The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.

From being outright dismissive of cryptocurrencies to adopting them, most central banks have come a long way. Research by the International Monetary Fund shows that several countries, both developed and developing, are toying with the idea of launching their own Central Bank Digital Currency (CBDC). While Uruguay has already launched a CBDC pilot program, others are likely to follow suit soon.

JPMorgan Chase CEO Jamie Dimon is confident that cryptocurrencies are unlikely to pose a threat to the core business of the banking system. However, he believes that cryptos will provide healthy competition to the banks. JPMorgan plans to launch its own cryptocurrency JPM Coin by end of 2019. Similarly, Switzerland-based online bank Dukascopy is exploring options to develop its own stablecoin, called “Dukascash,” that will be pegged to the euro, Swiss franc, and U.S. dollar.

Institutional and large traders, who were previously wary of investing in cryptocurrencies, seem to be warming up to the idea and are using crypto to diversify their portfolio. Billionaire Henry Kravis has invested in a crypto fund launched by Ben Forman, who previously worked at his firm, KKR & Co.

The fundamentals in the blockchain and crypto space are improving rapidly. Will this boost prices higher or will the cryptocurrencies enter a minor correction and consolidate the recent gains? Let’s analyze the charts and try to find out.

LINK/USD

Chain Link (LINK) is the best performing major cryptocurrency. It has rallied more than 110% in the past seven days. Bulk of the gains came after Coinbase Pro announced listing of the cryptocurrency on June 26. Can the momentum continue?

As the LINK/USD pair has a relatively short trading history, we will use the daily chart to analyze it. The trend is clearly up as it has been making new lifetime highs on a regular basis. With the recent leg of the up-move, the RSI has risen deep into overbought territory, which suggests that the rally has been overextended in the short term.

If the rally stalls, the digital currency might correct to $3.34471, which is the 38.2% Fibonacci retracement of the recent leg of the up-move. Below this level, we expect strong buying in $3.09630–$2.7455 zone, which corresponds to the 50% and 61.80% retracement levels.

Contrary to our assumption, if the rally continues, it can reach Fibonacci extension levels of $5.30 and above it $6.10. However, we give it a low probability of occurring in the short term.

BTC/USD

In the past week, bitcoin (BTC) led the bull market from the front. It easily scaled the overhead resistance of $12,000 and came very close to $14,000. The scintillating run is reminiscent of the vertical rally seen during the previous bull market. Its market dominance rose to over 60% during the week, the highest in the past two years. This shows that buyers are preferring bitcoin over other altcoins. Peter Brandt, a veteran trader, warned that the bullish sentiment in bitcoin might not rub off to altcoins.

Many central banks in the developed countries have indicated that they are likely to ease their monetary policy to support respective economies. Deutsche Bank executive Jim Reid believes this policy initiative has increased the demand for bitcoin. A report by institutional crypto lender Genesis Capital shows huge institutional interest in bitcoin in the past 12 months. They believe this might also be a contributing factor in the recent surge in the top cryptocurrency.

While there are many reasons for the rise in bitcoin’s price, as traders, should we jump on the bandwagon or wait for lower levels to buy?

During the week, the BTC/USD pair reached a high of $13,973.5. However, profit booking was seen at higher levels that dragged the price to below $12,000. Currently, the bulls are attempting to push the price back above $12,000. If successful, it will keep the momentum alive. The target levels to watch on the upside are $13,973.50 and above it $15,433.33.

The trend remains bullish as the 20-week EMA is sloping up and the RSI is in the overbought zone. But if the bears defend the overhead levels, the pair might correct to $10,740.35 and below it to $9977.33, where we expect buyers to step in.

We are against the idea of chasing prices higher because vertical rallies are unsustainable and risky. Bitcoin is likely to correct or consolidate for a few days before resuming the uptrend. Therefore, traders can wait and buy on dips once the price stabilizes.

