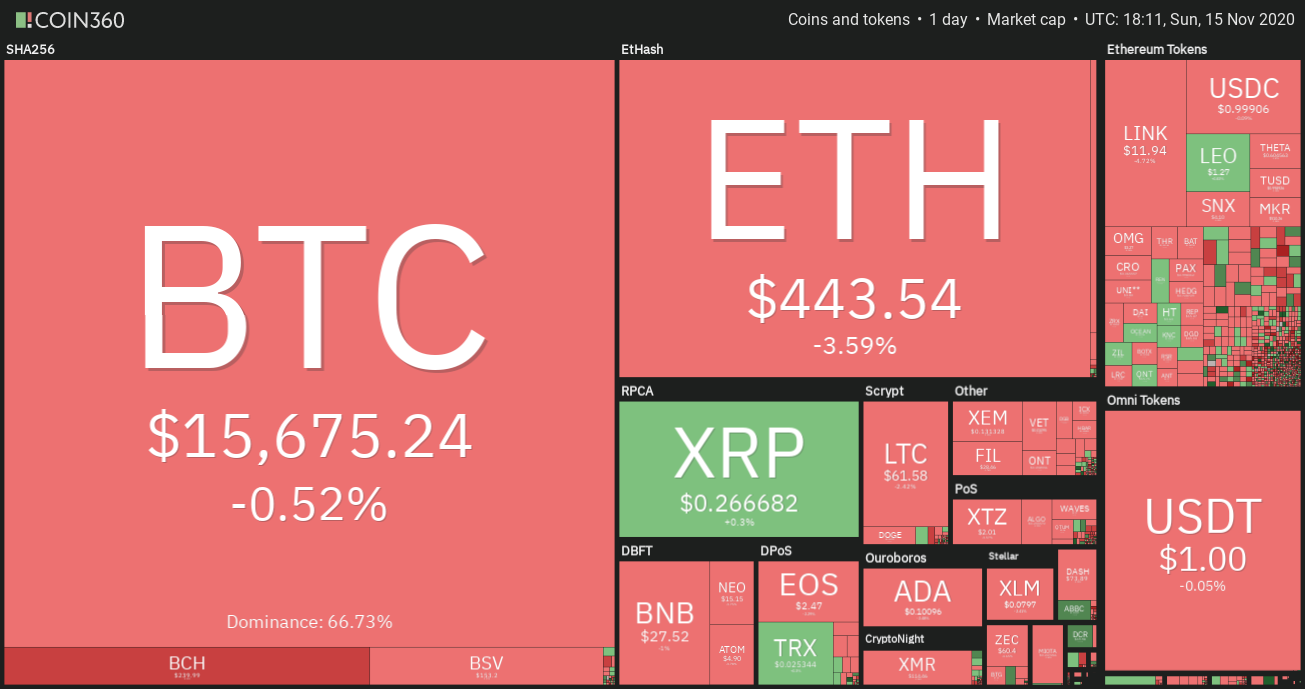

If Bitcoin consolidates near $16,000 for a few days, traders may shift their attention to altcoins and DeFi tokens.

Bitcoin (BTC) has long been touted as digital gold by crypto enthusiasts. Now as the digital asset faces its first economic crisis since its birth, Bitcoin has validated the narrative and outperformed gold by a large margin in 2020. This suggests two important things, Bitcoin is here to stay and it is a better bet than gold.

Some popular traditional investors have already jumped on the Bitcoin bandwagon and analysts at Whalemap believe that institutions have been the primary buyers in the $12,000 to $15,000 range.

The over-the-counter trading desk at Galaxy Digital also reported an increase in trading volumes by the institutional investors. The company’s CEO Mike Novogratz and head of sales Tim Plakas, both showed confidence that more traditional investors and funds could enter the crypto space in 2021.

While most investors seem to be bullish on Bitcoin, on-chain data suggests that some whales believe that the rally could have topped out in the short-term, hence, they have turned into sellers.

Let’s analyze the charts of the top-five cryptocurrencies to determine whether the rally may continue for some more time or is a short-term top around the corner.

BTC/USD

Bitcoin (BTC) has not closed below the 10-week exponential moving average ($15,613) since Oct. 8. This shows that the trend is strong and the bulls have been buying on every minor dip without waiting for a larger correction.

The upsloping moving averages and the relative strength index in the overbought territory suggest that bulls are in control. The buyers are currently attempting to sustain the price above the immediate support at $16,000.

If they succeed, the BTC/USD pair could resume its uptrend with the next target objective at $17,200.

Conversely, if the pair drops below the 10-day EMA, it will suggest profit booking by traders at higher levels. There is a minor support at $14,800 but if that also cracks, the correction could extend to $14,000.

The 10-EMA on the 4-hour chart has flattened out and the RSI is close to the midpoint, which suggests a balance between supply and demand. The bearish divergence on the RSI warns of weakening momentum.

