Crypto is on the march, and not just in terms of market price. Not only does data indicate that the number of ID-verified users of cryptocurrency doubled over 2018, but there are various other metrics that suggest that adoption is gaining traction. As many as 84% of companies worldwide are involved with blockchain-based technologies in some way, while cryptocurrency ownership is twice as high among young Americans than among the general United States population. And at a time when there’s plenty of talk about the need for crypto to standardize and regulate itself before adoption can really take off, it would now seem that lobbying on cryptocurrency-related issues is also increasing.

This indicator of growth emerged at the end of April, when the U.S. Congress released its latest quarterly data on lobbying on Capitol Hill. Its statistics revealed that the number of companies and organizations lobbying for crypto had increased between Q4 2018 and Q1 2019, with lobbying efforts from the likes of Mastercard, Accenture and EY underlining how the regulatory fate of blockchain and cryptocurrencies isn’t of interest only to Coinbase, Coin Center and other representatives of the crypto industry.

It’s encouraging that more companies are involving themselves in the issue of cryptocurrency regulation, since, if nothing else, this growth indicates that such regulation is more likely to be drafted in accordance with the views and interests of the organizations that actually have a stake in crypto. However, the recent growth in lobbying is also a sign that lawmakers and regulators aren’t moving quickly and decisively enough on crypto legislation, while the preponderance of organizations that didn’t originate in the cryptocurrency industry indicates the possibility that this industry might be shaped against the wishes of the wider crypto community.

