New York-based ETF provider Wisdomtree has launched a physically backed bitcoin exchange-traded product (ETP) on Switzerland’s SIX stock exchange. According to Wisdomtree, the new product is not cash-settled like most ETPs traded on the SIX exchange as the BTCW investment product will be settled in BTC.

Also read: 7 Crypto Exchange-Traded Products Now Live on Swiss Bourse

Wisdomtree Launches Physically Backed Bitcoin ETP on Switzerland’s Principal Stock Exchange

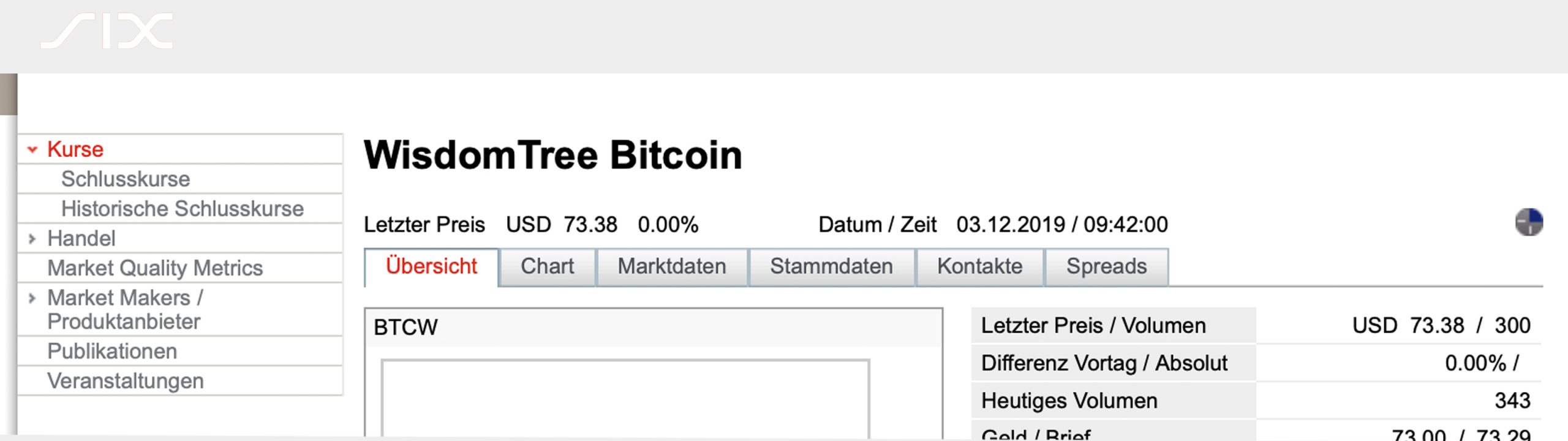

On December 3, the American firm Wisdomtree Investments (NASDAQ: WETF) announced the launch of a new BTC-based exchange-traded product (ETP) that will be traded on Switzerland’s SIX stock exchange. The new product will be different from the other cryptocurrency ETPs traded on SIX, because the BTCW product will be physically backed by bitcoins held in storage. The ticker BTCW will compete with seven other cryptocurrency ETPs traded on SIX that essentially track a basket of digital assets or track the prices of single cryptocurrencies.

The Switzerland-based firm Amun AG is behind most of the crypto ETPs on SIX, which include cash-settled ETPs for a basket of coins, BTC, ETH, XRP, and BCH. The ETF provider Wisdomtree is the seventh largest ETF firm in the U.S. and has been offering exchange-traded products for nearly two decades. Wisdomtree’s latest announcement says investors will get exposure to BTC. The company also highlighted that with BTCW, investors will get “access to institutional-grade storage solutions without needing to set it up with a custodian themselves.”

“We have been monitoring cryptocurrencies for some time and are excited to bring investors secure access to this developing asset class,” Wisdomtree’s Head of European-based Products, Alexis Marinof, said. “Wisdomtree has a history of bringing innovative investment themes to a broad market through institutional-class products, allowing investors to take exposures in difficult-to-access asset classes — we see many parallels between the cryptocurrency space and commodities in this regard.”

Marinof added:

The introduction of cryptocurrencies in an ETP structure will enable investors to find new ways to introduce digital assets into portfolios while still relying on the safety and security that they have come to expect from Wisdomtree.

‘Bringing Cryptocurrencies to the ETP Structure’

This is not Wisdomtree’s first experience dealing with physically-backed ETPs as the company launched the world’s first physically backed gold ETP in 2003. Moreover, the company has the largest ETF in terms of AUM in Europe as well because it utilizes European equities, but removes the volatility tethered to the exchange rates between the USD and EUR. The BTCW settlement will be handled by the International Central Securities Depository (ICSD) and Wisdomtree aims to “offer liquidity like any other exchange-listed security.” Wisdomtree notes that bringing digital currencies to the ETP structure may bring the possibility of liquidity centralization, which in turn could “benefit the underlying digital asset.”

“Cryptocurrencies are potentially the next asset class to benefit from increased interest when they become accessible in an ETP structure,” Wisdomtree’s capital markets and technology product development executive Rafi Aviav explained during the announcement. “We have developed a solution which addresses the difficulties investors face in accessing digital assets and are bridging the gap between the underlying decentralised online blockchain technology and traditional investment structures.”

Aviav believes that the ETP system could invoke “new dimensions” into crypto markets, which include bolstering institutional-grade custody solutions. The Wisdomtree executive thinks that incorporating digital currency trading into standard brokerage accounts will make markets “more liquid and transparent.” At press time, Wisdomtree’s BTCW product is live on Switzerland’s principal stock exchange, but the investment vehicle is only available to institutional investors. Wisdomtree has also recently published various educational resources for institutional and retail investors on how to invest in digital currencies and the “rise of cryptocurrencies as a new asset class.”

What do you think about the new Wisdomtree physically backed bitcoin ETP that’s trading on the Switzerland exchange SIX? Let us know what you think about the relationship between cryptocurrencies and ETPs in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Image credits: Shutterstock, SIX Exchange, and various Wisdomtree online documents.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.