The bitcoin price recorded a large drop on July 24, plunging by nearly $700 overnight from $10,200 to $9,565, leading the valuation of the crypto market to slip by $12 billion.

Despite the 6 percent overnight drop of the bitcoin price, some technical analysts foresee a bigger pullback in sight for the dominant crypto asset.

Is a larger drop for bitcoin price possible?

DonAlt, a cryptocurrency technical analyst and trader, said earlier this week when the bitcoin price was hovering above $10,200 that two major supports for bitcoin can be found at $9,800 and $8,200.

“If I had to pick two places to close shorts or long it would be the two green areas below. S1: $9800; S2: $8200. Anything else is in no shape or form significant enough to me to buy in a (short-term) bear trend,” the trader said at the time.

Following the dip in the bitcoin price, DonAlt noted that the inability of bitcoin to record strong recovery at a crucial support level indicates a bearish trend.

If bitcoin fails to rebound to $10,800, which has been considered a key support level throughout July, he emphasized that the asset could test lower support levels.

“These weak bounces while resting on support are bearish to me, not bullish. I wouldn’t be surprised to see it fall. Abandoned all plans to close shorts or start longing, bidding lower. 10800+ closes or a spike + rejection of the lows are the only ways to flip me bullish,” he added.

While technical indicators generally point towards a bearish short term trend, fundamental factors have raised the overall sentiment around the crypto sector in recent months.

The anticipation of the emergence of trading venues such as ICE’s Bakkt, Fidelity’s custodial services, and TD Ameritrade’s potential retail product revolving around bitcoin have led investors to express optimism towards the market.

This week, Bakkt officially launched its testing platform for international users, moving a step close towards a full launch in the upcoming months.

“Today kicks off user acceptance testing ICE for the Bakkt Bitcoin Daily & Monthly Futures contracts Testing is proceeding as planned with participants from around the world,” said Bakkt.

Bakkt has been considered as a potential catalyst for the market due to its bitcoin-settled market. Other leading futures market like CME have processed cash-settled trades.

Fundamental indicators also not looking so good

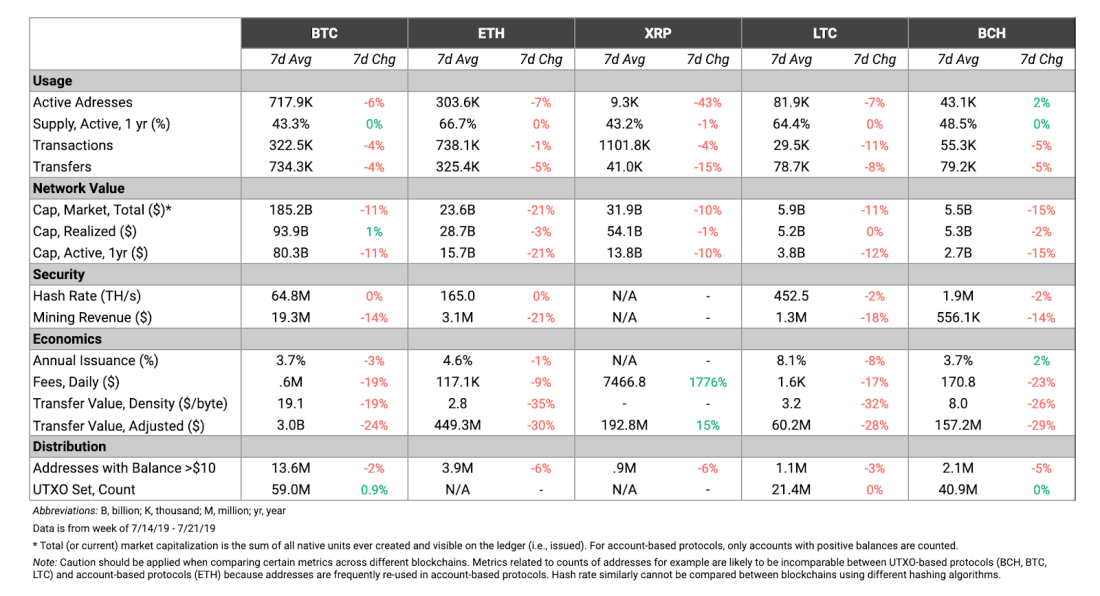

According to a recent report by Coin Metrics, apart from hash rate, most indicators for the usage of major blockchain protocols like Bitcoin, Ethereum, XRP, Litecoin and Bitcoin Cash have dropped.

Active addresses, transactions, transfers, transfer value, and total market cap among other indicators that demonstrate the level of adoption of the four major blockchain protocols have generally dropped by large margins.

“Network metrics fell across the board over the past week. ETH’s market cap is down 21% compared to last week (computed by taking the seven day average from this week and comparing it to the seven day average of the previous week), which is the biggest drop out of the largest five assets. Unsurprisingly, ETH’s adjusted transfer value also dropped significantly, down 30% from the week prior,” the report read.

Click here for a real-time bitcoin price chart.