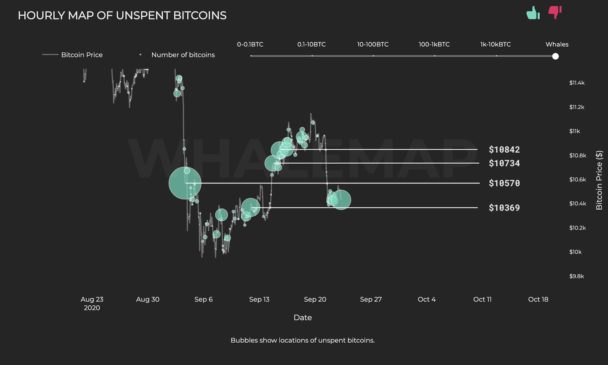

The latest Bitcoin (BTC) whale clusters’ data shows four key short-term price levels could potentially act as resistances, namely $10,369, $10,570, $10,734 and $10,842.

The hourly map of unspent Bitcoin from whales. Source: Whalemap

Whalemap, an on-chain analysis firm that tracks Bitcoin whale activity, observes areas where whales, or high-net worth individuals, accumulate or move their holdings.

Green clusters indicate areas where whales last bought Bitcoin. Given the tendency of whales to wait until break even or in profit to sell, the clusters could act as resistance areas.

Bitcoin faces strong resistance above $10,400 in the near term

There are an abundance of whales who are at a loss or breakeven until BTC hits $10,842, clusters show. That also means that there is potentially a high number of whales that might sell in the near term.

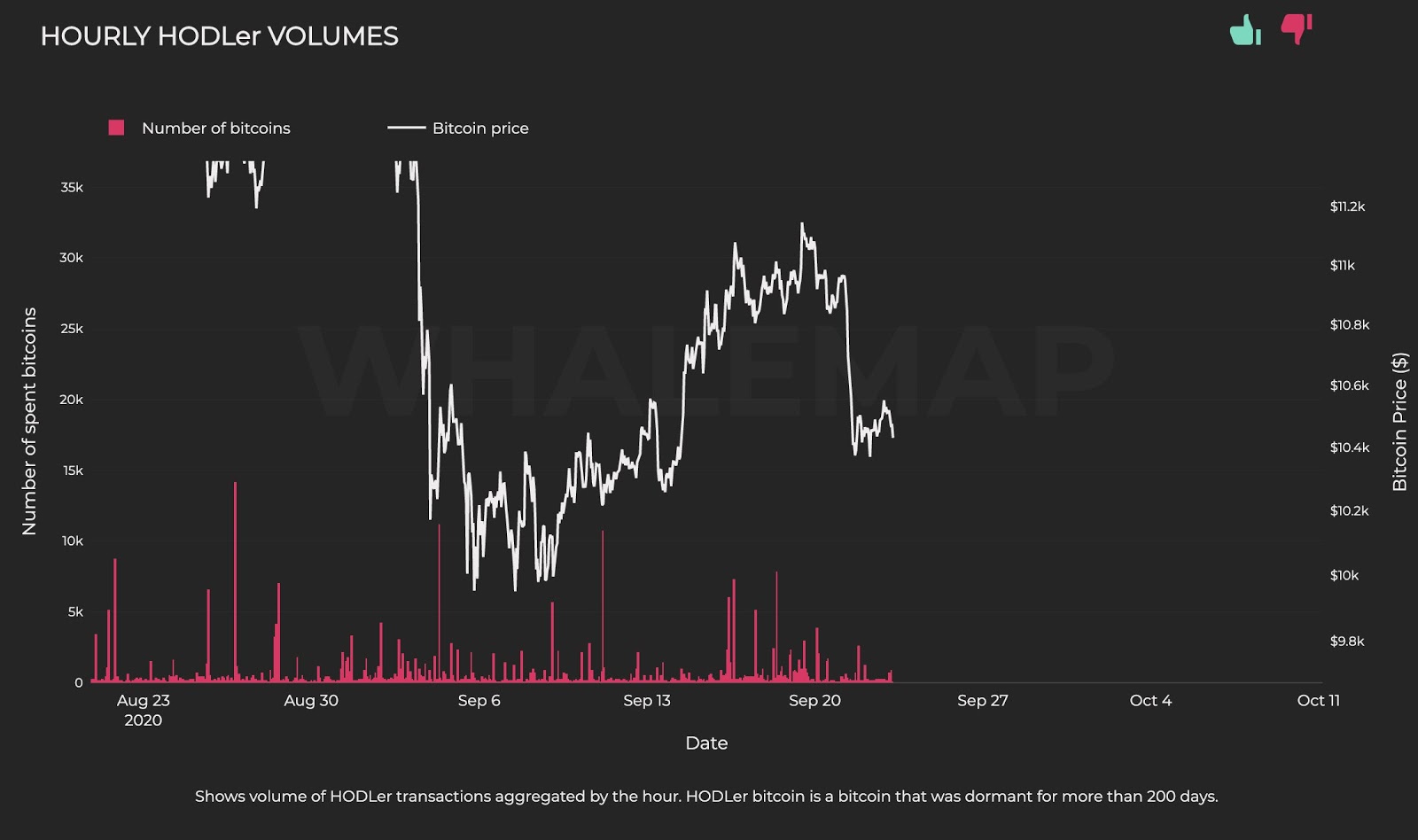

The whale data also shows that some whales likely sold in the $10,900 to $11,100 range. The “HODLer” activity of whales indicates sell-offs at that resistance range, which is typically a bearish sign.

The researchers at Whalemap said HODLer activity has declined in the past two days, showing an uncertainty in direction. They explained:

“HODLer activity: Looks like they were quite active at the 10.9-11k prices. Not a good sign usually. But, we are quite clear so far for today and yesterday’s HODLer bubbles also do not show much activity.”

The timing of BTC’s rejection from $11,100 matches the clusters and where whales began to sell. Bitcoin has also struggled to recover beyond $10,570, the second and the largest whale cluster in the short term.

Bitcoin has continued to see steep rejections since its steep drop from $11,179 to $10,296 on Sep. 21. The levels of $10,550, $10,450 and $10,370 have served as resistances in the last 48 hours.

The clusters and the sell-off of whales above $11,000 indicate BTC is likely to stagnate in the foreseeable future. The decreasing activity among whales also hints that a large spike in volatility is not expected.

The HODLer volume of Bitcoin whales. Source: Whalemap

Cryptocurrency traders are seemingly anticipating an extended period of consolidation, at least throughout September. Considering the intensity of the BTC drop within a short period, BTC would likely remain less volatile.

Traders echo a similar sentiment as whale activity

Edward Morra, a Bitcoin trader, said the BTC price trend remains bearish until it closes above $11,000. As the clusters show, BTC faces numerous heavy resistance levels on its way towards the $11,000 level.

The lackluster technicals of Bitcoin coincide with an unfavorable macro backdrop. In the near term, the weakness of gold, the stock market, and the rally of the U.S. dollar could amplify selling pressure on BTC. Morra said:

“Still bearish since September started, bullish either above $11k on daily or below in untested demand.”

Cantering Clark, a cryptocurrency technical analyst, said the $9,600 to $10,000 range could form a “bear trap.” The $9,600 remains an unclosed CME gap, which makes it a likely short-term target. He said:

“Think over the coming weeks we have a lot of ranging and consolidation to do. I do think that this 9.6-10k area is going to set up a nice bear trap at some point. Will be looking to swing SOS for that.”