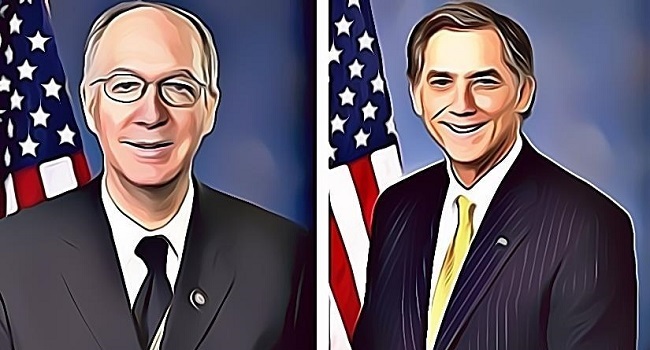

Two U.S. congressmen from both major political parties, French Hill (R-Ark.) and Bill Foster (D-Ill.), have written a letter to the Federal Reserve Chairman Jerome Powell, urging the central banking organization to start working on a ‘national digital currency’ in lieu of the various risks that the U.S. dollar faces.

In the letter, both of the congressmen expressed their concerns regarding the rapid development of cryptocurrencies by various states around the world. The letter referred to the constitutional right of the Federal Reserve to create and manage U.S. currency policy and asked whether the Fed is planning on developing a new digital currency to save the U.S. dollar.

They highlighted the recent trends and developments in the crypto industry, and said that the deployment of digital currencies represents an ‘inflection point’ in the way that money and payment methods have changed. If the U.S. did not move, they said, it could end up undermining the dominance of the U.S. dollar in the entire global market.

The letter noted that cryptocurrency was, with each passing day, taking the characteristics of a paper money, and that it is imperative that the Federal Reserve will take on the task of developing a national digital currency that could complement the U.S. dollar.

Interestingly, the congressmen cautioned the U.S. administration of letting private companies develop and deploy their own cryptocurrencies. The letter explicitly made a note of Facebook’s Libra, which already prompts a lot of concern in Washington. It said that if such cryptocurrencies were allowed to operate and flourish, in due time, a lot of governance of financial policies would soon fall out of U.S. jurisdiction.

Concern Due to Other Nations’ State-Sponsored Digital Currencies

Some notable state-owned cryptocurrencies include Venezuela’s Petro, Tunisia’s eCFA and the Marshall Island’s SOV. Other than these, 40 more unique cryptocurrencies are currently being developed by nations around the world.

Both France and Germany have staunchly spoken against cryptocurrencies like Facebook’s Libra and have instead hinted at developing their own digital tokens to meet up with the technological demand of a crypto payment method by their respective markets.

It certainly seems that the U.S. has been lagging in the race to adopt cryptocurrencies as a major gear in global commercial activities and members of congress are coming out in numbers to raise a red flag over this.

French Hill and Bill Foster concluded their letter by posing a series of questions to the chairman of Federal Reserve. Most notably, they asked if the Federal Reserve was considering creating a national cryptocurrency or if they had a plan B to protect the U.S. dollar in case the said threats against the U.S dollars were to materialize.