“What’s the price of those Bitcoin’s you keep talking about?” a friend asks me. I look at my phone and it’s still averaging around $9,200. “About the same as last month mate,” I replied.

Bitcoin (BTC) price has hardly moved an inch in the last six weeks, barely moving 2% in either direction from its average price. Therefore, I’m starting to think it’s a stablecoin now.

Bitcoin’s current “stablecoin” period resembles early 2017

However, this long period of static price reminds me very much of early 2017, when Bitcoin stayed around $900 for the first three months of the year, which was followed by an explosive 300% move in the second quarter, and then just kept going.

Daily crypto market performance. Source: Coin360.com

The question on my mind now is whether we can genuinely expect anything like that to happen in 2020 now that half the year is behind us, or whether Bitcoin has simply topped out and is waiting to drop.

Bitcoin’s downward trend

We all know that the first quarter of 2020 was brutal for Bitcoin. However, after the Black Thursday dump in March, those lucky people that bought at the bottom have already seen a whopping 180% ROI on their investment.

It would be naive of anyone to not expect some of those people to be taking profit, so a period of consolidation is a completely natural thing to expect.

However, what makes BTC very different from other assets is the position the miners are finding themselves in. They have 50% less Bitcoin to sell than before, and the effect of the consolidation following the mini bull-run has put BTC/USD in a downward trend.

BTC/USD 1-day chart. Source: TradingView

At the same time, Bitcoin is less than 1% away from breaking out of this downward channel. The current price of Bitcoin is sitting at just under $9,300 and the resistance of the descending channel on the daily is a mere $9,350.

This also puts the mid-channel support around $8,900, and the final support before signaling a greater move down at $8,350. From here, all hope of an immediate bull run would be lost.

The hopium approach

Zooming out to the weekly chart for Bitcoin, and drawing Fibonacci lines using the 2017 ATH peak to the 2019 bottom, we can see that BTC has been hovering around the 0.382 Fib for several weeks, sometimes crossing up, and sometimes crossing down.

BTC/USD 1-week chart. Source: TradingView

With Fibonacci trading, you look at the next levels as potential targets, and typically once the 0.382 has been broken after rising through 0.236, the next level is the 0.5 or 50% Fib, which sits at $11,500.

If the 0.382 of $9,250 can become support in the upcoming week, then bears are in for a bad time. Conversely, if the support of $8,350 fails to hold, it’s a long way down for Bitcoin to go to find new support on the 0.236, which puts the downside target at $7,000.

The MACD is showing signs of a reversal

BTC/USD 1-week MACD chart Source: TradingView

In last week’s technical analysis, the weekly MACD was looking very “weak” and due to cross bearishly. A cross up or down on the weekly MACD are pivotal points for Bitcoin. You only need to look through the history of the price action compared to the MACD to see that it’s the only indicator you need to time your buying and selling of Bitcoin.

However, thanks to last week’s mini-alt season, it seems the interest in Bitcoin is picking up, and this is reflected by the blue MACD line changing its trajectory from down to up.

When the MACD blows open like this on lower time frames, it’s a trader’s worst nightmare if they had failed to wait for confirmation as it’s a very early sign of a trend reversal. In other words, Bitcoin bulls are not ready to capitulate to the bears just yet.

Diversify, Tether up, or HODL?

