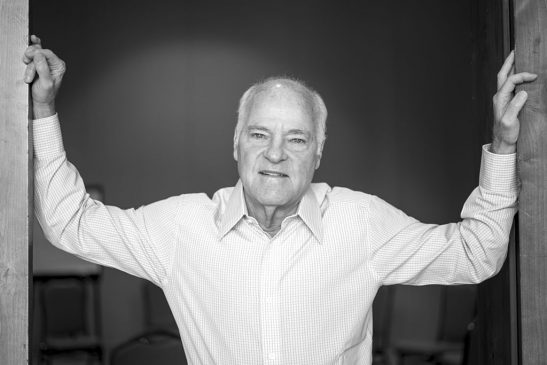

The financial whales are slowly diving into the crypto sector with the world’s 317th richest person, Henry Kravis, also trying his luck by joining the rapidly growing industry.

Henry Kravis, the co-founder of Kohlberg Kravis Roberts, has decided to test cryptocurrencies. The world’s 317th richest person follows in the lead of other financial whales like Peter Thiel, Louis Bacon, and Alan Howard. All these famous individuals have already got involved in crypto.

In 2018, co-founder of Brevan Howard Asset Management, Alan Howard, hired employees to help him manage chunks of crypto investments. Although the firm has not acquired or traded any cryptos itself, its partners had invested in crypto assets. The asset management company seeks to enter the ICO market and fund blockchain start-ups.

PayPal’s Peter Thiel who is an early investor of many tech companies like Spotify and Facebook has been a vocal Bitcoin bull. Thiel, Howard, and Louis Bacon also invested in Block.one which manages EOS.

ParaFi Attracts High-Profile Investors

A former KKR employee, Ben Forman, who is also the founder and chief investment officer of ParaFi Capital, said that Kravis invested in his company’s flagship crypto fund. He explained:

“In the high-yield markets, I used to fight to outperform the index by tens of basis points. Crypto, on the other hand, due to its nascency, offers a tremendous amount of alpha to active managers.”

ParaFi’s founder said that his company manages $25 million currently and targets to reach $100 million by Q1 2020. While at KKR, Forman covered credit business and debts investments for three years. He also led the firm’s in-house blockchain and crypto research team during his tenure. He said:

“While I toyed with the idea of pursuing blockchain investing within KKR, it was clear to me that the firm did not provide the optimal format to do so. Instead of pursuing crypto at KKR, I wanted to build the KKR of crypto.”

ParaFi has attracted several investors to its crypto fund including Dragonfly Capital Partners and Bain Capital Ventures. These two companies are reported to have also invested in ParaFi’s management firm. A partner at Bain Capital Ventures, Salil Deshpande, added:

“[Some liquid crypto assets] present asymmetric return opportunities. [ParaFi is] well positioned to capitalize on some misunderstood investment opportunities.”

Who Is this Henry Kravis?

Kravis has worked at different jobs in New York before him and George R. Roberts joined the former global investment bank, Bear Stearns. They met Bear Stearns’ corporate finance manager, Jerome Kohlberg. In 1976, the three individuals formed KKR which had a net income of around $800 million in 2017.

KKR is best known for organizing RJR Nabisco’s $25 billion buyout. They also took the utility firm TXU private with two other companies in a $45 billion buyout in 2007. Kravis is estimated to have a real-time net worth of around $5.7 billion making him the world’s 317th richest person.