VeChain has been on a tear over the last couple of weeks. Since the beginning of the month, VET entered a bull run that has seen its price appreciate more than 149%.

The blockchain-based supply chain management token went from trading at a low of $0.0088 to hit a new yearly high of $0.022. This price level has not been seen since 2018.

VeChain Is Up 120% Since the Beginning of the Month. (Source: TradingView.com)

Despite the substantial gains already incurred, the VeChain Foundation continues to expand the utility of this token which may help increase the demand for it.

VeChain’s Utility Expands Over Time

Indeed, the massive buying pressure behind VeChain seen over the past couple of weeks appears to have been ignited by the expansion of its use case throughout a wide range of industries.

On July 3, Luxembourg-based steel manufacturing firm ArcelorSteel said to have adopted VeChain’s technology to mitigate the risk of COVID-19 infection. By employing VET’s My Care application, a blockchain-enabled infection risk management, ArcelorSteel plans to alleviate the widespread transmission of such a highly contagious virus in the workplace.

Congratulations to @ArcelorMittal‘s UK Mayfair office for achieving a successful readiness assessment against DNV GL’s My Care methodology. My Care builds trust in a company’s ability to manage infection risk.

Read about My Care: https://t.co/kUfjbgdhSX pic.twitter.com/pUqtcge2vv

— DNV GL – Assurance (@DNVGL_Assurance) July 3, 2020

The news seems to have encouraged investors to flock to VET since the company in question is a global titan in the steel industry. Data from Statista reveals that ArcelorSteel has over 190,000 employees distributed across 60 different offices around the world with reported revenues of nearly $15 billion.

As some of the most prominent companies and government agencies around the world continue to give VeChain a vote of confidence, its price has done nothing but shoop up. To top it off, Coinbase announced in June that it might add support for VET.

Coinbase is exploring the addition of 18 new digital assets, some are live, some are not. We will evaluate each against our Digital Asset Framework. It’s our goal to offer support for all assets that meet our standards and are compliant with local law. https://t.co/IN4g4WfYjW

— Coinbase (@coinbase) June 10, 2020

Like other tokens that have been added to Coinbase, VeChain could enjoy further gains upon listing by becoming another beneficiary of the well-known “Coinbase Effect.” However, there is a massive supply barrier ahead of VET that it must overcome.

Strong Resistance Ahead

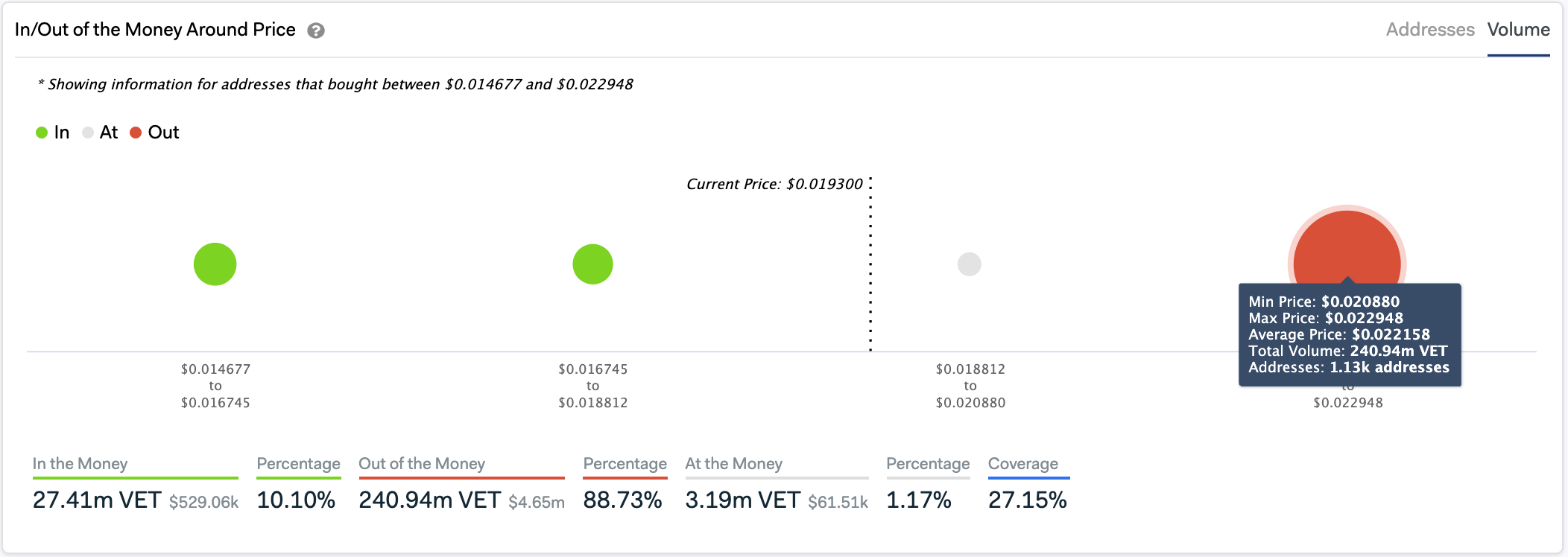

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that the $0.022 hurdle may have the ability to put a stop to VeChain’s uptrend. Around this price level, over 1,300 addresses had previously purchased nearly 241 million VET.

This is a critical resistance level as several of these addresses will attempt to break-even on their positions in the event of a bullish impulse. But moving past this price supply wall increases the odds for a further advance towards the next resistance level at $0.028.

Strong Resistance Ahead of VeChain. (Source: IntoTheBlock)

Given the increasing levels of adoption that VeChain has experienced, its CEO Sunny Lu affirmed that this cryptocurrency is the answer to the mass adoption of blockchain. If this proves to be true, it is reasonable to expect a further upward advance.

Featured Image by Shutterstock Price tags: vetusd, vetbtc Chart from TradingView.com