The hype surrounding decentralized finance is sometimes credited with triggering a wider market rally in July, as new protocols began releasing tokens that were immediately posting gains of many times their initial value. Despite undeniable price growth, however, it is not immediately clear if the sector as a whole has grown, as reliable metrics to measure the fundamental performance of DeFi protocols are incredibly hard to come by.

The projects lend themselves to fairly rigorous analysis methods, as they will often have well-defined revenues and expenses. But the rise of liquidity mining, or yield farming, is throwing the metrics off balance in some ways. Protocols reward their users with their own governance tokens, essentially as a payment for using the platform. A frenzied movement to maximize the yield for these tokens distorted the prevailing DeFi success metric, the Total Value Locked, or TVL.

A clear example of this is the Compound protocol where the value of Dai supplied to it surpasses its total amount of tokens by almost three times — $1.1 billion vs. $380 million in existence as of writing. This is due to Compound users entering leveraged positions on Dai — something that normally does not happen with stablecoins. While this led the community to discuss the merits of TVL, some other similar measurements have been distorted as well.

Evaluating a DeFi lending project

Valuation metrics will change slightly based on the type of project. In the case of lending protocols like Compound and Aave, TVL represents the supply-side liquidity of the project or the total sum of all deposits currently held by them. It is worth noting that TVL only takes the on-chain reserves into account. According to DeFi Pulse, there are only around 220 million Dai locked in Compound, not 1.1 billion.

DAI locked in Compound. Source: Defipulse.com

However, lending providers are generally evaluated based on book value, or how much is being borrowed. Since that is what generates revenue, it’s considered a much more direct measurement of the protocol’s financials.

Due to the distribution of the network’s coin, COMP, however, all tokens except Tether (USDT) and 0x (ZRX) have negative effective interest when borrowing, according to Compound’s dashboard, meaning that users are paid to do so. The Compound protocol is currently offloading that cost to the buyers and holders of COMP through dilution.

