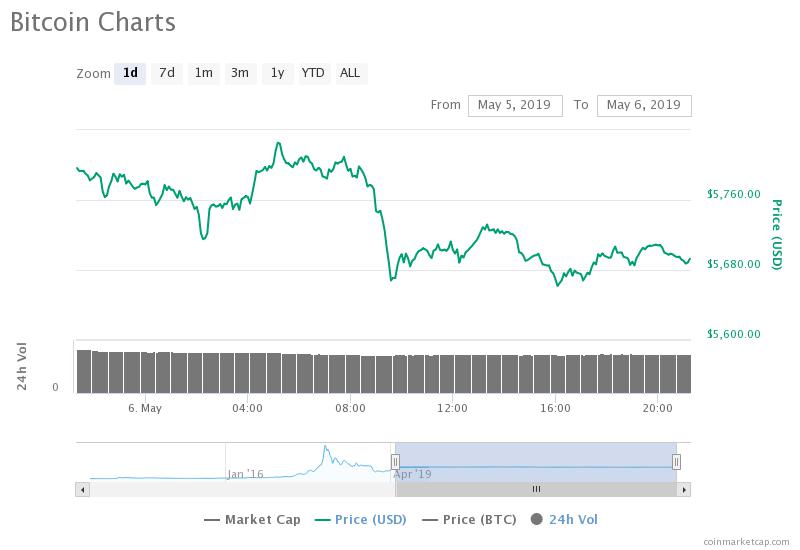

By CCN.com: In the last 24 hours, following a strong week, the bitcoin price slipped by around $157, dropping by nearly two percent against the U.S. dollar amidst an insense stocks sell-off.

The Dow Jones is set to open with a 500-point drop after U.S. President Donald Trump announced the imposition of additional tariffs on $200 billion worth of Chinese goods, leading both the U.S. and Chinese stock markets to plunge.

A slight correction in the crypto market occurred simultaneously as stocks declined substantially in value, raising questions on the correlation between crypto and stocks.

Will Global Uncertainty Lead to Bitcoin Investment?

On May 6, after President Trump expressed his intent on raising tariffs due to the lack of progress on the trade talks, the Shanghai Composite recorded its biggest drop for the first time since February 2016.

Although the Dow is set to open with a large several hundred points drop, the unexpected statement of Trump had a bigger impact on the Chinese market than the U.S.

Trump said:

For 10 months, China has been paying Tariffs to the USA of 25% on 50 Billion Dollars of High Tech, and 10% on 200 Billion Dollars of other goods. These payments are partially responsible for our great economic results. The 10% will go up to 25% on Friday.

325 Billions Dollars of additional goods sent to us by China remain untaxed, but will be shortly, at a rate of 25%. The Tariffs paid to the USA have had little impact on product cost, mostly borne by China. The Trade Deal with China continues, but too slowly, as they attempt to renegotiate. No!

There exists a possibility that the recent tightening of U.S. dollar withdrawals by the Chinese financial authorities could raise the appetite for bitcoin as an uncensorable alternative to the U.S. dollar and other safe haven assets like gold.

China imposed a strict ban on bitcoin trading in late 2017. But through various over-the-counter (OTC) trading platforms, Chinese investors are said to be investing in the crypto market quite actively.

Stocks Drop May Cause Bitcoin Drop

Several studies have been conducted throughout the past year to analyze the potential correlation between stocks and bitcoin.

The studies have generally pointed toward a lack of correlation between the two asset classes, primarily due to the relatively small size of the dominant cryptocurrency in terms of the market cap when compared with assets like gold.

“Crypto and stocks aren’t correlated” pic.twitter.com/qEGzRjMYoL

— OCCUPY WISDOM (@OccupyWisdom) April 10, 2019

“Historically, the correlation between the S&P 500 and Bitcoin has been insignificant. Although correlation values between the two asset classes have ticked up this year versus historical averages, with the current correlation hovering around .11, we believe this to be an insignificant value and don’t believe the two markets to be related,” Eric Ervin, the CEO at Blockforce Capital, a US-based asset management firm, told Forbes.

But, as shown by the research of Bitwise Asset Management, a significantly large portion of the daily spot bitcoin volume is concentrated in the U.S. market.

The bitcoin price has dropped by nearly two percent against the U.S. dollar in the last 24 hours (source: coinmarketcap.com)

In times of uncertainty, investors often move to the bond market or acquire cash to minimize losses in the equities market and in other high-risk markets.

Considering that the size of the crypto market still remains relatively small in comparison to precious metals and other safe haven assets, while uncertain, there exists a strong possibility that the stocks sell-off have a negative impact on the near-term price trend of crypto assets.

Click here for a real-time bitcoin price chart.