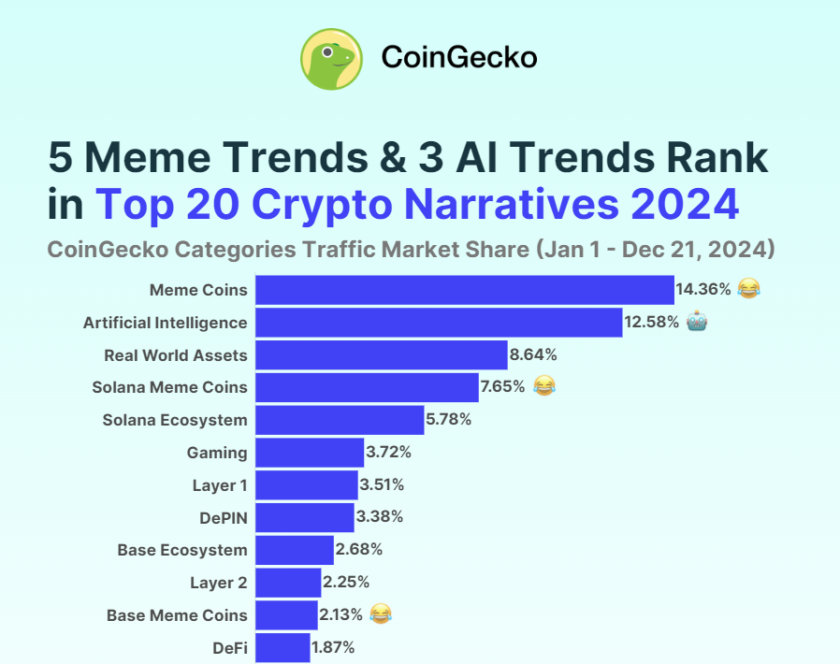

DeFi presented us the freedom to borrow finance, arrange loans, make deposits, and trade financial products without the need for any middlemen. But is it here to stay? Or maybe DeFi is just the next technology bubble?

Decentralized finance (DeFi) has arrived, and considering the total value locked into DeFi rocketed from around $1 billion to nearly $10 billion in the space of three months, there’s every indication that it’s here to stay. However, the DeFi ecosystem has skyrocketed so rapidly that its power transcends just money – other assets are finding themselves caught up in the thriving ecosystem.

Could the growth of decentralized finance continue to snowball until it envelops the rest of the cryptocurrency landscape? Let’s take a look at why everybody’s talking about DeFi:

Understanding the Power of DeFi

By definition, decentralized finance is a crypto ecosystem that’s comprised of financial apps designed to operate on popular blockchain platforms. In short, DeFi is the name given to the use of blockchain technologies like smart contracts, decentralized asset custody to replace all intermediaries with impregnable program codes – thus establishing greater efficiency of financial services while minimizing the costs associated.

Imagine utilising a blockchain platform to establish binding smart contracts that require no paperwork and no middlemen. These programs are almost impossible to tamper with, undermine, or censor. If for instance, somebody agreed to lend another individual money through a smart contract, the terms built into the contract are required to be followed and it’s extremely rare for a human to make alterations to the pre-determined requirements.

Decentralized cryptocurrencies are built on blockchain frameworks that are technological marvels in their own right. DeFi represents a significant step towards realising the true potential of blockchain – so much so that the total value of finance stored in DeFi today has eclipsed that of just three months prior.

The graphics showing the total value locked (USD) in DeFi. Photo: DeFi Pulse

The sheer volume of finance held up in the DeFi ecosystem is such that crypto assets linked to DeFi have been rocketing. Notably, yearn.finance reached a value of $38,000 at the end of August – eclipsing Bitcoin’s famous bull run.

With DeFi largely occurring on Ethereum’s blockchain, it’s fair to say that ETH has also enjoyed a quiet renaissance as the DeFi revolution was underway, however the gap from Ethereum to Bitcoin will take some bridging yet.

The Significance of Tokenization

One of the most significant components of DeFi is tokenization. Acting as cryptocurrencies that run on a parent blockchain, tokens behave similarly to the smart contracts championed by decentralized finance.

Tokens on the Ethereum blockchain share plenty of similarities to ETH, but they can be created with various features that make them similar to specific financial products and services.

For instance, stablecoins behave as tokens that have values that are pegged to real-world assets, services, and fiat currencies. In this regard, Tether and USD Coin are designed to mimic the US dollar, while EURS is pegged to the Euro.

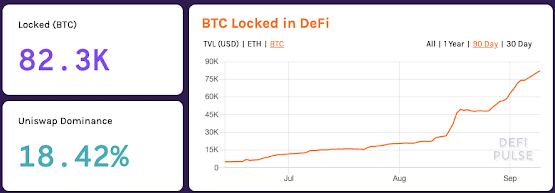

In recent months, more external assets and financial products have been tokenized on the Ethereum blockchain. Bitcoin, which is unable to offer smart contract services remains a valuable crypto asset. Due to this, BTC is being injected into DeFi projects which commonly lock Bitcoins as collateral while producing Ethereum-based tokens that are pegged to the value of BTC.

A graph showing the number of BTC locked in DeFi. Photo: DeFi Pulse

As the chart above illustrates, over 82,000 Bitcoins are locked into DeFi services at the time of writing – with the figure expected to continue to grow.

Are We Witnessing Another Bubble?

The ease in which new DeFi products and services can be set up and made available to the market has prompted a huge surge in interest, and the rate in which decentralized finance is growing is showing some signs that a bubble has formed.

One of the key reasons for this spike can be found in yield farming, where new DeFi services opened up with little oversight offering astronomical returns on lending products. Then, subsequent services were set up on top of these services – further boosting the promised returns.

As Stan Schroeder notes in his Mashable article, among the listed lending interest rates for DeFi products sits platforms like Nuo, offering 11.47% returns on USD Coin deposits, and Aave offering 7% on DAI. The promise of over 10% returns on a US dollar-pegged cryptocurrency may seem appealing, but delving further into the DeFi ecosystem brings even more outlandish return rates – some of which jump into the hundreds of percents.

All the excitement of DeFi can lead to adopters getting carried away, but as the co-founder of Ethereum Vitalik Buterin notes, hefty returns on capital will rarely be risk-free. “Interest rates significantly higher than what you can get in traditional finance are inherently either temporary arbitrage opportunities or come with unstated risks attached,” Buterin explained on social media.

After months of sustained growth, September 2020 started with a slight fall back down to earth for the volume of finance caught up in DeFi projects. However, while there may be the reason to believe that the growth of DeFi has been inflated by the lure of hefty returns and excitement at the arrival of advanced financial services, but the realization of smart contracts is one that’s been long anticipated in the burgeoning world of blockchain, and it’s difficult to foresee a bubble bursting for a form of technology that’s powerful enough to change the way the world uses financial services.

Yasmita Kumar is a writer who has been writing about various topics for many years now. She enjoys writing about technology and its impact on everyday life. Professionally Yasmita writes about Technology, Finance, and Health, and previously worked for the NHS.