Every year has a handful of days that you’ll never forget. Sometimes for great reasons, sometimes for awful ones, and sometimes because a level of noise and action coalesces into an awareness that something big has shifted.

Wednesday was one of those days, with the staccato of compromised Twitter accounts (including ours) escalating to reach prominent public figures including current and former heads of state. The scale of the hack was spectacular.

You’re reading Crypto Long & Short, a newsletter that looks closely at the forces driving cryptocurrency markets. Authored by CoinDesk’s head of research, Noelle Acheson, it goes out every Sunday and offers a recap of the week – with insights and analysis – from a professional investor’s point of view. You can subscribe here.

The mainstream press called this a “bitcoin scam,” and to some extent it was – the hacker set up the typical ploy of promising to send back double whatever amount of bitcoin anyone sent to a certain wallet. It’s amazing that people fall for this.

But some people do – a total of $123,000 worth of BTC was sent in approximately 400 transactions in total (some may have been the hacker recycling coins to inflate the activity). 17 transactions sent more than $1,000. Glossing over the fact that this is an astonishingly small amount for the scale of the hack, some skeptics took the opportunity to remind everyone how bitcoin was a scammer’s paradise.

Close the door

Some commentators went as far as to call for the banning of bitcoin. “If bitcoin were illegal,” goes the reasoning, “this wouldn’t happen.” Of course, this brought out the defenders by the droves, who pointed out – among other compelling arguments – that making something illegal doesn’t stop it from happening; it often just makes it harder to monitor. And banning bitcoin would not stop its use nor eliminate its value.

But it did highlight a pervasive concern among many mainstream investors: a lack of regulatory clarity. Could the U.S. decide to outlaw bitcoin transactions within its jurisdiction? The very possibility is understandably enough to keep cautious investors away.

Technically, the U.S. could not ban bitcoin on a global scale – bitcoin lives on a distributed network that would continue to exist even if U.S.-based nodes shut off and U.S.-based users dropped out. One of the strengths of bitcoin is that it is out of the range of state actors.

But, realistically, making the holding or transacting of bitcoin illegal for U.S.-based entities and individuals would be a big shock to the price as its store of value narrative would take a significant hit.

What’s more, the U.S. has considerable influence over the FATF, which sets anti-money laundering and anti-terrorist financing systems for the world’s banks and payments companies. The organization could be pressured to penalize governments that allow cryptocurrency services within their jurisdiction.

Yet all of these concerns seem unfounded. Last week, the FATF announced its intention to step up crypto asset supervision with a view to building a global framework, which implies an interest in monitoring rather than stopping.

And in the wake of the Twitter hack, the talk coming out of Washington is not about bitcoin. The concern is the centralization of platforms. Twitter is under scrutiny much more than bitcoin.

If regulators were going to jump on the ban-bitcoin bandwagon, given the media frenzy, now would be the time. That they have not done so is a strong sign of acceptance. True, there may yet be hiccups ahead in the road to systemic support – but so far, the concern is more about the vulnerabilities in centralized services.

Furthermore, the amount of bitcoin involved in the scam is minuscule compared to what the take could have been, given the scale of the operation. Maybe the public is becoming more scam-savvy? And we should all be grateful that the hackers only wanted bitcoin, when you consider that they had control of the Twitter accounts of the likes of Elon Musk, Joe Biden, Benjamin Netanyahu, Barack Obama, Apple…

The lack of focus on bitcoin in Washington this week is a step forward, especially in the eyes of professional investors eager for greater regulatory clarity. If indeed bitcoin does weather this without louder calls for a clampdown, that is a strong sign that regulators acknowledge that bitcoin is here to stay.

I see you

Another way in which the Twitter hack was positive for bitcoin is the spotlight shone on the forensic transparency of the network.

Within hours of the hack, blockchain analysts were already constructing profiles of the hacker’s history and tracking the movements of the ill-gotten funds.

