As the second-largest altcoin by market capitalization, XRP is hardly far from consideration during periods of significant bullish enthusiasm in the cryptocurrency market. Despite being 85% down from its January 2018 high, recent price spikes have sparked noticeable interest in XRP as investors consider viable diversification candidates for their crypto portfolios.

Any discussion about XRP often includes criticisms of Ripple, a blockchain payments firm that originally created the XRP token. Furthermore, XRP critics argue that Ripple’s ownership of the majority of the token supply, as well as its penchant for dumping “coins” on the market, is likely to erode any significant value for XRP holders.

As a firm located in the United States, Ripple is also contending with the lack of regulatory clarity in the country. The U.S. Securities and Exchange Commission is yet to state whether the XRP token is a security, a ruling that could have significant implications for the firm.

In the absence of clear-cut regulations, U.S.-based investors appear reluctant to risk significant exposure to XRP. Also, traders who bought above $1 back in 2018 might be expecting considerable selling pressure as they attempt to recoup their initial investment, likely keeping prices lower.

Meanwhile, several countries are working toward creating their own central bank digital currencies. Intergovernmental economic and financial establishments continue to espouse the claim that sovereign digital currencies are preferable to private cryptos. With Ripple marketing XRP as a bridge currency for cross-border remittance, it remains to be seen what the future holds from a utility standpoint for the third-ranked crypto by market capitalization.

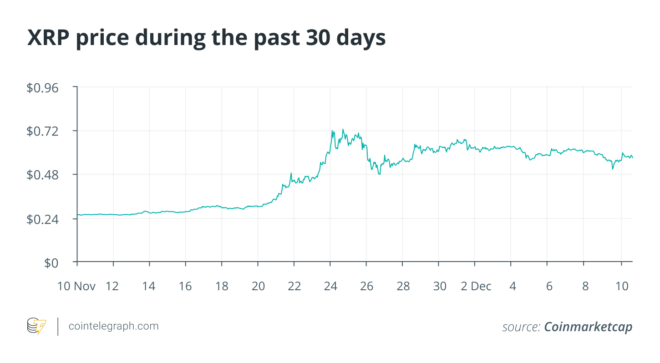

XRP up twofold since November

The XRP price has more than doubled since the start of November on the back of significant tailwinds in the crypto space within the period. A flood of institutional money into Bitcoin (BTC) triggered bullish advances that also translated into a renewed interest in the altcoin market as well.

XRP is currently at its highest price mark since September 2018 as the popular altcoin broke through a multi-year resistance, opening up the possibility for a parabolic advance at least in the short term. Indeed, XRP did reach the $0.9 level on Coinbase as retail interest peaked in late November.

However, the sudden spike to $0.92 was followed by an even sharper 45% decline, with XRP hovering between the $0.50 and $0.60 price bands since then. According to crypto analyst and Cointelegraph contributor Michaël van de Poppe, if the XRP price stays above the support level at $0.45, then an assault on the $1 price mark is not unlikely, especially amid tailwinds from another Bitcoin push toward a new all-time high.

The last major crypto bull run, which occurred between late 2017 and early 2018, saw altcoins experiencing significant gains even after the Bitcoin pullback began. However, the price correction for the likes of Ether (ETH), XRP, Litecoin (LTC) and other altcoins was slightly higher than that of BTC.

Indeed, the average decline in the altcoin space was 90% during the year-long bear market period of 2018. Thus, while Bitcoin is less than 10% from its ATH, altcoin tokens like XRP still trail their price records by a considerable margin, typically between 60% and 90%.

XRP eyeing a move toward the $1 price mark

For XRP, the price path upward appears to hinge on two important milestones: the $1 psychological level and the $3.82 ATH. Presently, there exists a few driving forces that could fuel a move toward and above the record.

However, a sustained parabolic advance that would push XRP north of its ATH appears unlikely at least in the short term. “From a technical perspective, calling for new all-time highs for XRP at the moment seems far-fetched,” Konstantin Anissimov, executive director at crypto trading platform CEX.io, told Cointelegraph.

According to Anissimov, XRP’s November breakout triggered the formation of a bullish flag-pattern on its price action. Flag patterns typically indicate areas of tight price consolidation, and XRP is currently range-bound below the $0.60 level. He clarified:

“If the buying pressure behind this cryptocurrency continues mounting, another breakout may take place in the same direction of the previous trend. As a matter of fact, the bull flag pattern anticipates that XRP could rise more than 65%. The bullish impulse could take this altcoin beyond $1.00.”