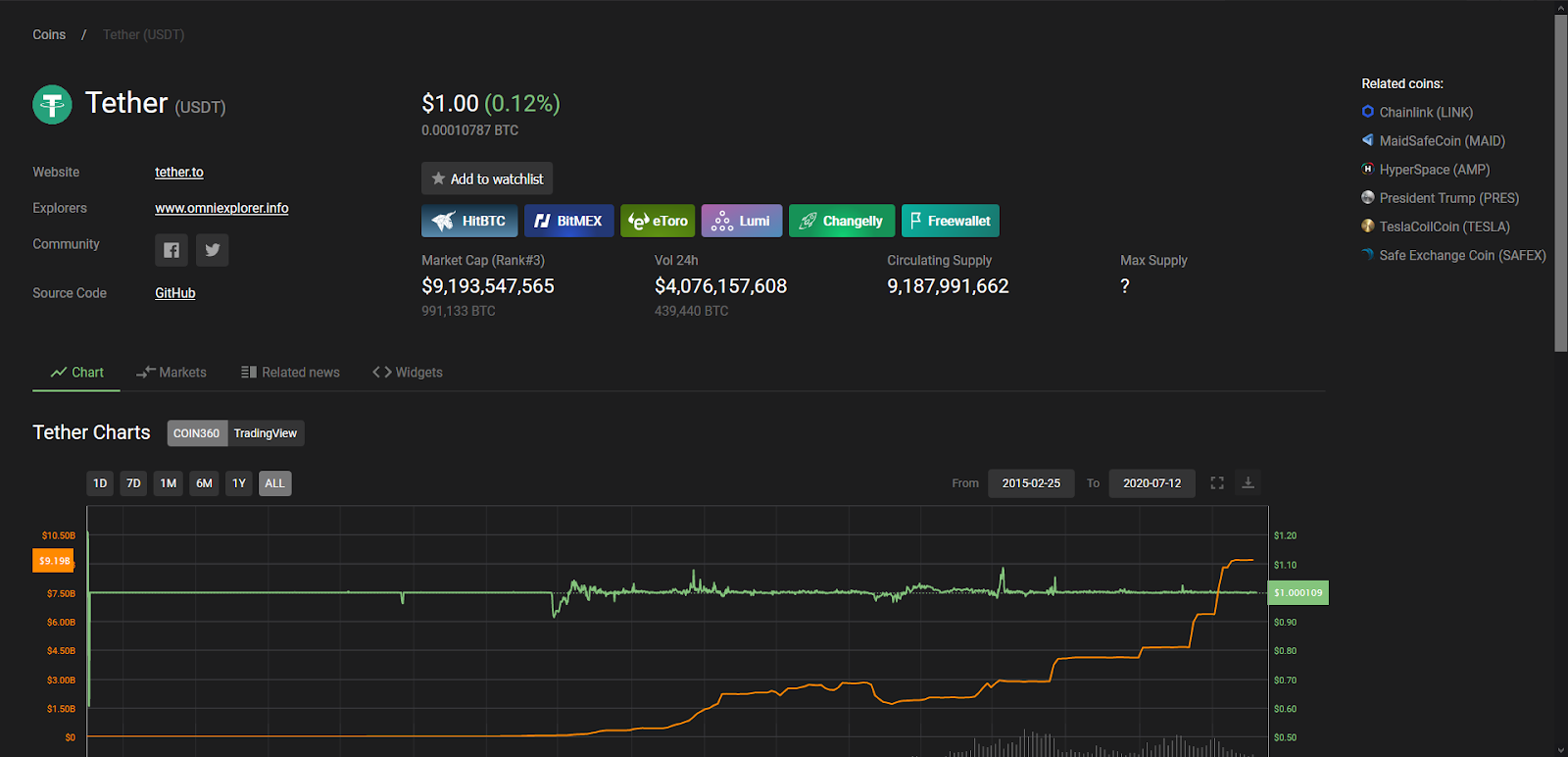

Tether Market Cap Source: Coin360

Normally during periods of consolidation, Bitcoin traders have the choice of parking their realized profits into Tether, affording them the luxury to buy the dip with ease or to re-enter on confirmation of a bullish reversal.

However, in a recent article in Forbes about a formal investigation into Tether and its fast approach towards a $10 billion market cap in the wake of Brock Pierce recently announcing his intentions of running for president of the United States, I for one would be nervous holding any amount of USDT right now.

As such, it seems likely that a large chunk of that $10 billion parked in Tether would logically start heading into Bitcoin and top-tier altcoins. This would explain the recent surge in altcoins, as well as affecting the outlook for Bitcoin in the immediate future.

