Contrary to expectations, bitcoin could see a positive performance during a possible bout of global deflation if it acts not just as an investment asset, but as a medium of exchange and a perceived safe haven like gold.

The top cryptocurrency by market value is widely considered to be a hedge against inflation because its supply is capped at 21 million and its monetary policy is pre-programmed to cut the pace of supply expansion by 50 percent every four years.

As such, one may consider any deflationary collapse as a price-bearish development for bitcoin. Talk of deflation began earlier this month after the U.S. reported massive job losses due to the coronavirus outbreak. The prospects of a deflationary collapse have strengthened with this week’s oil price crash.

“The oil price rout will send a deflationary wave through the global economy,” tweeted popular macro analyst Holger Zschaepitz on Tuesday.

Cash typically becomes king during deflation because the drop in the general price levels boosts the monetary unit’s purchasing power, or the ability to purchase goods and services.

“Unlike inflation, when people try to get out of the dollar because it’s losing value, during deflation people are more comfortable with the dollar because its value is going up,” said Erick Pinos, ecosystem lead for the Americas at the public blockchain and distributed collaboration platform Ontology.

The rush for cash, however, may not have a substantially negative impact on bitcoin’s price because deflation would also boost the purchasing power of the cryptocurrency.

“While the price per coin may stagnate during a period of aggressive economic deflation, the inherent buying power of the currency will actually rise, possibly quite significantly,” said Brandon Mintz, CEO of the bitcoin ATM provider Bitcoin Depot.

As time goes on and people become more comfortable with digital assets, the average person begins to see Bitcoin as a legitimate viable alternative to gold.

The uptick in the purchasing power will likely draw greater demand for bitcoin, as the cryptocurrency is already used as means of payment.

“Hundreds of thousands of businesses, brands and merchants do accept the ‘digital gold’ as payment, and thousands more every day are realizing the benefits of diversifying their revenue stream and accepting bitcoin as payment for their goods and services,” said Derek Muhney, director of sales and marketing at Coinsource, the world’s leader in Bitcoin ATMs.

Moreover, the cryptocurrency’s appeal as a medium of exchange is likely to continue strengthening with the growing prevalence of technology in consumers’ everyday lives caused by the coronavirus pandemic.

Digital gold

Ever since its inception, bitcoin has been dubbed “digital gold.” Like the yellow metal, the cryptocurrency is durable, fungible, divisible, recognizable and scarce.

Both assets share features that fulfill Aristotle’s call for a currency to be practical and functional. Bitcoin has actual utility as the means of payment, which gold lacks, according to Coinsource’s Muhney.

“As time goes on and people become more comfortable with digital assets, the average person begins to see Bitcoin as a legitimate viable alternative to gold. Thus, it’s reasonable to assume that during a period of deflation bitcoin would perform well like gold has in the past,” said Eric Pinos, America’s ecosystem lead at the public blockchain and distributed collaboration platform Ontology.

Hence, gold’s performance during the previous bouts of deflation could serve as a guide for bitcoin investors.

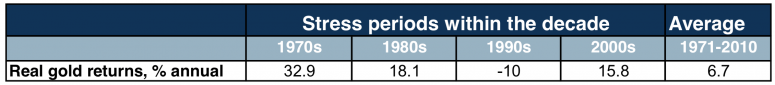

Historical data shows gold performs well during deflation, which includes a sharp rise in financial stress and increased risk of corporate defaults; highly levered companies tend to go bust during deflation because their revenues fall while their debt service payments remain the same.

Of course, gold’s shine is particularly bright during periods of inflation as well. As in periods of sizable deflation, inflation brings a set of price distortions that shake-up income statements and economies.

A commonly-used measure of stress is the “Ted spread” or the difference between the three-month U.S. interbank rate and the three-month T-Bill rate.

“Massive spikes in the Ted spread in the 1970s were accompanied by a sharp rise in gold. The Ted spread also rose sharply in the early 1980s; in 1987 in the wake of the stock market crash and during the global financial crisis of 2007-2009 – both also periods of stronger gold prices,” according to Oxford Economics’ research note.

The real or inflation-adjusted price of gold rose an average 33 percent per annum in the 1970s, 18 percent in 1980s and 15.8 percent in 2000.

Underscoring all of the scenarios is that a sudden rise in economic stress usually fuels a global dash for cash, forcing investors to sell everything from stocks to gold. However, once economic uncertainty starts settling, people again start looking for safe havens.

“During the Great Recession, while gold initially declined alongside other equities, it found its footing and rallied faster than stocks recovered,” Ontology’s Pinos told CoinDesk.

The Ted spread spiked as high as 4.6 following the collapse of Lehman Brothers in August 2008. Gold fell from $920 to $680 per troy ounce in the August to October period, as investors treated the yellow metal as a source of liquidity, but still ended that year with 5.5 percent gains. More importantly, it rallied by 24 percent in 2009 and went on to hit a record high above $1,900 in 2011.

The yellow metal’s recent price gyrations suggest history may be repeating itself. As the Ted spread rose from 0.11 to 1.42 in the four weeks to March 27, gold fell from $1,700 to $1,450 yet is now trading near $1,725 per ounce, having hit a 7-year high of $1,747 ten days ago.

Bitcoin, too, was treated as a source of liquidity last month, as evidenced from the near 40 percent drop to levels under $4,000 seen on March 12. Since then, however, the cryptocurrency has risen by nearly 85 percent to $7,500.

If gold’s historical data and the recent market activity is a guide, then the path of least resistance for bitcoin appears to be on the higher side.

Unprecedented stimulus to undermine fiat currencies

Both the U.S. government and the Federal Reserve have unleashed massive amounts of liquidity into the system over the past few weeks to contain the economic fallout from the coronavirus pandemic.

Notably, the Fed is running an open-ended asset purchase program and its balance sheet has already risen to record highs above $6.5 trillion. Meanwhile, central banks from New Zealand to Canada have slashed rates to zero and have recently announced bond purchase programs.

What’s more, the amount of fiscal stimulus announced by 22 countries in March is equivalent to 75 percent of the global gross domestic product (GDP), according to JPMorgan.

However, most governments and central banks appear to have run out of ammo. Hence, if the coronavirus pandemic continues to spread or leads to corporate defaults, investors may lose trust in traditional finance and look for alternatives like bitcoin and cryptocurrencies in general.

Moody’s Analytics recently warned of the heightened risk of corporate defaults in the oil and gas sector across the globe, and weakness in entertainment and leisure giving way to pressure on consumer durables.

“The willingness to fight deflation should bode well for bitcoin,” said Richard Rosenblum, head of trading at GSR.

Meanwhile, Ashish Singhal, CEO and founder of the cryptocurrency exchange Coinswitch.co, said, “In a deflationary scenario, the chances of negative interest rates are high, and users would want to move their existing assets into more stable assets like bitcoin to prevent loss in their asset value.”

Interest rates are already set below zero across Europe and in Japan and are hovering at or near zero in other advanced countries.

Further, with central banks willing to do whatever it takes to defeat deflation, the real yield or inflation-adjusted returns on bonds are likely to remain negative or meagerly positive at best. As a result, zero-yielding assets like gold and bitcoin may attract more buyers.

Bank of America’s analysts noted earlier this week that the stimulus frenzy amid the coronavirus pandemic would put pressure on the currencies and send gold to $3,000 by October 2021.

While bitcoin could perform well during deflation, bitcoin and cryptocurrencies have seldom tracked macro developments on a consistent basis in the past. “Blockchain-based currencies are really their own beasts,” said Bitcoin Depot CEO Brandon Mitz.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.