Over the last few days, whales and miners have been depositing the largest amount of Bitcoin this year, yet despite all the selling, price is soaring. The reason? Elon Musk has changed his Twitter bio to include the cryptocurrency’s hashtag and it has ignited a flood of FOMO from retail Robinhood traders seeking free markets.

Miners, Whales, And More Can’t Stop Bitcoin Rally

Bitcoin kicked off 2021 as bullish as can be, rising from under $30,000 to above $42,000 in a matter of days. After that high, things turned bearish for the short-term, driven by profit-taking from early investors in the asset, miners, and even some whales.

Related Reading | Bitcoin Trend Strength Suggests No End In Sight, Second Most Powerful Historically

Institutional investors have been buying up what the market could offer, but price action began to sink as sentiment turned.

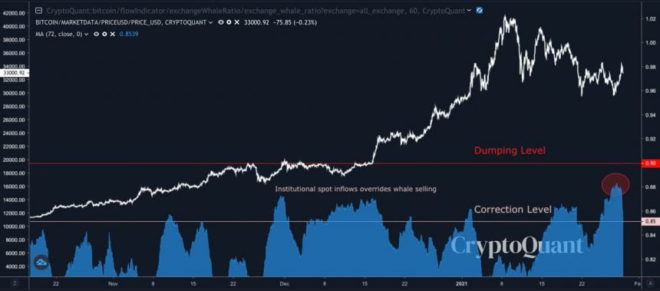

Whales are selling BTC at the highest level in eight months | Source: CryptoQuant

Whether the turning sentiment is behind the trend, or if it is simply more profit booking, whales have moved more BTC to exchanges recently than they have the last eight months. At the same time, miner deposits have reached the highest point of the year.

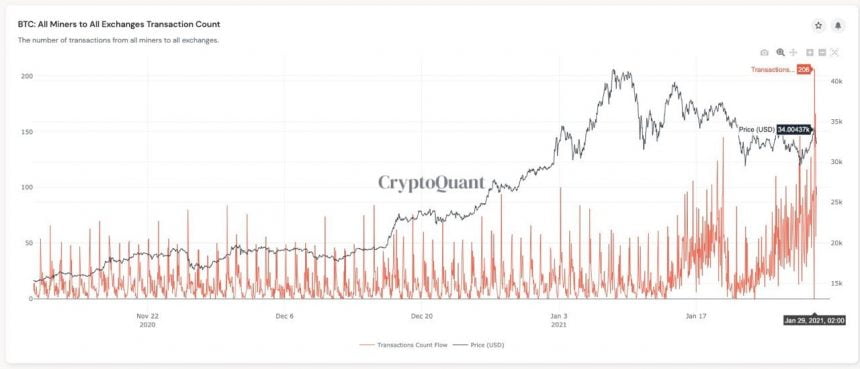

Miners have also moved the most BTC all year | Source: CryptoQuant

But despite all these bearish signals, the price of cryptocurrencies keep on rising today, and are up 20% or more in some cases over the last week.

Elon Musk Boosts Retail FOMO, Robinhood Floodgates Open

Miners and early crypto whales have met their match in an army of retail traders exiting Robinhood searching for greener pastures, combined with a “tidal wave” of institutional capital, and now, those who follow or support Tesla and Elon Musk.

Elon Musk added the #Bitcoin hashtag and corresponding emoji to his bio | Source: Twitter

The recent Robinhood kerfuffle has had the likes of Musk outraged, and speaking out in support of free markets. Assets like Bitcoin cannot be shut down like stocks can. An exchange can of course still halt trading if the situation calls for it, but no one can outright stop the Bitcoin market from existing.

Related Reading | Robinhood Reminder: Not Your Keys, Not Your Bitcoin

Even if exchanges were taken down, the peer-to-peer asset could still transact and could find a way. Tech leaders like Musk have come to appreciate cryptocurrency technology for these reason, along with the fact they remain out of reach from state actors.

Bitcoin price skyrocketed after investors saw the addition to Musk's bio | Source: BTCUSD on TradingView.com

Along with Musk’s nod of approval over Bitcoin, the Robinhood situation itself has prompted an exodus from the platform and major boost to Coinbase – which offers the ability to move assets off of the platform, unlike Robinhood.

Featured image from Deposit Photos, Charts from TradingView.com