Bullish scenario

If the price of Bitcoin can push past $9,350, there are a few key areas of resistance that must be overcome before $11,500 can be reached.

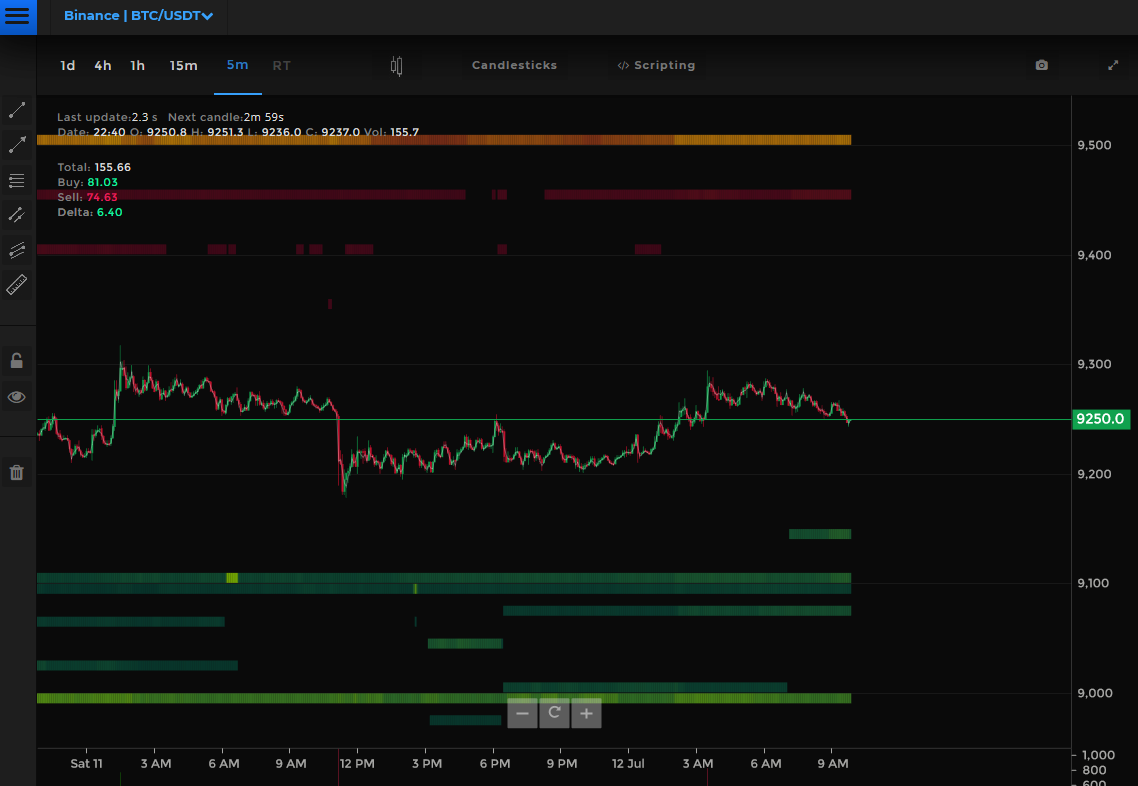

First, there is a large sell wall around $9,500 on Binance, according to the Tensorcharts heatmap. After this level, attacking the multiyear resistance level of $10,500 looks like it could be back on the cards, and with all the Tether fud, this is a scenario that looks quite promising.

Orderbook heatmap. Source: Tensorcharts

Bearish scenario

Using the same Tensorcharts heatmap, there’s a huge buy order ahead of the $8,900 support at $8,990. Should this level fail to hold I would be looking at $8,350 as the next level for the descending channel on the daily to stay intact.

Breaking below $8,350 could open up $7K BTC as a stark reality in the short term. However, with Tether potentially off the table in the short term, I doubt the bears will have a good week.

The views and opinions expressed here are solely those of @officiallykeith and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.