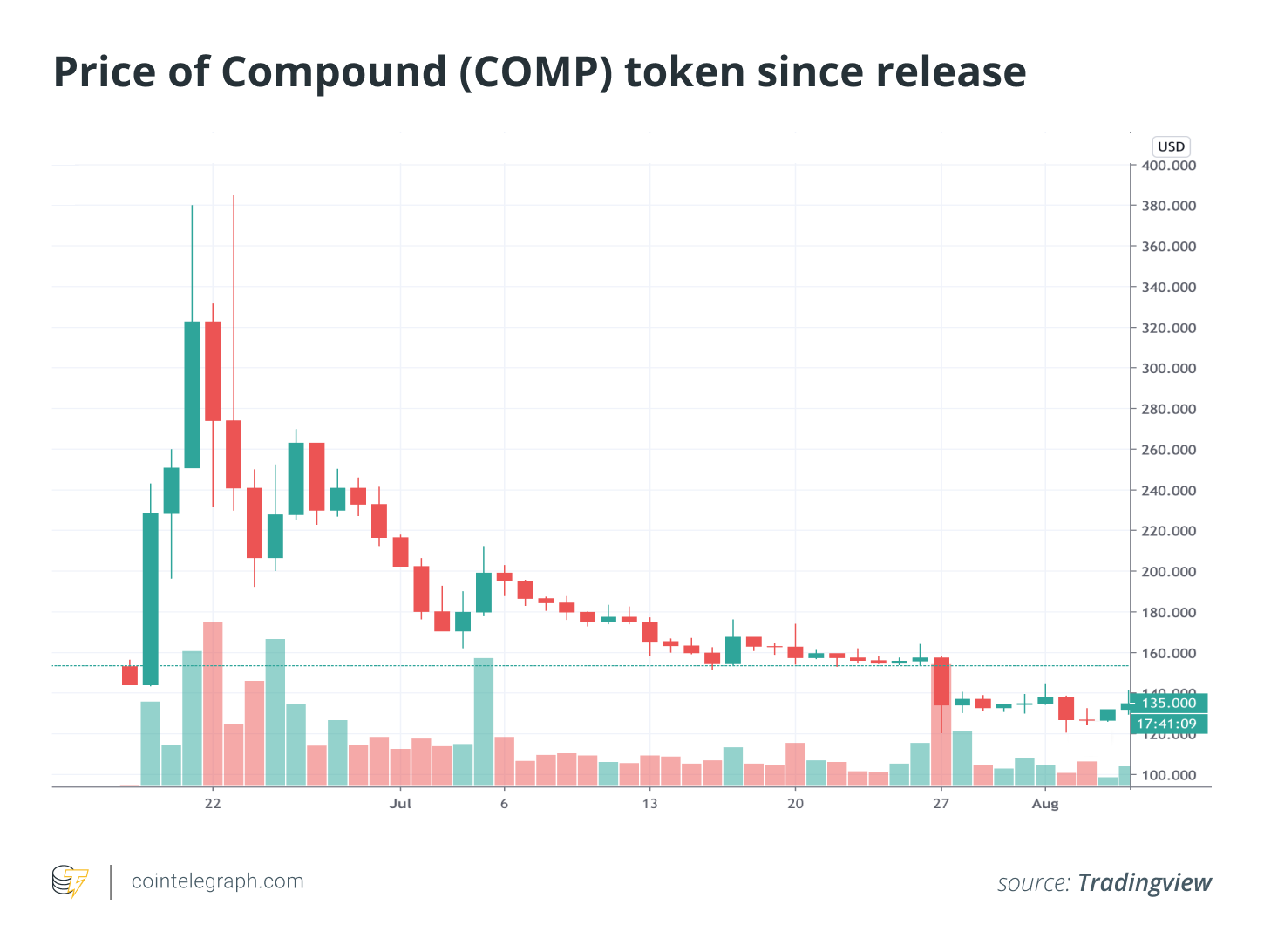

Though it may be difficult to filter out how much liquidity there is only to speculate on COMP yields, this may not be necessary. The purpose of evaluating the bank’s or lending protocol’s revenue is to gauge how much of that value can be captured through the stock or token, but since the token is being used to subsidize the cost of borrowing, the value is being effectively extracted from its holders. This can be seen through COMP’s token price. Since its release, it has continued to fall in value due to the dilution and selling pressure from newly mined tokens.

COMP token price chart. Source: TradingView

Due to this phenomenon, an evaluation strategy for Compound could easily ignore, or even subtract, the part of the book value that is extracting value from token holders. Even in the former case, Compound’s book value would just be $25 million out of a claimed $1 billion — the total sum of the USDT and ZRX being borrowed.

Though obviously not all assets are there just for the yield, Cointelegraph previously reported that only $30 million worth of Dai was being borrowed just before it became the go-to currency for liquidity mining. Andre Cronje, the founder of the yEarn protocol, told Cointelegraph that the market has not been taking these nuances into account: “We have this weird TVL equals evaluation mentality, which I do not understand at all, where if the TVL is $100M, then the market cap — circulating, not fully diluted — should be $100M.” Although he finds it “completely insane” to ignore revenue, he continued his thought exercise:

“So, if circulating market cap equals TVL, what’s the best way to increase that? Increase TVL. How do you increase TVL? Reward with tokens. Token value goes up because of TVL speculation, and repeat the loop.”

