The third iteration of the decentralized exchange Uniswap (v3) has a mainnet deployment date of May 5. The official announcement confirmed a highly anticipated feature, support for the second layer solution Optimism Rollups.

This feature will be enabled at a later date. The official announcement focuses on another “groundbreaking new feature” that the Uniswap Labs team has dubbed Concentrated Liquidity Positions. This will allow users to:

Rather than being required to allocate capital across the entire price spectrum from 0 to infinity, each LP is given full control over what price ranges they wish to provide liquidity to.

Another new feature is multiple fee tiers that will allow liquidity providers (LPs) to receive rewards relative to the amount of risk they take. The third iteration of the decentralized exchange will allow LPs to take advantage of “greater flexibility”.

This will have multiple direct implications for liquidity providers: they will be able to participate with up to 4,000 times more capital efficiency than in Uniswap v2 and earn fees by limit order, according to the official announcement. Therefore, they will receive higher returns, Uniswap Labs’ team said:

Capital efficiency paves the way for low-slippage trade execution that can surpass both centralized exchanges and stablecoin-focused AMMs.

1/

🦄 Today we are thrilled to present a detailed overview of Uniswap v3, the most flexible and capital efficient AMM ever designed!

🏃 Mainnet launch is scheduled for May 5, with a scalable Optimism L2 deployment set to follow soon afterhttps://t.co/NTekDxWVA8

— Uniswap Labs 🦄 (@Uniswap) March 23, 2021

Uniswap v3 introduces license to prevent forks

Researcher for cryptocurrency investment firm Paradigm, Dan Robinson, claimed that Uniswap v3 has the “best DEX (decentralized exchange) design on the planet”. Robinson believes the newly announced features put Uniswap above the competition.

He added that in the future other automated market makers could be built on top of Uniswap v3:

By combining multiple positions, LPs can approximate arbitrary curves. Any static curve can be implemented on Uniswap v3 and efficiently aggregated with the rest of its liquidity.

This includes custom formulas like the ones used by Balancer and Curve, as well as ones that don’t have elegant formulas. This means that most existing DEXes could be built on top of Uniswap, but it also vastly expands the design space to previously unimaginable AMMs.

The first iteration of Uniswap was launched in 2018, the second in May 2020. Since then, trading volume on the automated market maker has surpassed that of large crypto exchanges. As somehow of a trade-off, other projects have forked the DEX.

To prevent similar actions, the new iteration will be released with a Business Source License 1.1. In theory, this should prevent other projects from forking Uniswap’s v3 codebase. The license will last for 2 years, then a GPL 2.0 license will be adopted permanently.

However, the community can vote to speed up this process or give “exceptions”, Uniswap Labs stated:

We strongly believe decentralized financial infrastructure should ultimately be free, open-source software. At the same time, we think the Uniswap community should be the first to build an ecosystem around the Uniswap v3 Core codebase.

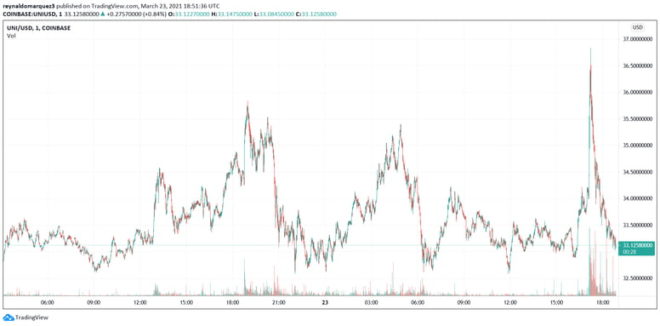

Governance token UNI is trading at $33.62 with losses of 2.7% on the 24-hour chart. On the one-week chart, UNI has posted gains of 12.6%.