If the bears can drag the price below the 50-simple moving average, a drop to $14,800 and then to $14,400 is possible.

Contrary to this assumption, if the price rebounds off the current levels or from the 50-SMA and rises above $16,500, the next leg of the uptrend could begin.

ETH/USD

Ether (ETH) has turned around from $478.058 on Nov. 13, which is just below the stiff overhead resistance at $488.134 where the previous rally had topped out on Sep. 1. It is usual to expect some amount of profit booking near the resistance.

However, if the bulls do not allow the ETH/USD pair to give up much ground, it will increase the possibility of a breakout of $488.134. Above this level, the bears may again try to stall the rally at the psychological level at $500.

If the bulls can thrust the price above the $488.134 to $500 resistance zone, the rally may extend to $550. The upsloping moving averages and the RSI in the positive zone, suggest advantage to the bulls.

This positive view will be invalidated if the price breaks below the 10-day EMA. If that happens, the pair may drop to $420 and then to $400. Such a move could point to a possible range formation in the short-term.

The 4-hour chart shows that the pair has broken below the support line of the rising wedge pattern and the RSI has also formed a bearish divergence.

Moreover, the downsloping 10-EMA and the RSI in the negative zone, suggest that bears have the upper hand.

If the pair sustains below the 50-SMA, a fall to $440 and then to $424 is possible. This short-term bearish view will be negated if the price turns around and rises above $478.058.

XRP/USD

XRP had been stuck in a range between $0.23 to $0.26 for over two months. The range resolved to the upside with a strong breakout of $0.26 on Nov. 13. However, the bears are unlikely to give up without a fight.

The tussle between the bulls and the bears could pull the price down to the breakout level of $0.26. If the bulls purchase this dip and the price rebounds off the breakout level, it will suggest that traders are buying as they anticipate higher levels in the future.

The upsloping 10-day EMA ($0.258) and the RSI in the positive territory suggest that bulls have the upper hand. The next target on the upside is $0.30.

Contrary to this assumption, if the bears pull the XRP/USD pair back below $0.26, it could catch several aggressive bulls off guard who may then have to liquidate their positions in a hurry.

The ensuing panic selling could sink the pair below the 50-day SMA ($0.248) and keep it range-bound for a few more days.

The moving averages on the 4-hour chart are sloping up and the RSI is above 59, suggesting the advantage is with the bulls.

If the pair rebounds off the current levels, it will indicate that the bulls are buying on dips to the 10-EMA, which shows that the sentiment has turned bullish.

Contrary to this assumption, if the bears sink the price below the 10-EMA, a retest of $0.26 will be on the cards. If the price breaks and sustains below this support, it will suggest that bears have made a comeback.

XMR/USD

Monero (XMR) had been in a correction since topping out on Oct. 26. The bulls pushed the altcoin above the downtrend line on Nov. 10 and are currently attempting to propel the price above the $118.10 to $120.7773 resistance zone.

If they succeed, the XMR/USD pair could move up to $128 and if this level is also scaled, the rally may extend to $139.2885. The 10-day EMA ($115) has flattened out and the RSI is just below the midpoint, which suggests that the selling pressure has reduced.

This bullish view will be invalidated if the price turns down from the current levels or the overhead resistance zone and plummets back below $110. Such a move could drag the price down to $104.

The 4-hour chart shows the formation of an ascending triangle pattern that will complete on a breakout and close above $118.10. This bullish setup has a target objective of $132.90.

On the other hand, if the bears sink the price below the support line of the triangle, it will invalidate the bullish setup and could drag the price down to $110.

Both moving averages are flat and the RSI is just above the midpoint, which suggests a balance between supply and demand. The break above or below the triangle could start the next short-term trending move.

UNI/USD

Uniswap (UNI) bottomed out at $1.7563 on Nov. 5 and since then embarked on a strong uptrend. The up-move in the past few days has resulted in a rally of over 136%.

The 10-day EMA ($3.27) has turned up and the RSI has risen from close to the oversold zone to the overbought territory. This suggests that the bulls are back in the game. They will now try to push the price to the psychological level of $5.

This level may act as a resistance as the bears will try to stall the up-move in the $5 to $5.55 zone. However, if the bulls do not give up much ground from this zone, then the uptrend could continue.

The first sign of weakness will be a break below the 10-day EMA. Such a move will suggest profit booking by the short-term traders and shorting by the aggressive bears.

The 4-hour chart shows that both moving averages are sloping up and the RSI is in the overbought zone. This suggests that the bulls are in control. The immediate resistance is at $4.50 where the bears may try to stall the rally.

If the bulls defend the 10-EMA on the downside, it will suggest that the momentum still favors the bulls. This positive view could be invalidated if the price turns down and sustains below the $3.50 support.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.