- Copper is at a two year high, and rising prices generally bode well for the economy.

- Chinese demand is robust, signaling a growing economy there.

- A weak dollar is also playing a role.

Copper, the metal that used to be in pennies, is on a tear. Economists refer to the metal as “Doctor Copper” due to its historic predictions about the economy. Rising prices typically show an expanding economy, and falling prices often show a declining economy.

Good news, right? Not so fast. The metal’s move right now is a bit more complicated for two reasons.

Copper Demand Surging in China

One of the biggest drivers of any commodity price comes from the demand from China.

The country’s command economy often requires that it buys up massive amounts of raw materials abroad to complete projects. As Chinese manufacturing activity has started to shoot back up, copper demand has been through the roof, sending the price of the metal to two-year highs.

The latest numbers for July show imports hitting 554,979 million tons, about a 90% increase from the prior year.

Again, that sounds like good news, since the demand is driven by manufacturing. But China has been shifting from an export-driven model to an internal-consumption economic model for a few years. That trend will likely be exacerbated by the global pandemic and its aftermath, as companies look to source their manufacturing needs elsewhere.

China’s recent stimulus announcement included new infrastructure projects like railways and power lines, which can be used for exporting goods as well as delivering goods and services internally.

The command economy works in two directions. China has a history of driving up prices for goods as it stockpiles them, only to stop buying and let the market drop before moving on. So the Chinese demand data needs to be taken with a grain of salt.

Weaker Dollar Pushing Up Prices

The U.S. dollar has been trending down in recent months, a factor that’s helped to push up not only the prices of copper but the precious metals gold and silver as well. As copper has made two-year highs, the U.S. dollar index has dropped to two-year lows.

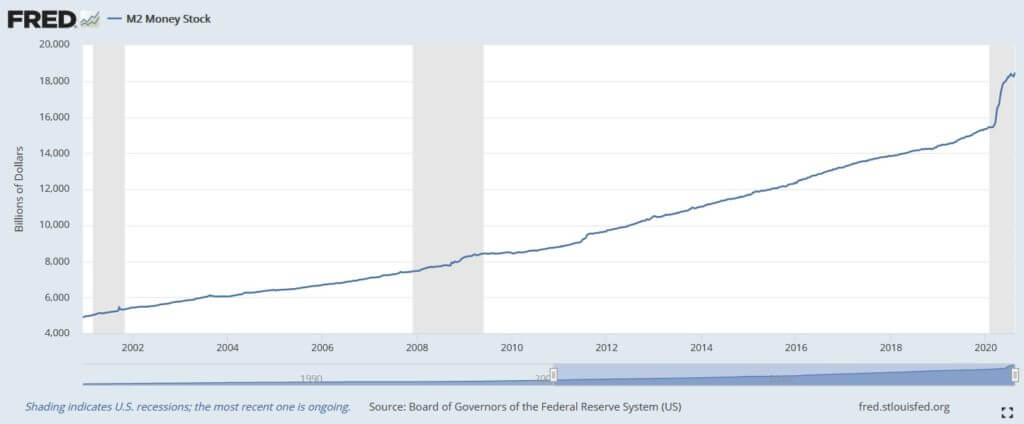

While many expected the dollar to strengthen relative to other currencies amid the pandemic, the opposite has occurred thanks to the Federal Reserve’s open-ended activities.

When a central bank can not only print up money but immediately put it to work buying corporate debt, there’s not only massive money creation, but that newly created money is getting out into the economy quickly. Given the rapid rate of money creation this year and the Fed’s recent comments, the market is pricing in higher inflation.

If anything, copper’s move is far from over. But it’s as much a sign of rising inflation expectations as it is an economic recovery this time around. That also bodes well for anything that does well when the dollar goes down, including gold, silver, real estate, bitcoin, and, yes, the stock market.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the stocks mentioned.