On October 29, the total value locked (TVL) in decentralized finance (defi) protocols is around $243 billion with Curve capturing 7.76% of the dominance. Meanwhile, as ethereum has the largest dominance of TVL in defi, a number of alternative blockchains are seeing significant increases every week. Moreover, the TVL in cross-chain bridge technology has reached $22.48 billion, up 48.8% over the last month.

Defi Total Value Locked Hovers Above $240 Billion — Avalanche, Fantom, Polygon, Tron, Arbitrum TVLs in Defi Increase

The total value locked in decentralized finance apps has continued to climb higher this year reaching new heights. Data from defillama.com’s dashboard shows the TVL on Friday is $243 billion with Curve’s $18.91% commanding a 7.76% dominance rating. The defi protocol Curve supports seven different blockchains, which means users can access cross-chain bridge technology to leverage the decentralized exchange (dex).

Statistics indicate that Ethereum (ETH) is still the dominant defi chain with $164.75 billion worth of the $243 billion TVL in defi aggregate. Despite Ethereum making up a large portion of the defi pie, blockchains like Avalanche, Fantom, Polygon, and Tron have seen TVLs increase a great deal this past week. Avalanche’s TVL in defi increased by 10.44% during the last seven days, while Tron’s TVL in defi spiked by 18.76%.

Cross-Chain Bridge TVLs Spike by 48% This Month — Over $22 Billion Total Value Locked

Fantom’s TVL saw a significant jump this past week gathering 31.21% more in TVL. Meanwhile, Solana and Terra saw much smaller increases this past week as Solana captured 0.44% and Terra only jumped by 0.79%. Arbitrum saw a TVL increase of around 24.58% this week and Polygon (MATIC) lifted by 4.41%. The TVL on the Binance Smart Chain (BSC) dipped this week losing 6.15%, but it is still the second-largest defi TVL after Ethereum.

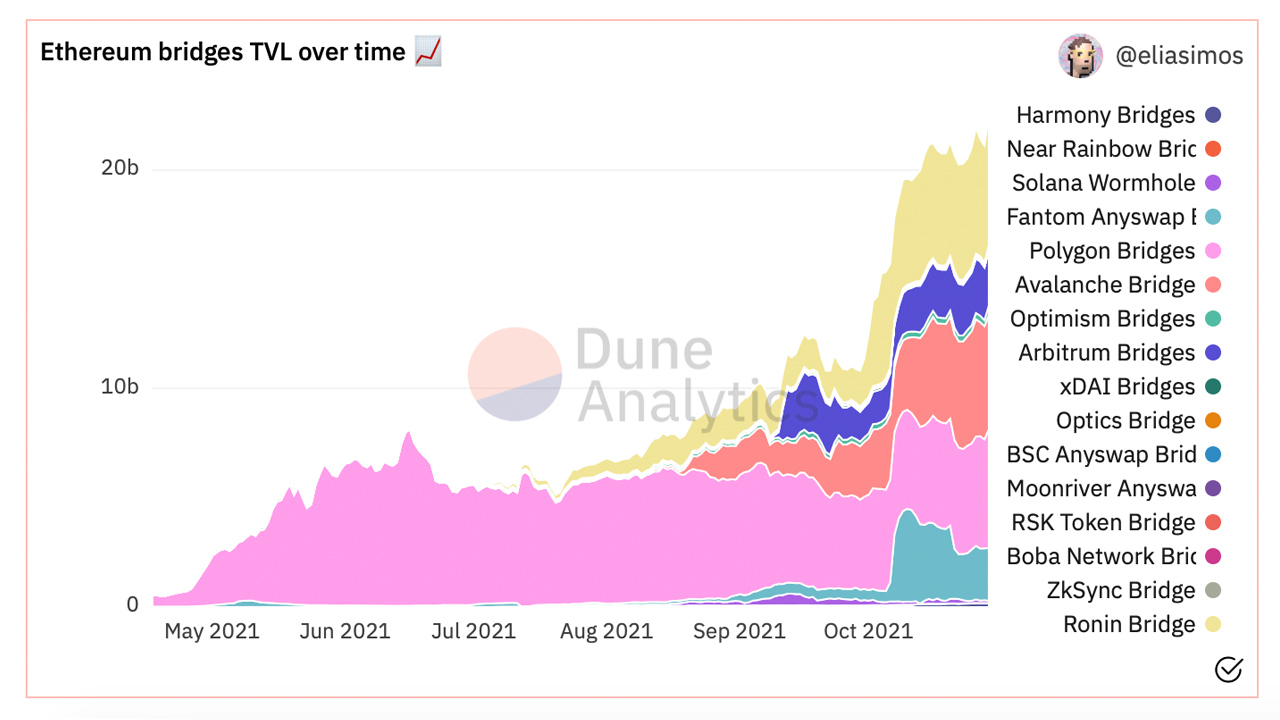

This week the TVL in cross-chain bridges swelled by 48.8% over the last month and on Friday, the cross-chain bridge TVL is $22.48 billion. Statistics from Dune Analytics show Ronin bridge increased by 2% this past week with $5.3 billion. Dune Analytics cross-chain bridge dashboard called “Bridge Away (L1 Ethereum)” shows 16 different bridges from chains like Avalanche, Arbitrum, BSC Anyswap, Boba Network, Fantom Anyswap, Harmony Bridges, and more.

Assets that command the most activity in cross-chain bridges include tokens like WETH, ETH, AXS, USDC, WBTC, MATIC, USDT, and DAI respectively. In terms of WETH/ETH the TVL in cross-chain bridges is around $7,062,594,503 on Friday morning.

What do you think about the amount of funds increasing in cross-chain bridge technology during the last month? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Dune Analytics,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.