Of course, we’re still in the early stages of the crypto derivatives market. One exchange, Deribit, has the lion’s share of both bitcoin and ether’s options trades. “It’s still nascent,” Luuk Strijers, the exchange’s chief commercial officer, told CoinDesk, adding his prediction that growth will be fast as the market is still maturing.

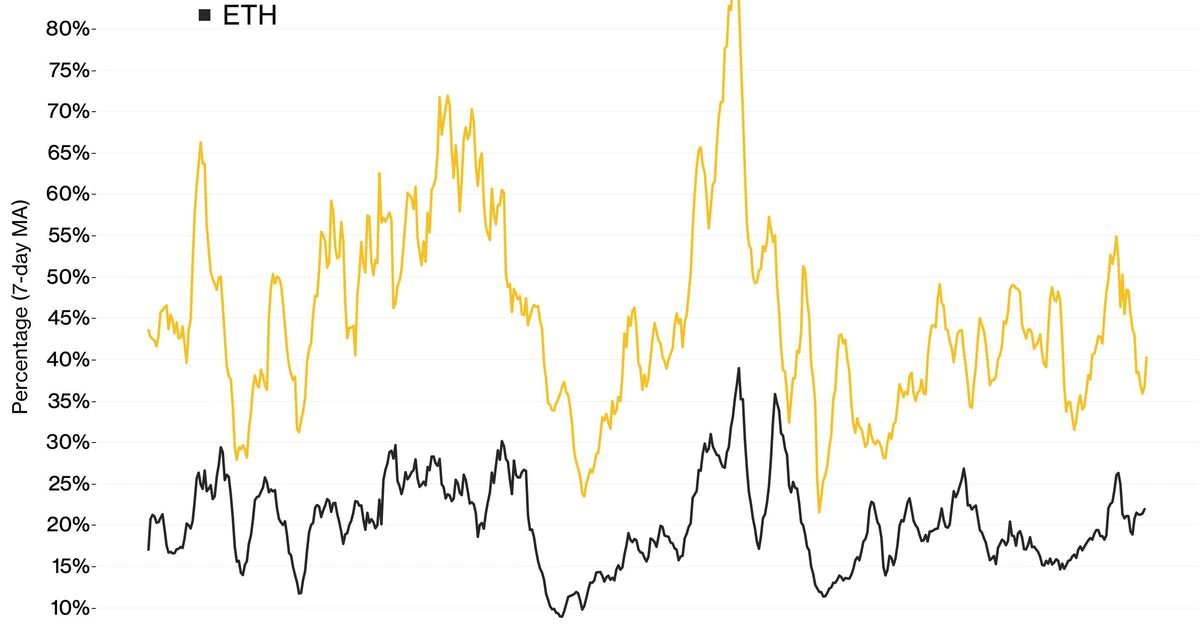

What Bitcoin and Ether’s Options Tell Us About Their Maturity