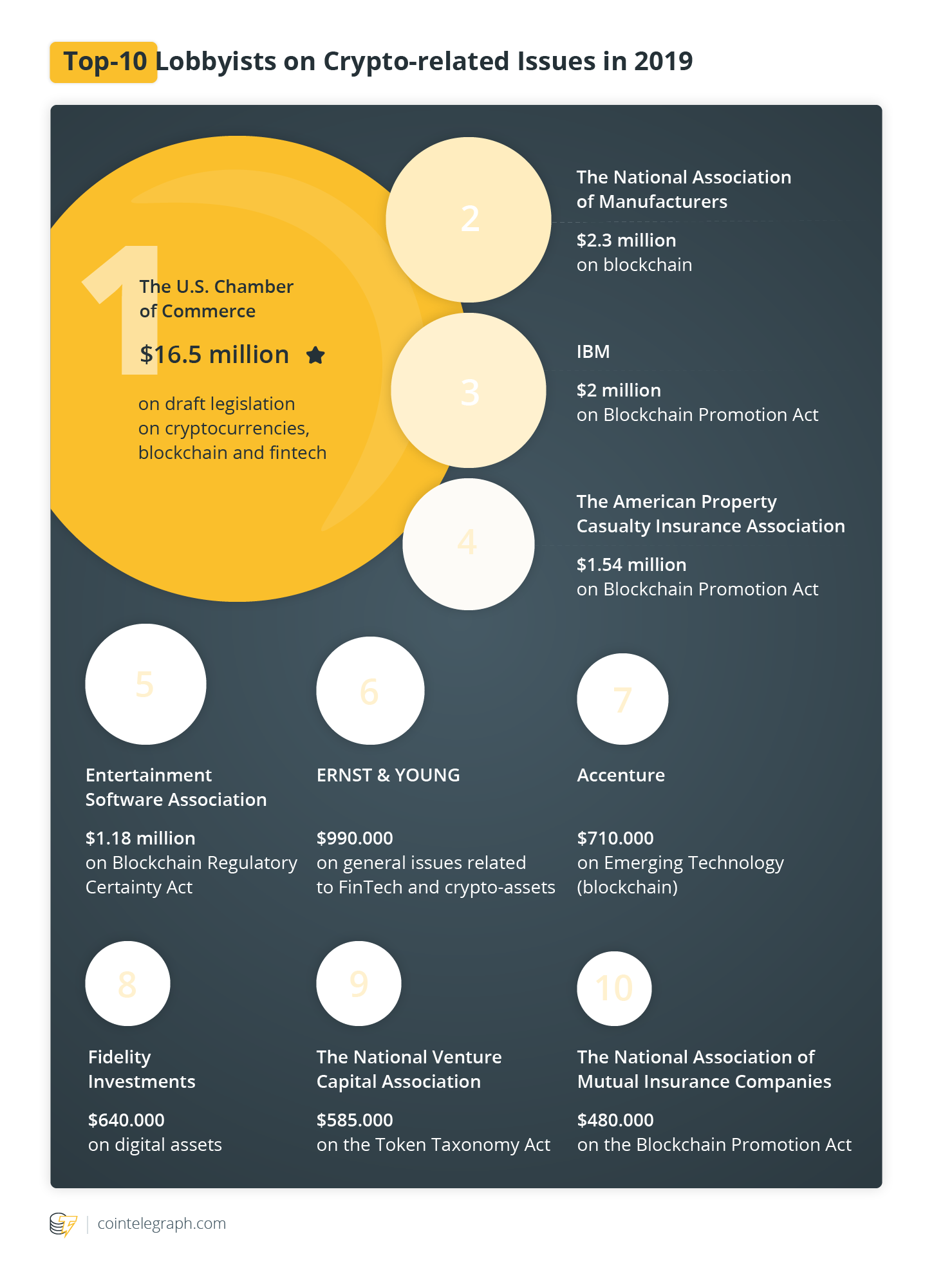

Top 10 lobbyists interested in crypto

Crypto-related lobbying has been consistently expanding ever since 2017, with last year being a particularly strong one. At the end of 2017, there were only 12 entities lobbying on issues related to blockchain technology or crypto, while a year later there were 33. This already represents impressive growth, yet it would seem that the numbers are still rising, since the latest report – from Q1 2019 – shows an increase to 40.

The specific issues being targeted by lobbyists vary from organization to organization, yet a search of the Lobbying Disclosure Act Database reveals that the biggest areas include cryptocurrency taxation, standardization of concepts and definitions, and Anti-Money Laundering (AML) provision. Taken together, these three areas all represent an effort on the part of the cryptocurrency industry to obtain regulatory certainty, through which the industry as a whole should be able to invest, develop and move forward more confidently.

As for which organizations are the biggest spenders, it’s perhaps not surprising to learn that the U.S. Chamber of Commerce spent almost $16.5 million lobbying Congress in the first quarter of the year, although it’s safe to assume that most of this wasn’t lavished specifically on blockchain- and crypto-related issues. Still, the lobbying group — to which around 300,000 businesses belong as members — did declare in its quarterly report that one of its many specific issues was “draft legislation on cryptocurrencies,” while another was “blockchain and fintech.”

This doesn’t reveal much about how exactly it wants the crypto landscape to change, but it’s worth noting that it has previously participated in meetings on Capitol Hill that had the aim of promoting regulatory certainty for cryptocurrencies and initial coin offerings (ICOs). In other words, it would seem that it’s aiming to ensure legal clarity for the businesses it represents, so that they know where they stand when it comes to pursuing their own crypto-related projects. And given that it represents upward of 300,000 members, its interest in crypto is a testament to a growing interest in blockchain and cryptocurrency among the wider (American) business community in general.

The same goes for many of the other “household” names that also lobbied Washington, D.C. between January and March of this year. After the Chamber of Commerce, the next biggest spender with an interest in either blockchain or crypto was the National Association of Manufacturers, which had $2.3 million to spend on lobbying in the first quarter of 2019. It was fairly tight-lipped as to its specific interest in crypto, however, since it simply entered “blockchain” as one of its lobbying issues, without further explanation.

Luckily, IBM was more helpful in its lobbying reports, which revealed that it shed just over $2 million on a broad spectrum of lobbying activities. As the first of its two reports for the quarter disclosed, one of its interests was blockchain — and in particular, the need for Congress to arrive at a legally conclusive definition of blockchain technology, as suggested by its lobbying on the Blockchain Promotion Act.

While hardly as well known as IBM, the American Property Casualty Insurance Association was big enough to spend $1.54 million on a number of concerns. And much like IBM, it also lobbied on the same Blockchain Promotion Act, once more indicating that there are a growing number of companies that are desperate for the U.S. government and regulators to settle on clear regulation, standards and definitions with regard to the cryptocurrency and blockchain industries.

And while the Entertainment Software Association didn’t specifically lobby on the Blockchain Promotion Act, it nonetheless focused on regulatory certainty, turning its attention in Q1 2019 to the appropriately named Blockchain Regulatory Certainty Act. It spent $1.18 million on lobbying overall, although judging by the large number of issues spanning privacy, cybersecurity, net neutrality and online safety for children, its main focus wasn’t crypto.

Next is Ernst & Young (EY), which splashed out $990,000 on lobbying. Once again, most of this probably went to noncrypto issues, yet EY also declared a lobbying interest in “general issues related to FinTech and crypto-assets,” and also general issues “related to innovation, emerging technologies, and blockchain.” It had, in March, also launched a tool for calculating the tax owed on cryptocurrencies, so it’s possible that some of its lobbying time was focused on tax regulation for cryptocurrencies.

