Critical macro data were released in the United States at once, and the cryptocurrency market instantly responded to the latest reports.

American authorities released several vital reports on June 12, including the Federal Reserve’s inflation data and interest rates. How did the crypto market react to the latest macro data?

Inflation has slowed

At the end of May, annual inflation in the United States slowed from 3.4% to 3.3%. This figure was below the consensus forecast of 3.4% and was the lowest since April 2021.

The indicator excluding prices for food and energy increased by 0.2% compared to the previous month and 3.5% compared to May last year. The values were 0.3% and 3.6% a month earlier, respectively. Analysts expected a slowdown in annual rates to 3.5% and monthly rates to 0.3%.

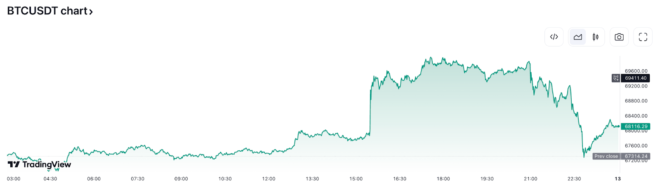

Macro data stimulated Bitcoin’s growth, which increased by 2% in the first 15 minutes. Ethereum’s rise over the same period was 2.5%.

The Fed kept its interest rate

The U.S. Federal Reserve System maintained the interest rate range at 5.25–5.5% per annum.

The cryptocurrency market reacted negatively to the decision. Bitcoin immediately fell below $69,000. In addition, most digital assets from the top 10 by capitalization showed slight negative dynamics, according to the CoinMarketCap data.

What were crypto traders waiting for?

Ahead of crucial inflation data and the Federal Reserve meeting, K33 Research analysts said that clients of unregulated crypto derivatives platforms remain highly exposed to risk, increasing the potential for long liquidations ahead of vital macroeconomic events.

Analysts estimate that open interest (OI) in Bitcoin perpetual contracts has risen to a one-year high after a two-week uptrend. Investors who made bullish bets during this period faced paper losses in their positions.

K33 noted that the observed significant inflows into the BTC-ETF may only partly reflect arbitrage between the spot and futures markets amid aggressive basis trading on the CME. It’s more about demand rather than hedging.

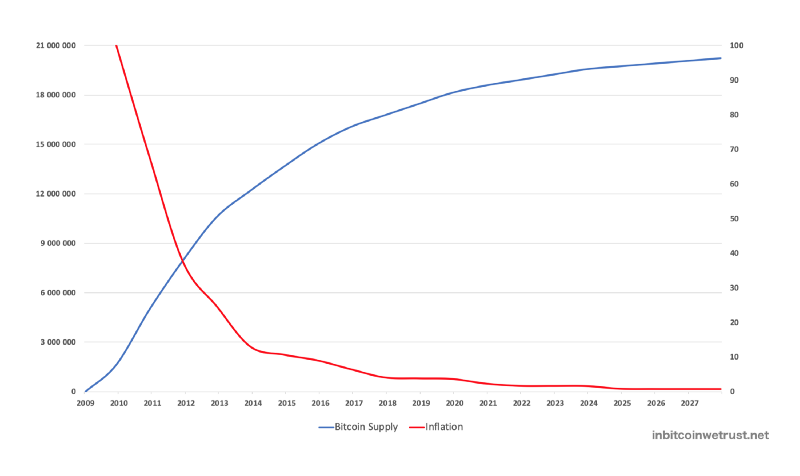

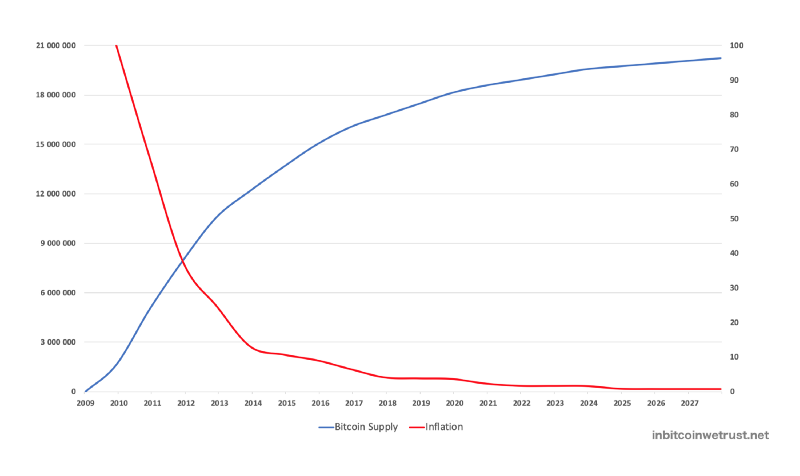

Fed rate and impact on Bitcoin

The Federal Reserve System’s (Fed) base rate is the lending rate at which banks make short-term loans to each other. It is the main instrument of monetary policy in the U.S. Changes in the base rate have a significant impact on the financial system and the stock market and are reflected in the value of various asset classes, including Bitcoin and altcoins.

Why does the price of Bitcoin change when the Fed rate increases? During periods of economic growth, the Fed keeps the base rate low, which stimulates investment and reduces the overall savings rate. Because high-risk assets have higher return potential, they are more popular among investors.

During an economic recession or crisis, the Fed raises its base rate. This encourages economic agents to increase savings, sell high-risk assets and go to a “safe haven”, that is, invest in conservative instruments whose profitability is growing.

The Fed rate is an essential factor, but it is not a determining factor in cryptocurrency prices.

Treasury bonds

The decline in 10-year Treasury yields from a November 2023 high to 4.47% in early May has made high-risk assets such as technology stocks and cryptocurrencies more attractive to investors.

