After opening the week on reasonably stable ground, major cryptocurrencies including Bitcoin, Ethereum, and Ripple endured painful sell-offs on Wednesday that thrust them below key levels.

However, technical indicators suggest that the worst might be over for the crypto market. But only if BTC, ETH, and XRP secure important short-term milestones.

How the Bitcoin Price Could Recover Back to $11,000

The Bitcoin price has been struggling to secure credible support for two weeks, ever since it slid below the $13,000 mark.

The war of supply and demand is playing out in BTC markets, and the bears have successfully forced the largest cryptocurrency closer to critical support areas.

The break below $10,000 brought $9,000 (July lows) back into play, but a weekly low formed at $9,595 (Coinbase) serves as immediate support and a possible bottom.

Bitcoin trades at $9,743 at the time of writing, while facing resistance at the 23.6% Fibonacci retracement level taken between the last swing high of $13,158 to a swing low of $9,007 around $10,000.

If BTC/USD can correct above $10,000 and clear the 50-SMA on the four-hour chart, the cryptocurrency could target $11,000 in short order.

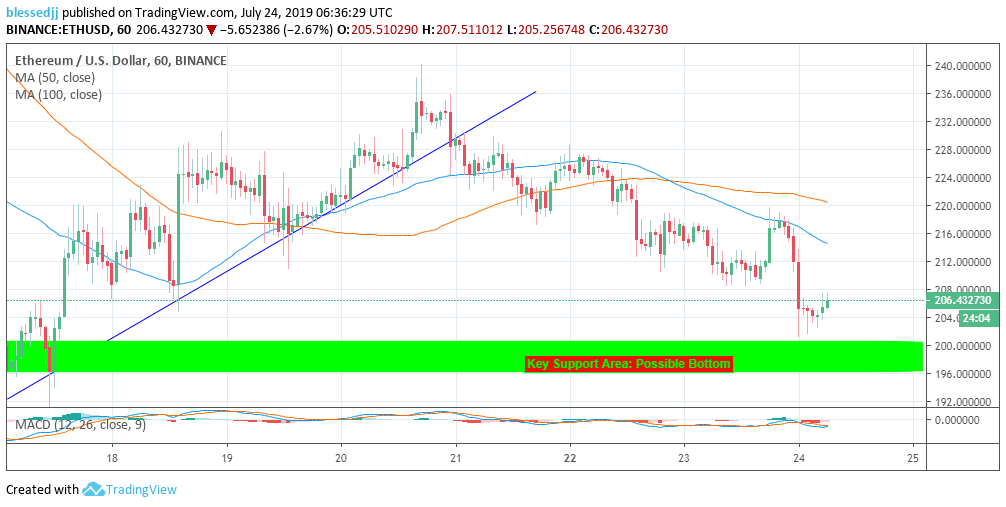

Ethereum Price Clings to $200 Mark

Ethereum, on the other hand, remains tentatively bullish so long as it holds above support at $200. The second-largest cryptocurrency tried and failed to punch through resistance at $240 last week, and it ultimately slipped below both the 50-SMA and 100-SMA on the hourly chart.

Now trading at $206, Ethereum’s $200 support has legs from lower support areas. The Moving Average Convergence Divergence (MACD), although stuck in the negative region, is holding ground at $-2.78. The decreasing negative divergence is key to the ongoing reversal.

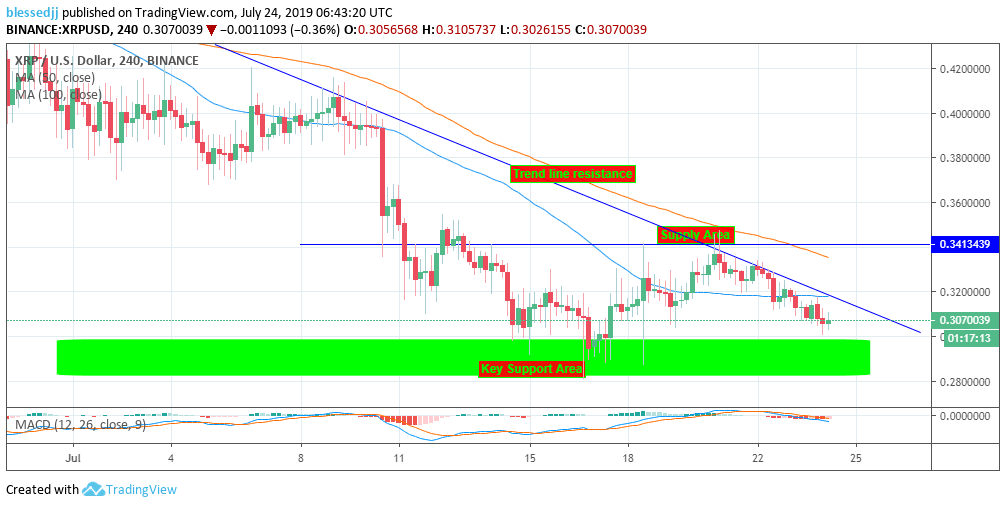

Ripple Price: Watch This Crucial Level

As for Ripple (XRP), its ability to recover from its painful downturn rests on the capacity of bulls to defend support at the $0.30 mark. Glancing higher, $0.34 has proved to be a stubborn resistance area.

XRP currently teeters at $0.3067 with the immediate upside limited by its four-hour 50-SMA. It is essential that the price holds firm $0.30 and possibly even jumps above $0.32 level to avoid a breakdown to July lows around $0.28.