liechtenstein, Luxembourg and Australia. It seems that crypto funds generally prefer cities, which house traditional hedge funds.

In the past, the small size of many crypto funds excluded them from the spotlight. However, things are changing, as the U.S. Securities and Exchange Commission (SEC) and other regulatory bodies across the world are establishing guidelines for ICOs and security tokens. And since crypto hedge funds are heavily linked with security tokens, it is looking more likely that they will be required to meet stiffer registration requirements. A telling factor is the case of Pantera Capital, which disclosed in December 2018 that it might pay refunds and fines for investing in ICOs that violate U.S. securities laws.

A typical cryptocurrency fund could either be a hedge fund or a venture capital fund. Meanwhile, crypto funds are not as big as their traditional counterparts and are not so significant yet in the financial market. Nonetheless, on average, crypto hedge funds outperform Bitcoin, the leading cryptocurrency in the world. Crypto funds did good work in the bear market as the industry’s inexperience continues to propel its impressive run. To a large percentage of the world’s crypto funds, the U.S. remains to be home, and so, the regulatory uncertainties of this region is still a major talking point that needs to be clarified for future improvements of the industry.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Constantin Kogan is a venture partner at BitBull Capital, a board member of ABOTMI and has been a cryptocurrency investor since 2012. He has 10+ years of experience in corporate leadership, technology and finance. He contributes to the digital asset space, sharing and value economies.