Shifting to another accountancy and professional services firm, Accenture spent $710,000 in the first quarter of 2019. It lobbied on such issues as artificial intelligence (AI), privacy and cybersecurity, as well as on “Emerging Technology (blockchain),” providing no other details than this little cryptic reference. Still, it has become a known advocate and adoptee of blockchain technology in recent years, having published a number of blockchain-based patents and begun using a blockchain solution for employee benefits, and having recently joined the European Commission-launched International Association of Trusted Blockchain Applications (INATBA).

Only slightly behind Accenture in the lobbying stakes is Fidelity Investments (aka FMR LLC), which spent $640,000 on a wide range of issues, including asset management, systemic risk regulation, equity markets, and of course “digital assets.” Interestingly, it published a report at the beginning of May on cryptocurrency adoption, noting that a “lack of clarity around regulation” was one of the biggest obstacles to digital asset investment cited by institutional investors.

Another big obstacle to investment is, unsurprisingly, the possibility that most cryptocurrencies are likely to be classified as securities by the Securities and Exchange Commission. However, the Token Taxonomy Act seeks to exempt cryptocurrencies from this classification, and it was lobbied for by the National Venture Capital Association, which spent just over $585,000 overall ($525,000 and $60,000) on lobbying in the first quarter.

Rounding out the top 10 of crypto-interested lobbying organizations was the National Association of Mutual Insurance Companies (NAMIC). Spending $480,000 on a spectrum of insurance-related issues, it also lobbied on the aforementioned Blockchain Promotion Act, possibly indicating that its 1,400-plus members want clarity on what blockchain legally is, so that they can then go about adopting their own blockchain-based solutions.

What’s interesting about NAMIC and the other top-10 lobbying groups is that none of them operate primarily within the crypto industry. As such, their interest in cryptocurrencies and blockchain highlights just how much crypto has taken root in the general corporate and business landscape, indicating that mainstream adoption of blockchain is gradually accelerating.

