Ki Young Ju, the CEO at CryptoQuant and an on-chain analyst, says Bitcoin (BTC) is neutral to short-term bearish for the time being.

There are two major indicators that have been useful in spotting trend reversals in the ongoing bull cycle.

First, whenever the Coinbase premium appeared, which means BTC is trading higher on Coinbase than on Binance, for example, BTC saw bullish momentum. Second, the momentum of Bitcoin strengthened when it saw large outflows from Coinbase.

In the past several days, however, neither of these two indicators have shown any staying power as the metric dipped into negative territory on Jan. 24.

When will Bitcoin market sentiment improve again?

Bitcoin will most likely find a renewed bullish rally if the premium on Coinbase consistently appears with large outflows.

The combination of these two indicators would suggest that high-net-worth individuals are accumulating Bitcoin once again. Ki explained:

“I’ll keep my bearish bias until there are significant Coinbase premium and Coinbase outflow. $BTC needs USD spot inflows from institutional investors to start the next bull run.”

The popular narrative around the recent Bitcoin rally is that high-net-worth individuals and institutional investors are scooping up BTC on every dip.

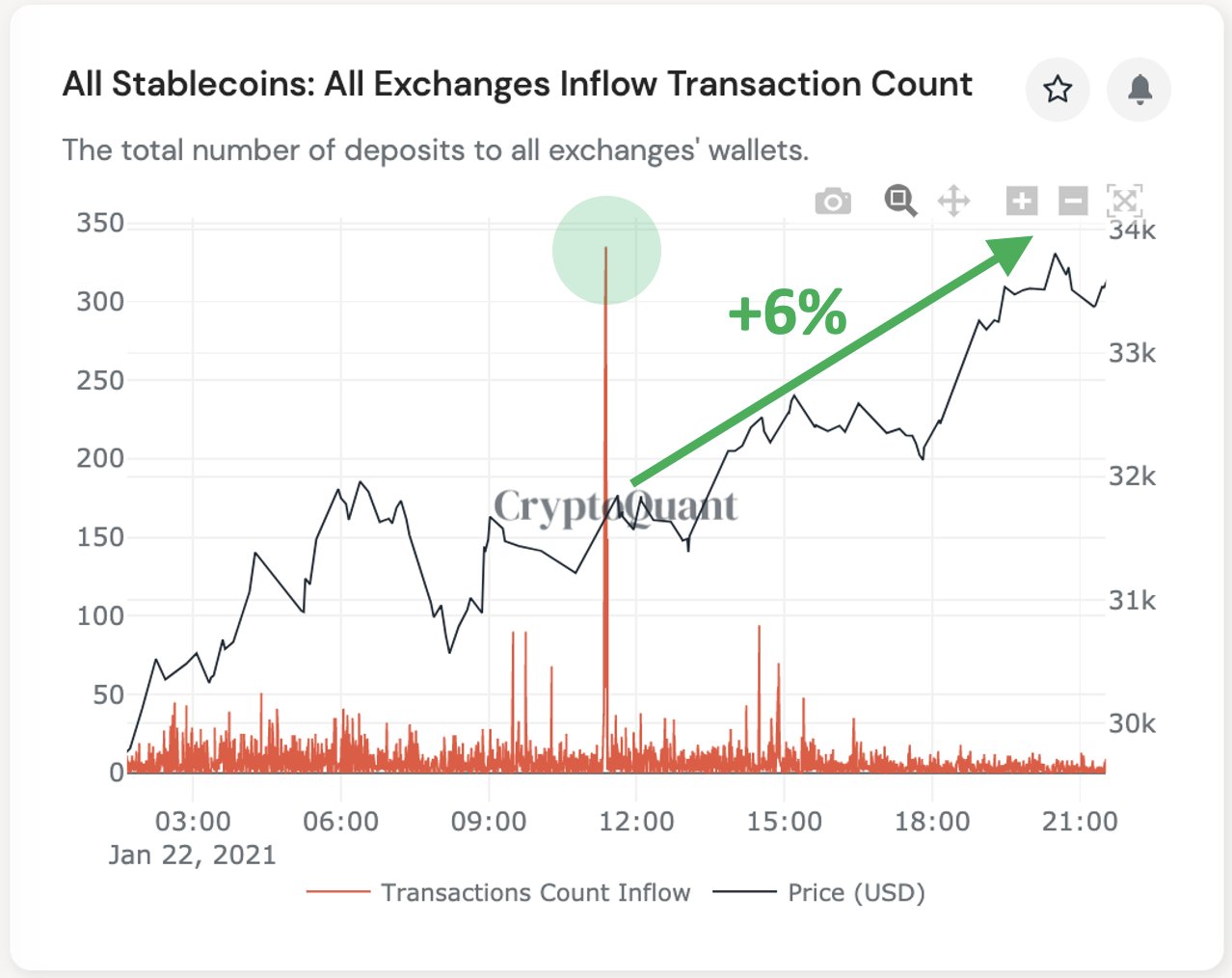

Besides the two Coinbase-related indicators, stablecoin inflows is another important metric that could spot a new rally brewing.

Ki noted that stablecoin inflows into exchanges are often a powerful on-chain signal for a rally because it shows the entry of sidelined capital into the cryptocurrency exchange market.

For instance, when stablecoin inflows spiked on Jan. 22, BTC proceeded to rally by around 6% in the next 24 hours. He said:

“This indicator is one of the powerful on-chain signals with a pretty good hit rate. You can predict an instant rise in the short term, regardless of the overall market trend. It’s the number of stablecoins deposits on all exchanges, meaning investors try to send stablecoins to exchanges to buy crypto. For example, if this value hit 80, we can assume that 80 people are trying to deposit on exchange at a single block, in 15 seconds.”

How low would BTC go?

In the foreseeable future, if Bitcoin continues to trade sideways, some traders foresee BTC dropping to as low as $27,000.

A pseudonymous trader known as “CJ” shared a potential scenario where BTC could bottom at around $26,000 to $27,000.

However, even in the worst-case scenario, analysts generally do not see the price of Bitcoin declining to the low-$20,000 area. The trader wrote:

“This channel could be the very thing that prevents a 20k re-test. Based on this chart, the sweet spot for a dip is between 23-27k.”

Although short-term on-chain indicators signal a slightly bearish outlook, they do not hint at the likelihood of a deep correction.

Bitcoin dropping back down to around $20,000, the previous all-time high, would mean a 35% drop from current levels. Such an event is unlikely, but traders should be aware of a possible black swan event such as a regulatory clampdown or a high-profile lawsuit against a major industry player.