The upcoming Flare network airdrop is also likely providing an incentive for sustained XRP buying. On Dec. 12, multiple exchanges that support the airdrop will take a snapshot of their customers’ XRP balances as the basis for distributing Spark (FLR) tokens. FLR is the native token of the Flare network, a project developed by Ripple to introduce “Ethereum-like” capabilities to the XRP ledger. The project, reportedly compatible with Ethereum smart contracts, is expected to go live before the end of Q2 2020.

With Ripple excluded from the airdrop, crypto enthusiasts might be more inclined to increase their XRP holdings or become owners of the token for the first time in order to receive the airdrop. The DeFi craze of Q3 2020 demonstrated how valuable some air-dropped tokens can become, particularly for projects that manage to cultivate significant network effects.

For Mostafa Al-Mashita, executive vice president at crypto-focused merchant bank Global Digital Assets, the upcoming FLR airdrop is sufficient enough to provide an upward push for XRP. In a conversation with Cointelegraph, the executive identified $0.93 as a short-term price mark for XRP on the back of the airdrop snapshot.

Possible institutional interest, coin burns and token dumps

Bitcoin has enjoyed considerable institutional attention in 2020, with Wall Street firms and noted investors alike buying into the value proposition of BTC. Reports are also emerging of investors casting a broader glance at the crypto market beyond Bitcoin. Grayscale managing director Michael Sonnenshein recently revealed that there is a growing class of “Ethereum only” investors. The emergence of the DeFi market in 2020 is seemingly improving Ethereum’s appeal among institutional players.

Related: Game recognize game: Institutions make it easier to invest in Bitcoin

With XRP being the third coin by market capitalization, perhaps the token is primed for an institutional push as well. In its 2020 shareholder letter, financial risk management firm FRMO Corp singled out XRP as “one of the more intriguing [crypto]currencies,” adding:

“If the transaction velocity of XRP were to rise greatly, the number of currency units would decline greatly, thereby creating a substantial return even if the coin itself did not experience an increase in market capitalization. It would, however, experience an increase in value per unit.”

It’s perhaps important to point out that FRMO’s analysis relies on an exponential increase in XRP utility, which would cause transaction fee payments to rise significantly. According to the XRP tokenomics model, transaction fees, which are in themselves small fractional units of the token, are burned. On the contrary, this amount is paid to miners and network validators for mined cryptocurrencies.

In theory, a rising utility for XRP would mean a major increase in the total amount collected as fees. Since this amount is inevitably destroyed, XRP’s circulating supply would begin to decline constantly, thus creating a situation where token demand outstrips available coins. This significant decline could be accelerated by the XRP community voting for Ripple to burn all of its XRP token holdings. Earlier in December, Ripple chief technical officer David Schwartz hinted at such a possibility, adding that the company would be unable to stop the move.

Ripple has long been accused of diluting the XRP supply with incessant token sales, with critics saying the company has outright tanked the value held by coin holders. Apart from Ripple’s actions, XRP also suffers downward selling pressure from former Ripple co-founder Jed McCaleb, who routinely sells off his token stash.

As part of McCaleb’s acrimonious departure from the company in 2014, the ex-Ripple chief technical officer was awarded a 9 billion XRP settlement for his role in founding the company. The only stipulation attached to the deal was that McCaleb could not dispose of the entire sum in one go.

With XRP experiencing a significant increase in retail trading activity, regulatory uncertainty surrounding Ripple and the token itself still means the market attention is not translating to actual utility for the coin, at least in the United States. Earlier in December, Ripple CEO Brad Garlinghouse claimed that about 95% of the company’s clients are overseas.

According to Garlinghouse, XRP’s perceived limited adoption in the U.S. comes from the lack of regulatory clarity from the SEC about the status of the token as a security or a currency. Indeed, in October, Ripple revealed plans to move out of the U.S., with Japan and Singapore suggested as likely relocation candidates. While still maintaining frustration at the “regulation through enforcement” policies of U.S. agencies, Garlinghouse has since remarked that the company will wait and see which changes the Biden administration will implement.

Related posts