Risk assets, including crypto, are teetering on the brink of a major correction due to the actions of the Fed, which is committed to maintaining current funding rates in the range of 5.25 to 5.5% in response to the lack of progress towards achieving its 2% inflation target.

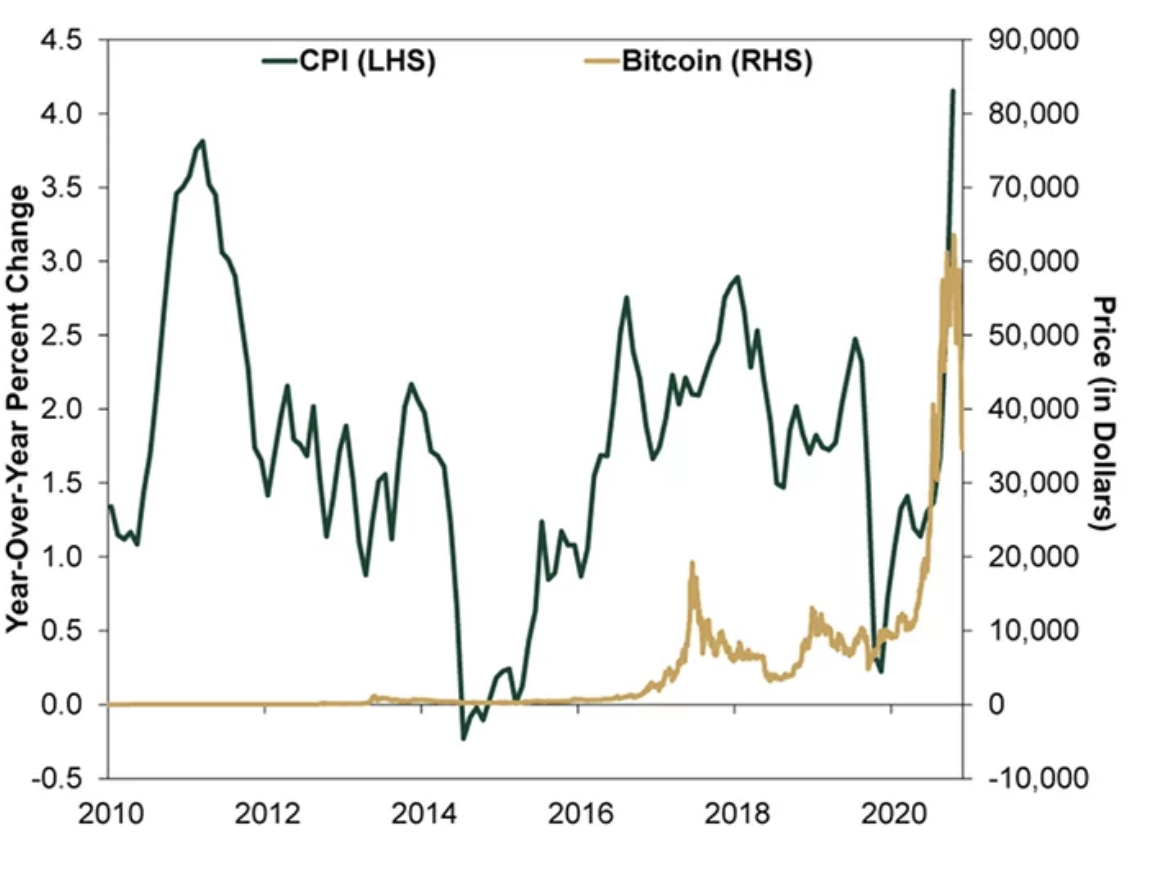

Consumer price index

The CPI index measures the gradual change in the overall price level of goods and services that a specific population group purchases and uses. It reflects inflation or deflation in the economy, and monetary regulators often rely on this metric to make economic policy and financial stability decisions.

The consumer price index is seen as a measure of inflation. When CPI reaches high values, fiat currencies like the U.S. dollar lose their purchasing power.

An increase in CPI can theoretically contribute to the growth of the first cryptocurrency’s quotes — it can act as a means of storing value that is not directly related to the economic policy of a particular country.

However, in practice, the correlation between CPI and Bitcoin’s price is not always positive and straightforward. The digital asset market is characterized by its volatility. It is influenced by several factors, including participant sentiment, technological innovation, regulatory actions, and the macroeconomic situation.

For example, a high CPI can attract investors’ attention to Bitcoin. However, if this happens against the backdrop of news about regulatory restrictions affecting the industry, the expected price increase may not occur.

U.S. national debt

At the beginning of this year, the U.S. national debt exceeded $34 trillion, a new record and an alarming sign for many experts. Analysts admit that Bitcoin could become the main defensive asset as the U.S. national debt grows.

Forbes experts note that the growing U.S. government debt instills uncertainty in investors about the future of the U.S. financial system, which leads to an increase in investment in cryptocurrencies and gold, thereby increasing the value of these assets.

Thus, Michael Hartnett, chief strategist of Bank of America, noted that spot Bitcoin ETFs that have taken Wall Street by storm over the last month are on course for a “blowout year,” in part because of the collapse of the dollar.

“Inflows into the new spot bitcoin ETFs have suddenly accelerated over the last two weeks, fueling wild predictions that bitcoin could “steal gold’s crown” as the world’s “prime store-of-value.”

Forbes

Is traditional economics important for the crypto market?

U.S. monetary policy has long had an indirect impact on the cryptocurrency industry. This has become especially obvious since 2018, when Bitcoin went into correction. The same situation happened during the 2022-2023 bear market.

As a rule, a decrease in the Key Rate stimulates investments in riskier assets, such as Bitcoin. Thus, an economic recession and then a rate increase, on the contrary, encourage market participants to move to more traditional, safe instruments.