- U.S. President Donald Trump is putting direct pressure on major Chinese conglomerates.

- Consequently, a growing number of Chinese tech stocks are departing from the U.S. to Hong Kong.

- IPO listings in Hong Kong and China are increasing, fueling the local stock market sentiment.

U.S. President Donald Trump’s move to blacklist major Chinese companies is unnerving large conglomerates. Tech stocks, including Alibaba and Xiaomi, are seeing renewed demand in Hong Kong from investors fearing U.S. restrictions.

Ironically, the migration of Chinese companies from the U.S. stock market fuels the demand for Hong Kong stocks.

After TikTok and WeChat, the U.S. government said it might restrict China’s biggest chipmaker SMIC.

On September 8, President Trump vowed to scale back from U.S.-China ties. He said he would impose tariffs on American firms that leave the U.S.

Money is Flowing Into Hong Kong Stocks; is it Counterproductive For the U.S.?

Until the November Presidential election, strategists anticipate President Trump to heighten the pressure on China.

Amid the uncertainty around the ‘Phase 1’ trade deal, the Trump administration is continuously targeting individual companies.

But President Trump’s strategy might be benefiting China over the long term.

Sam Le Cornu, the CEO of Stonehorn Global Partners, said it is causing more capital inflow into Hong Kong stocks.

He said a “huge amount of money” is arriving back to Hong Kong and its initial public offering (IPO) market.

Throughout the year’s end, Cornu expects an increase in IPOs in Hong Kong. The trend could catalyze more well-established Chinese stocks to move away from the U.S.

The concerning trend results in two scenarios. First, it could cause China’s stock market to expand. Second, it boosts Hong Kong after the U.S. revoked its special relationship with the region.

In July, President Trump said at the White House that the U.S. would treat Hong Kong as China. He said:

“Hong Kong will now be treated the same as mainland China.”

Merely two months after the decision, multi-billion dollar tech companies are flowing into Hong Kong.

The departure of Chinese companies from the U.S. might not necessarily harm the U.S. But it could benefit Hong Kong and the sentiment around local stocks.

In the near term, Cornu anticipates more companies to follow the trails of Alibaba and JD.com. He said:

“There’s money to be made when looking at this activity. I think the second half of the year will see an increase… in these IPOs.”

The Shenzhen Stock Exchange, which tailors to tech companies, has also observed increased listings in recent weeks.

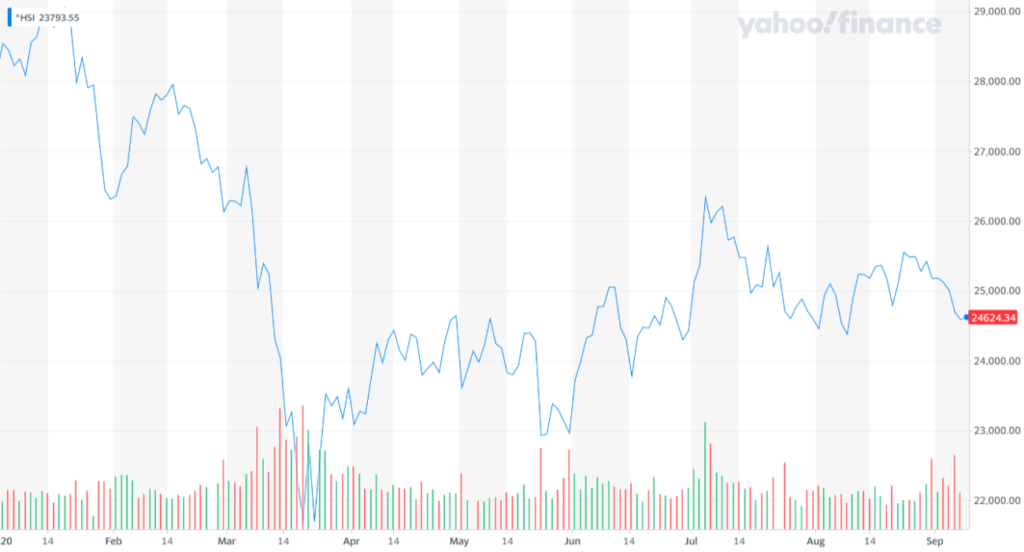

Could Hong Kong’s Hang Seng Index Thrive?

The Hang Seng index has aggressively started to include key tech stocks into the index in a short period.

On September 7, the index listed Alibaba and Xiaomi, two Chinese tech giants. Since mid-August, many investors began to swap Alibaba’s U.S. stocks for Hong Kong’s.

CreditEase Wealth Management executive Nelson Yan said long-term fund managers are increasingly considering moving to Hong Kong-listed shares.

Merely three months ago, wealthy investors in Hong Kong were preparing for the worst-case scenario. Watch the video below:

Jeffries’ report expressed newfound optimism towards Hong Kong stocks, expecting the Hang Seng index to expand. The report reads:

“In our view, it is not unthinkable that the index will be expanded as more companies come to the market… We remain bullish on the HSI.

The U.S. finds itself in an uncomfortable position wherein it maintains its tough stance in Hong Kong but its policies are catalyzing the local stock market.