The wallets in question may not have a name and address associated with them, but they are indelibly there for anyone to monitor, and transactions into and out of these wallets cannot be hidden nor undone. Digital fiat money transfers may have associated names and addresses, but movements are easier to obscure. And names and addresses can be faked.

What’s more, the fact that anyone can access this data spreads the potential for useful information coming to light. While there may initially be different interpretations of the addresses and transfers, a consensus interpretation tends to emerge, which is likely to be a help to law enforcement. And forensic techniques are advancing, as is the diversity of approaches to blockchain data analysis. This should reassure regulators that bitcoin-related crime is not the threat to society some skeptics claim.

The bigger question

It is true that having bitcoin in mainstream headlines is good for its “brand recognition” – but, in this case, the association with scams is not in its favor. Yet while politicians do pay attention to what the media is saying, by next week the “bitcoin scam” headlines will have faded into the pixels of time, given the frenetic news cycle we live in.

And the market itself does not seem worried – the bitcoin price barely budged in the aftermath of the news.

The lasting effect will be a deeper understanding for those willing to ask the right questions, not just about bitcoin’s seizure resistance but also about how one weak access point left so much power in a bad actor’s hands.

That is a third beneficial outcome that should strengthen interest in blockchain applications beyond crypto assets. Growing concern over centralized vulnerabilities in communication platforms is just the beginning. From there to worrying about vulnerabilities in the centralized financial systems on which our society runs is not that big a step.

Anyone know what’s going on yet?

This week exemplified the seesaw of good news swiftly followed by dampeners. Better-than-expected earnings were offset by forecast downgrades, which seem to be spooking investors. Vaccine optimism, buoyed by positive results from a few laboratories, yet again got tempered by vaccine realism, as even really good candidates could take years before they become widely available. And when it comes to the evolution of the number of COVID-19 cases, positive news in some areas was offset by devastating news in others.

The S&P 500 is very close to having clawed back its losses for the year-to-date, and by the time you read this, might well have done so. It is 7% higher than this time last year. I’ve given up wondering what economic outlook it is discounting.

Bitcoin has had a lackluster performance so far this month, yet it continues to outperform other major indices and assets on a year-to-date basis. Its lack of volatility has traders champing at the bit, however, and the emotional tension of waiting for a breakout, any breakout, could soon start to impact trading patterns.

CHAIN LINKS

Crypto asset fund manager Grayscale Investments* released its Q2 report, which revealed new investment of over $900 million over the quarter, its largest quarterly inflow to date, and 80% more than the previous quarterly high in Q1. TAKEAWAY: While the BTC price has been stagnant of late, it appreciated over 40% in Q2, largely as part of a broader market recovery from post-crash lows, but also perhaps partially because of growing institutional support. We don’t know, however, how much of the inflow is new investment and how much is recycled as qualified investors sell their holding in the market at a premium and buy back in at par. (*Grayscale is owned by DCG, also the parent of CoinDesk.)

Lex Sokolin, the CMO and Global Fintech Co-Head at Ethereum laboratory ConsenSys, published an analysis of the rumored upcoming listing of crypto exchange Coinbase. TAKEAWAY: The lack of available data at the current time is one major obstacle for analysts trying to get a feel for what a listing valuation could be, but Lex does an admirable job of scraping information from public sources. Yet even if/when listing documents are filed and more numbers become available, analysts will still have a hard time figuring this one out: what exactly is Coinbase? Is it an exchange? A bank? A custodian?

Crypto data provider Coin Metrics has published a report on stablecoins that looks into their explosive growth: It took supply five years to reach $6 billion in March 2012, and only four months since then to double that. TAKEAWAY: The report takes a close look at pegs – not everyone realizes that dollar stablecoins are not always worth $1, and that the difference can exert a material influence on supply as issuers arbitrage profit opportunities.

