Major decentralized finance (DeFi) tokens Yearn.finance (YFI), AAVE and Compound (COMP) plunged steeply in the last 24 hours. The three DeFi tokens, which are valued well over $500 million, declined by over 10% on the day.

Three reasons why DeFi-related cryptocurrencies pulled back particularly hard are low volume, the declining Ether (ETH) price, and the uncertainty around Bitcoin (BTC).

Even top DeFi tokens like YFI and AAVE have comparably low volume

Compared to major cryptocurrencies, like Bitcoin and Ether, DeFi tokens have relatively low volume. This means that when Bitcoin corrects, tokens with lower volume are at risk of larger pullbacks.

In recent weeks, DeFi tokens have shown signs of a lower correlation against Bitcoin and Ether, according to the pseudonymous trader “CryptoGainz.” As such, regardless of whether the cryptocurrency market is in risk-on or risk-off mode, the DeFi market rallied strongly in December. The trader said:

“DeFi is decoupled from btc and eth imo these assets aren’t that liquid and they’re getting a lot of interest from grown man money that does not [care] about whether the rest of crypto is risk on or not.”

However, short-term investors might have felt compelled to sell DeFi tokens when Bitcoin and Ether dropped nearly 10% within two days.

The timing of the Bitcoin price drop matched with the DeFi market’s correction on Dec. 11. As the BTC price started to decline from $18,400, leading DeFi tokens also began to correct.

YFI, for instance, the governance token of the Yearn.finance DeFi protocol, dropped 12% in the past 12 hours. In the same period, the Bitcoin price recorded a 4.6% drop.

The strong correction of DeFi assets comes as a surprise because of their recent momentum. As an example, Cointelegraph reported that COMP rallied 56% in one week as the amount of capital locked in the Compound protocol spiked.

Ethereum’s momentum slows

Although the impact of the Ether price on the DeFi market differs from protocol to protocol, Ether’s value has a major effect on the overall DeFi market.

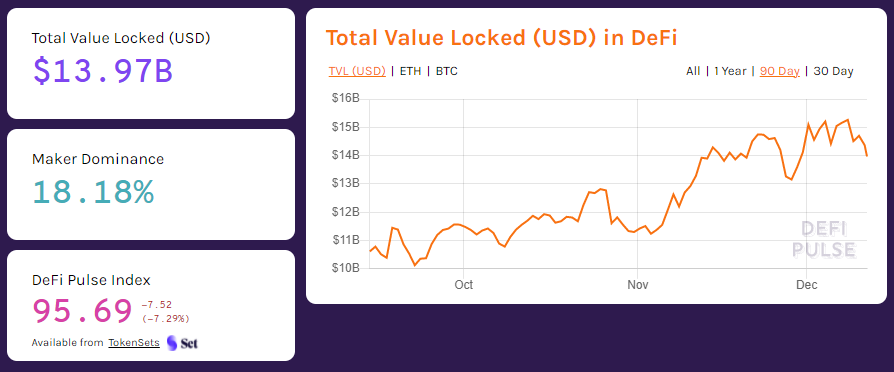

Most DeFi protocols revolve around investors lending and borrowing capital with Ether as collateral. Hence, when the price of Ether drops steeply, the total value locked (TVL) in DeFi would naturally fall.

According to data from Defipulse.com, the TVL across DeFi protocols declined from $15.16 billion to $13.97 billion in the past four days. The sharp drop in TVL coincides with the moment DeFi assets corrected.

Bitcoin price uncertainty

In the short term, traders are cautious about Bitcoin’s price trend. As Cointelegraph reported, the imbalance in the Bitcoin options market favors bears or sellers in the foreseeable future.

The combination of miners selling large amounts of Bitcoin unseen since 2017 and the lack of balance Bitcoin options market is causing heightened uncertainty in the market.

At the same time, it’s also possible that DeFi can front-run Bitcoin to recover in the near future. CryptoGainz notes that DeFi altcoins with “strong narratives” are attracting long-term value investors. The trader argues:

“I have no idea how funds are determining coin valuations, but there must be significant upside from here since they are aggressively accumulating and not de-risking.”