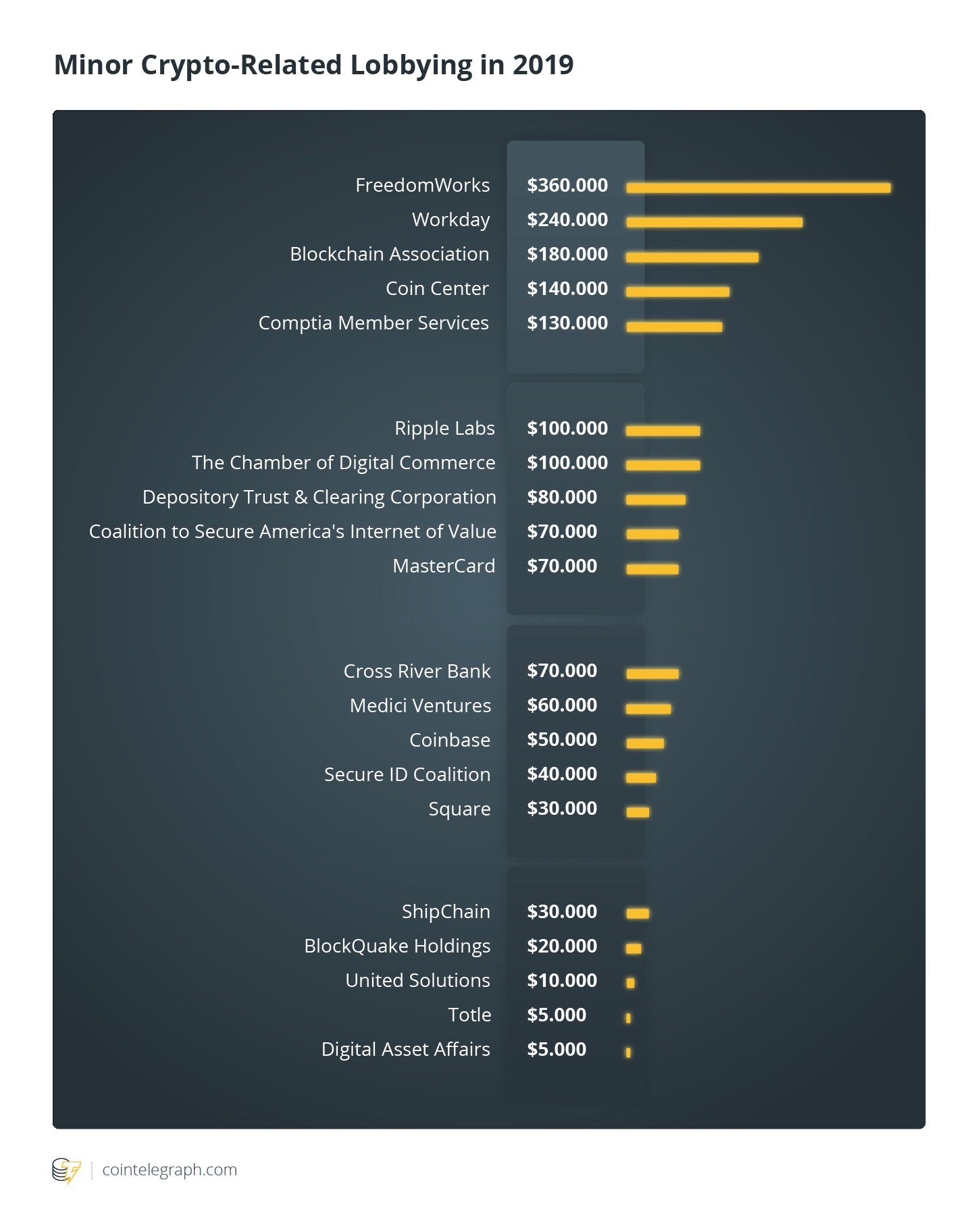

The best of the rest

There are, of course, other companies that lobbied Congress on crypto-related issues. However, while there isn’t space to detail what each and every one of them did in the first quarter of the year, here’s a rundown of what the remaining members of the top 30 spent.

As with Digital Asset Affairs, the remaining companies that engaged in lobbying also spent under $5,000, implying that their sway over lawmakers might not be as considerable as the top 30 spenders. Nonetheless, taking these organizations as a whole, it’s clear that the vast majority of them have all been pushing to establish a favorable regulatory framework in which the cryptocurrency and blockchain industries have the necessary space to develop.

Aside from the organizations all lobbying for regulatory clarity, it’s worth pointing out that certain others are also aiming to secure exemptions for cryptocurrencies from existing securities legislation. This is what the Chamber of Digital Commerce, for one, is doing, with its lobbying report revealing that it’s lobbying in favor of the Token Taxonomy Act and that it wants to “amend the Securities Act of 1933 and the Securities Exchange Act of 1934 to exclude digital tokens from the definition of a security.”

The ultimate aim of such legislation and lobbying is to provide the crypto industry with the stimulus and certainty to develop as strongly as possible, and it’s in this context that the increase in lobbying becomes significant. Not only is this increase a sign of adoption, but it’s also a sign that adoption is being hampered by unclear regulations and laws. A growing number of companies want these regulations and laws to be amended and cleared away so that businesses can proceed as concertedly and as rapidly as they’d like with the development and deployment of new crypto-based solutions.

Hence the recent rise in lobbying, particularly from large corporations and associations that stand to gain from the use of blockchain, but that also want the reassurance that such use will observe all relevant laws.

The taming of crypto?

On the other hand, it might be somewhat disconcerting for the cryptocurrency community that lobbying on crypto-related issues now appears to be driven largely by non-crypto organizations. While there is, of course, no indication that the likes of the U.S. Chamber of Commerce, IBM or Ernst & Young are actively lobbying for legislation that will prejudice the wider crypto ecosystem, it’s possible that their respective interests might neglect certain things that members of this ecosystem might want.

For example, even if the Chamber of Digital Commerce (a blockchain advocacy group) is lobbying for the exemption of cryptocurrencies from securities law, it’s telling that no member of the top 10 lobbying groups — apart from the National Venture Capital Association — is doing the same. By focusing mostly on regulatory “clarity,” such organizations as Fidelity Investments and the Entertainment Software Association are arguably distracting lawmakers from the benefits that could be had if the U.S. were to exempt cryptocurrencies from securities law. As a result, the growth in crypto-related lobbying might ultimately have the effect of sanitizing crypto and making it less dynamic.

There’s also the fact that at least one influential organization within the crypto community — the Bitcoin Foundation — terminated its lobbying activities in the first quarter of the year. It had previously lobbied against S.1241, a bill that would require anyone internationally transacting more than $10,000 in cryptocurrency to file a Report of International Transportation of Currency or Monetary Instruments. This was regarded by the industry as a restrictive piece of legislation that would hamper the operation and development of crypto. So, seeing as how the only other organization listed above to explicitly oppose the bill has been Coin Center, the exit of the Bitcoin Foundation from lobbying is potentially bad news for the cryptocurrency ecosystem.

Still, even if crypto-related lobbying is increasingly being dominated by noncrypto companies, the cryptocurrency industry has been improving its political activism game recently. Aside from spending more on lobbying activities, it has also been forming such advocacy groups as the Blockchain Association and Blockchain for Europe, which in addition to lobbying also engage in educational and promotional on the industry’s behalf. This is why there’s every reason to believe that crypto’s interests will be more substantially represented in the future, and that the adoption indicated by lobbying will only increase further.