Crypto fund manager Arca reviewed its 2020 predictions from January, and updated them for the rest of the year. TAKEAWAY: The ones I found particularly interesting included the growth in non-crypto companies issuing crypto tokens, the rise of non-fungible tokens as an asset group and the growing influence of younger generations (I wrote more about this here).

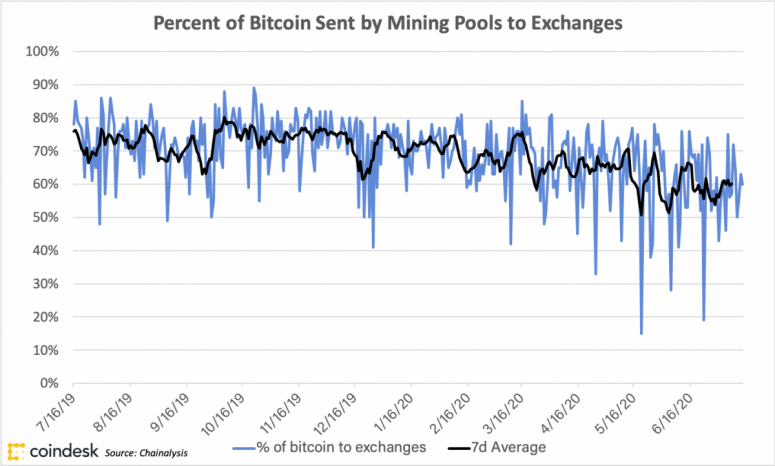

Bitcoin miners sent less bitcoin to exchanges during the second quarter of 2020 than at any time over the past 12 months. TAKEAWAY: This can be taken as bullish (miners are choosing to hold onto their mined bitcoin because they believe the price will go up) or bearish (they would rather not sell into what they think will be a weak market). Either way, we should remember that newly mined bitcoins now account for a very small fraction of trading volume, so the influence of miners’ decisions is mitigated. Their actions are worth watching, however, as most have close relationships with OTC desks that move high volumes and have their ear to the ground.

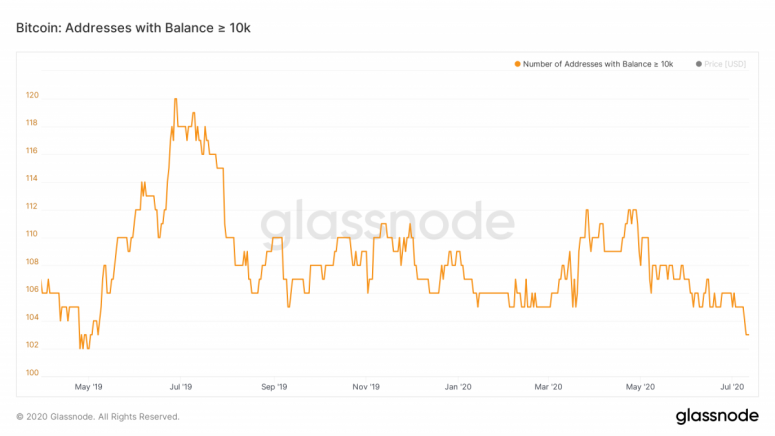

The number of addresses holding a large number of bitcoins, known as “whale addresses,” has declined to a 14-month low. TAKEAWAY: As with the miner flows metric above, this can also be either bearish or bullish. It’s not positive news for the asset price outlook to see large holders reduce their stakes; but a broader distribution of ownership is better for price resilience.

U.S.-based digital asset firm BitOoda published a report, together with the Fidelity Center for Applied Technology, that shows 50% of bitcoin mining is in China, and 14% in the U.S. TAKEAWAY: Earlier estimates had put China’s market share at 65%, so if these figures are accurate, the bitcoin mining industry is becoming more decentralized and less dependent on China.