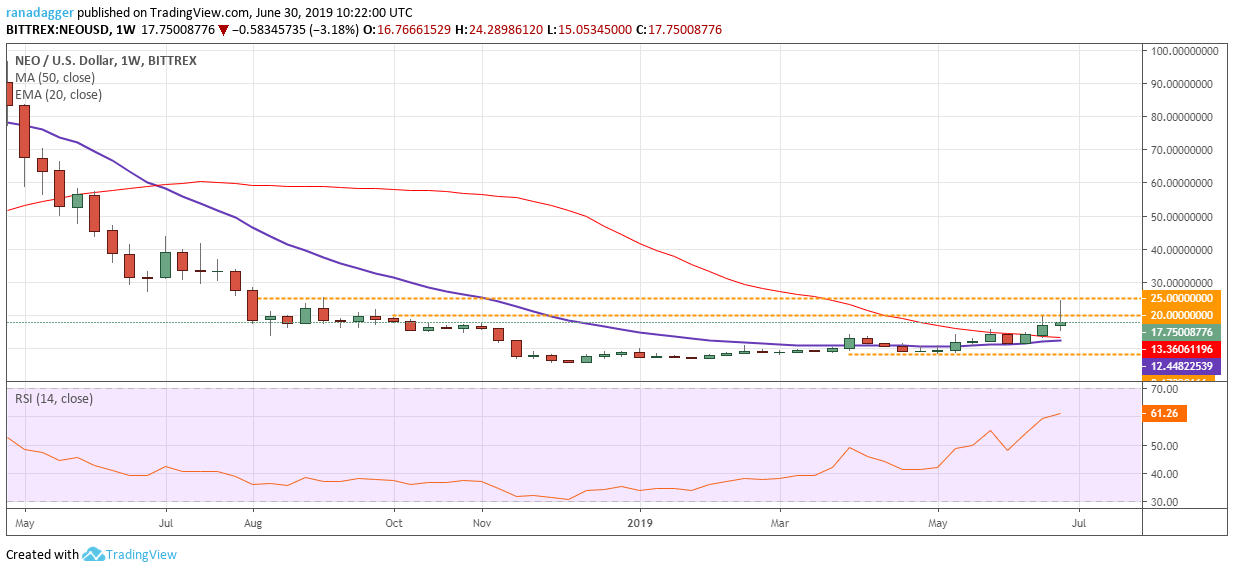

NEO/USD

NEO aims to build a robust ecosystem to stay ahead of the competition. NEO Global Development officially launched the previously announced $100 million EcoBoost program, which will have three phases. In the first phase, the program will establish various partnerships that will form a network to support the projects in the NEO ecosystem. Can this propel the price higher?

The NEO/USD pair is facing resistance in the $20–$25 zone. Therefore, a few weeks of consolidation is possible. On the downside, the pair will find support at the moving averages, which are on the verge of a bullish crossover.

If the price rebounds off the moving averages, the bulls will again try to scale the resistance of $25. If successful, a rally to $42 is probable.

Nonetheless, if the moving averages fail to provide support, the correction can extend to $8.17090666, below which a retest of the lows is likely.

LEO/USD

UNUS SED LEO (LEO), the recently launched token by iFinex, the parent company of Bitfinex, has made steady progress since listing on May 20 and has reached the 13th spot in terms of market capitalization. Can it continue its bull run and make a place among the top 10 cryptocurrencies? Let’s analyze the charts and try to find out.

We will use the daily charts because the LEO/USD pair has a short trading history. After the volatility on the day of listing, the pair has risen from a low of $1.00750 on May 21 to a high of $2 on June 26. That is a 98.51% gain in just over a month.

Currently, the price has been consolidating between $1.710 and $2. If the bulls push the price above $2 and sustain it, a rally to $2.29 and above it to $2.49 is probable.

On the other hand, if the bears sink the price below $1.710, it will signal weakness and a drop to $1.42 is likely.

ETH/USD

As cryptocurrencies emerge out of a long bear market, transactions on the Ethereum network rose above one million on June 28, reaching the highest level since May 2018. Seychelles-based securities exchange MERJ is planning to become the first exchange to offer trading in a regulated security token on the national stock market. Will ether extend its recovery or will it enter a correction?

Though the ETH/USD pair broke out of the overhead resistance at $320.840, it failed to sustain above it and meet the pattern’s target objective of $557.43.

The moving averages have completed a bullish crossover and the RSI is close to the overbought zone, which suggests that buyers have the upper hand.

The pair might correct to the 20-week EMA. It will turn negative if the bears sink the price below both the moving averages.

The market data is provided by the HitBTC exchange. Charts for analysis are provided by TradingView.