After the release of the October CPI data, bitcoin shot up by almost $3,000 to quickly print a new all-time high of $68,950. But within a few hours, the move reversed completely, and prices fell as more traders shifted to focus on the logical consequence of faster inflation: monetary-policy tightening by the Federal Reserve that might crimp demand for riskier assets from stocks to cryptocurrencies.

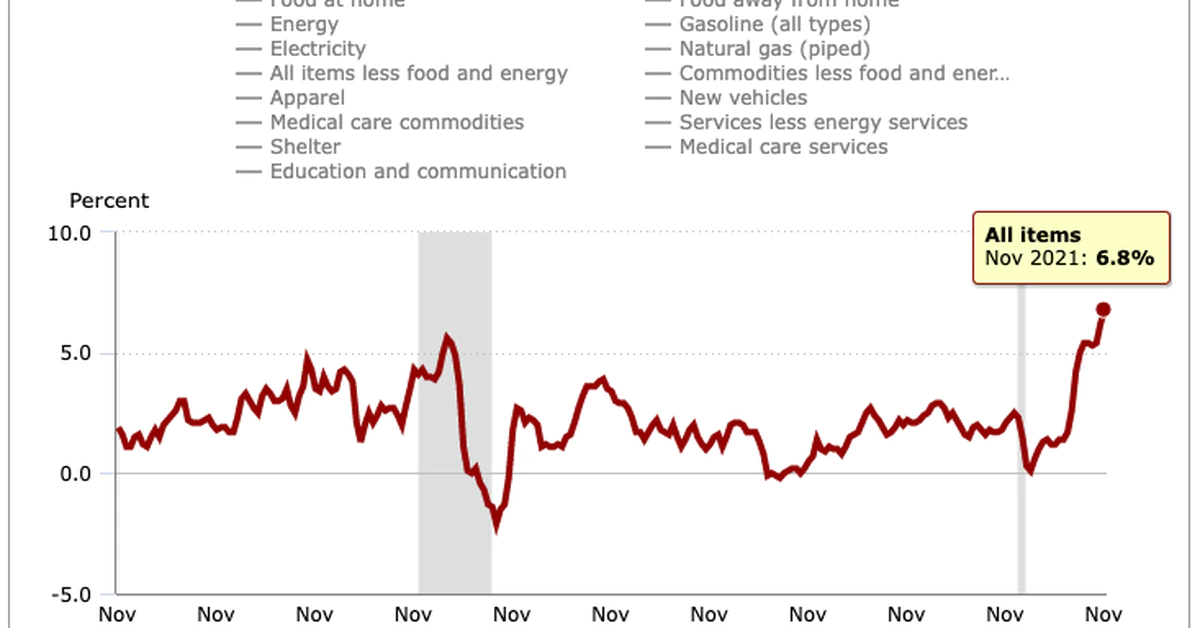

US Inflation Rate Surges to 6.8% in November, a 4-Decade High; Bitcoin Jumps