Crypto financial app Abra has settled charges from the SEC and the CFTC relating to its offering of synthetic swaps to retail investors without registering or selling them on a recognized national exchange. Abra and its Philippines-based partner company Plutus will pay $300,000 in fines and do not have to acknowledge the accusations. TAKEAWAY: This is the long arm of the law in action. Abra limited its offering to non-U.S. investors, and moved most of its operations overseas. But the regulators determined that having an office in San Francisco from which the contracts were marketed and hedged, serving a handful of U.S. retail investors that got through the geofencing, and having marketed to retail investors in the early days of the contract, put Abra in violation of securities laws. In other words, it doesn’t matter where your main base is – if your activity touches U.S. citizens and/or U.S. soil, you fall under U.S. jurisdiction.

On a recent panel, Linda Lacewell, superintendent of the New York Department of Financial Services (NYDFS), said that the recent changes to the BitLicense law were being well received. TAKEAWAY: The original BitLicense, which emerged just over five years ago as a requirement for any crypto business wanting to operate in the state of New York, received significant criticism for its onerous application obligations and the high cost of compliance. Lacewell introduced some reforms to the regulation that aimed to lower the barriers and encourage more experimentation. It’s not surprising they are being well received, but it is good news to get the confirmation. Many crypto businesses chose to not do business in New York as a result of the original design, and the update does not mean they will come back. But Wall Street is one of the greatest financial centers in the world, and if crypto is going to run with the “big boys,” a presence at the heart of finance will be a step forward in the push to position crypto assets as a respectable investment for institutional portfolios.

Bitcoin Core contributor Jeremy Rubin has revealed his work on a new smart-contract language for Bitcoin called Sapio, which he hopes will increase the “financial self-sovereignty” of users. TAKEAWAY: It’s worth keeping an eye on technological developments even in assets that, for many, are based on the store-of-value narrative. Enhanced smart contract ability will not only potentially lend application functionalities to Bitcoin, giving it a “residual value” and further likening it to gold (which, as well as an investment asset, is used in jewelry, technology, dentistry, etc.); it could also make it easier and/or safer to custody and exchange.

BitGo will offer API support for the latest “Travel Rule” guidelines from the FATF that stipulate originators and beneficiaries of financial transactions over $1,000 be identified. TAKEAWAY: This was always going to be a difficult proposition with crypto assets, since identification of both ends of a transaction is often not possible, and goes against the integral idea that transfers can be decentralized and independent of a third party. The FATF’s reach is long, however, and non-compliance is likely to be costly for jurisdictions that cannot control crypto activity within their boundaries. Technological aids like BitGo’s API, provided by a firm with a long history of custodial services, are likely to calm fears of both regulators and clients. Plus, BitGo’s origin is as a custody technology provider – in 2013, it launched the first multi-sig wallet, a staple of custody technology today.

Also, Shyft Network this week announced that it is releasing its blockchain-based solution to help crypto companies comply with the FATF requirements. TAKEAWAY: Tools like this are trying to get ahead of what is going to be a significant problem: the security vulnerabilities inherent in the FATF’s requirement to send sensitive financial information back and forth.

The crypto options marketis growing fast, both in volumes and in number of platforms. Gate.io, a relatively small offshore exchange, has launched a new options trading feature, and Singapore-based exchange Huobi, which already offers futures and perpetual swaps, plans to do so later this year. TAKEAWAY: Growth in options is a sign of a maturing market, and a necessary step for greater institutional involvement. How long this growth will continue is an open question, especially given the declining volumes in crypto spot and futures markets.

Switzerland-based crypto custodian Metaco has closed a Series A round that was reportedly oversubscribed by a factor of two. Investors include Standard Chartered, smart-card and currency note printer Giesecke+Devrient, Zürcher Kantonalbank (the fourth largest bank in Switzerland), and the country’s postal service Swiss Post. TAKEAWAY: That this was reportedly oversubscribed is a sign of growing interest in Europe in digital asset market infrastructure. Also, the mix and profile of the investors is intriguing.

Podcast episodes worth listening to:

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.