Over the past few weeks, investors have begun to doubt the veracity of the assertion that “Bitcoin is on the verge of its next bull run.” While there are reasons to believe this is the case, an analyst has asserted that per one key metric, BTC has “never been more bullish.”

Bitcoin Hash Rate Continues to Rip Higher

The past few weeks have undoubtedly been weak for the cryptocurrency market; the price of BTC has collapsed from the $10,500 high to a price as low as $8,400 established just this weekend, while the hash rate of Bitcoin has stagnated.

But, according to the latest data from Blockchain.com, miners are once again allocating many resources to the security of the world’s largest cryptocurrency. Case in point: the hash rate of the Bitcoin network reached a new all-time high of 136 exahashes (or 136,000,000 terahashes) per second just two days ago — nearly three times higher than it was one year ago.

Commenting on the significance of this, crypto price tracking app Blockfolio wrote:

“As Wall Street experiences the worst week since the 2008 financial crisis, Bitcoin’s hash rate has just reached a new all-time high. 136,264,908 tera hashes per second.”

This optimism has been echoed by analyst RookieXBT, who noted on Tuesday that the hash rate is almost “~940% from where it was when BTC was at an all-time high” of $20,000. This, RookieXBT wrote, is a sign that “Bitcoin has never been more bullish.”

#Bitcoin hash-rate up almost ~940% from where it was at when $BTC‘s price was at an all-time high.

Halvening is mere months away.

Bitcoin has NEVER been more bullish. pic.twitter.com/93LYbndqkL

— RookieXBT (@RookieXBT) March 3, 2020

Indeed, growth in the hash rate of the network suggests at least two things: 1) Bitcoin miners are confident in the long-term success of the cryptocurrency (especially in terms of price) and allocate more resources to the security of the network; and 2) the technology of mining machines is being improved on, resulting in the increase in hash rate.

Also, increases in hash rate — or at least the cost of mining the cryptocurrency — is purportedly closely correlated with price action.

Per previous reports from NewsBTC, digital asset manager Charles Edwards and the team at investment firm Capriole Investments found that BTC’s fair value can be equated by determining how many Joules are used to secure the network.

Below is a chart illustrating this correlation, which sees Bitcoin’s market value and energy value trend towards each other, almost as if they were magnets.

The rapidly-surging hash rate, then, implies Bitcoin will soon start to trend higher once again.

Other Fundamental Trends

There are other fundamental trends supporting bulls.

Namely, on Tuesday the Federal Reserve implemented a 50 basis point (0.5%) policy interest rate cut as an emergency measure, something last done in the 2008 Great Recession.

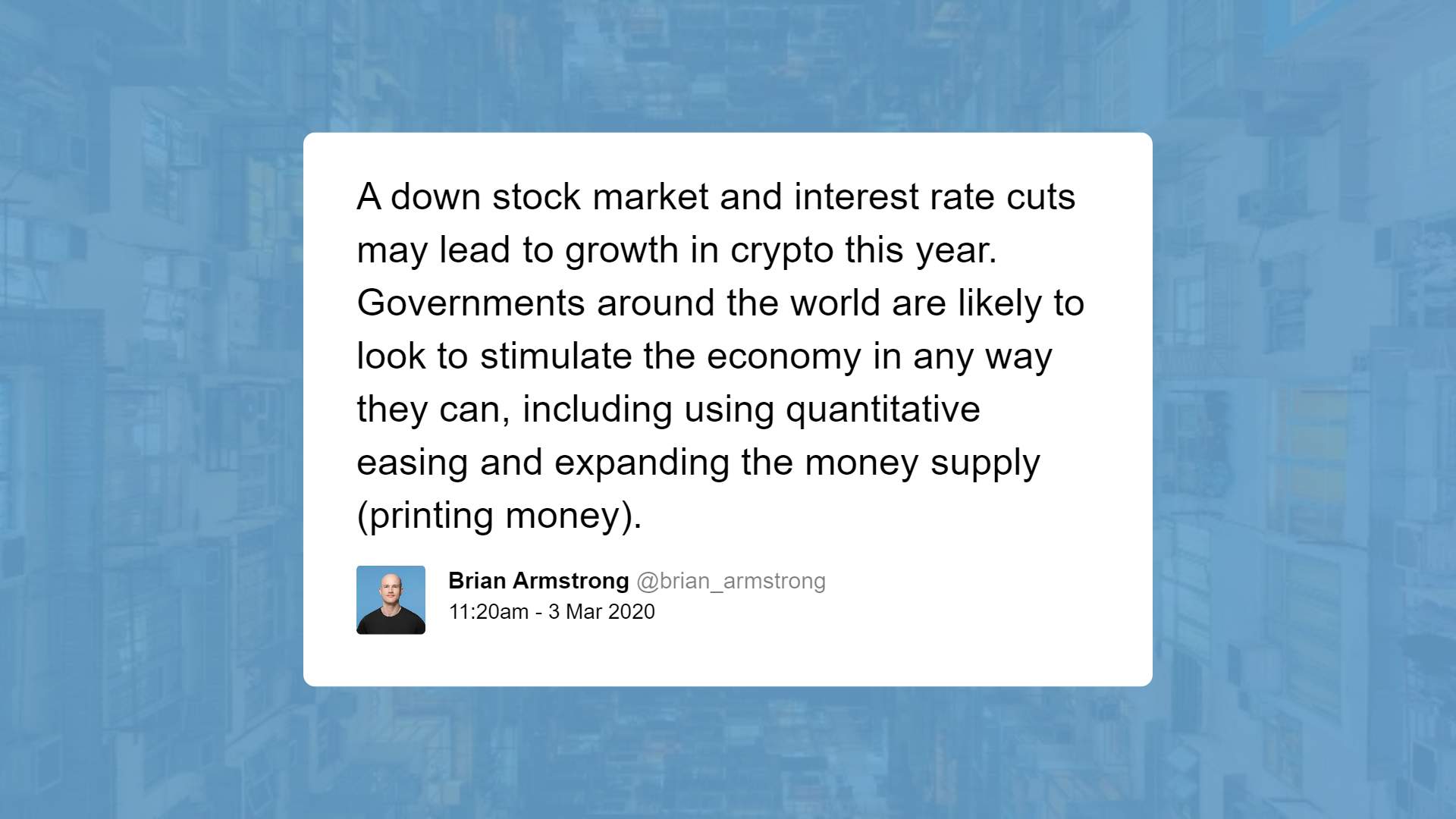

Pundits from industry executives like Coinbase CEO Brian Armstrong to mainstream economists have said that moves like these by central banks, which equate to the devaluation of currencies, have said that this should be of great benefit to BTC and other cryptocurrencies moving forward.

Featured Image from Shutterstock