Effects on other protocols

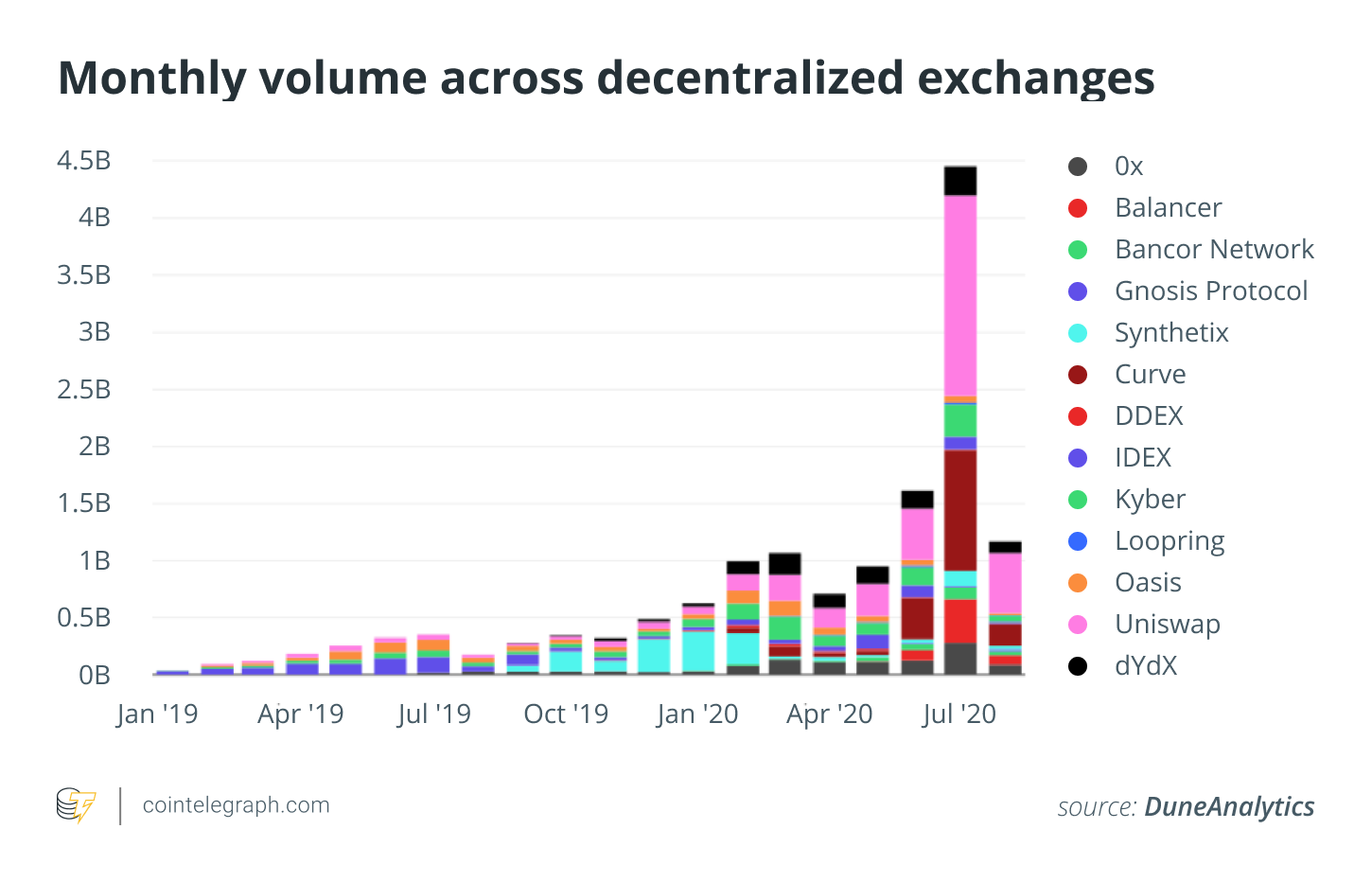

Compound started the yield farming trend, but it was not the only protocol that saw sizable increases in activity. Decentralized exchanges like Uniswap, Balancer and Curve have seen their trading volumes jump dramatically since June. Volume on Curve, a DEX focused on swapping stablecoins with one another, jumped as yield farming began in June.

Monthly volume across decentralized exchanges. Source: DuneAnalytics

Uniswap has a more varied offering, and most of its volume comprises Ether (ETH) to stablecoin pairs, especially Ampleforth — which saw a powerful boom-and-bust cycle occur. It has also taken in a lot of the volume for new tokens like YFI, often being the first place where they were listed.

MakerDAO saw its TVL almost triple from $500 million. The majority of that is due to the Ether price rally, though it grew in terms of ETH and Bitcoin (BTC) as well. As Cointelegraph previously reported, the community decided to increase the total amount of Dai that could be minted in an effort to return its price to $1.

While at face value, the growth of Dai may be considered a success story, the Maker community decided to put interest rates for virtually all liquid assets to zero, foregoing any revenue from the growth. At the same time, Compound has been the primary recipient of new Dai, with locked value having risen from about $140 million to $210 million since late July, over 55% of all Dai.

Is the growth real?

The liquidity mining boom had an undeniably positive impact on some general metrics, specifically the visitor volumes for DeFi platform websites and the number of users interacting with the protocols. Data from SimilarWeb shows that traffic to Compound has quadrupled since June to about 480,000, while for Uniswap it has more than doubled to 1.1 million, and Balancer established a strong presence in two months with 270,000 monthly visits.

Additionally, DeFi exchange aggregator 1inch.exchange almost tripled its traffic in the last two months. Protocols with a weaker relation to yield farming benefited as well, with MakerDAO and Aave posting more modest but still significant growth.

Related: Compound’s COMP Token Takes DeFi by Storm, Now Has to Hold Top Spot

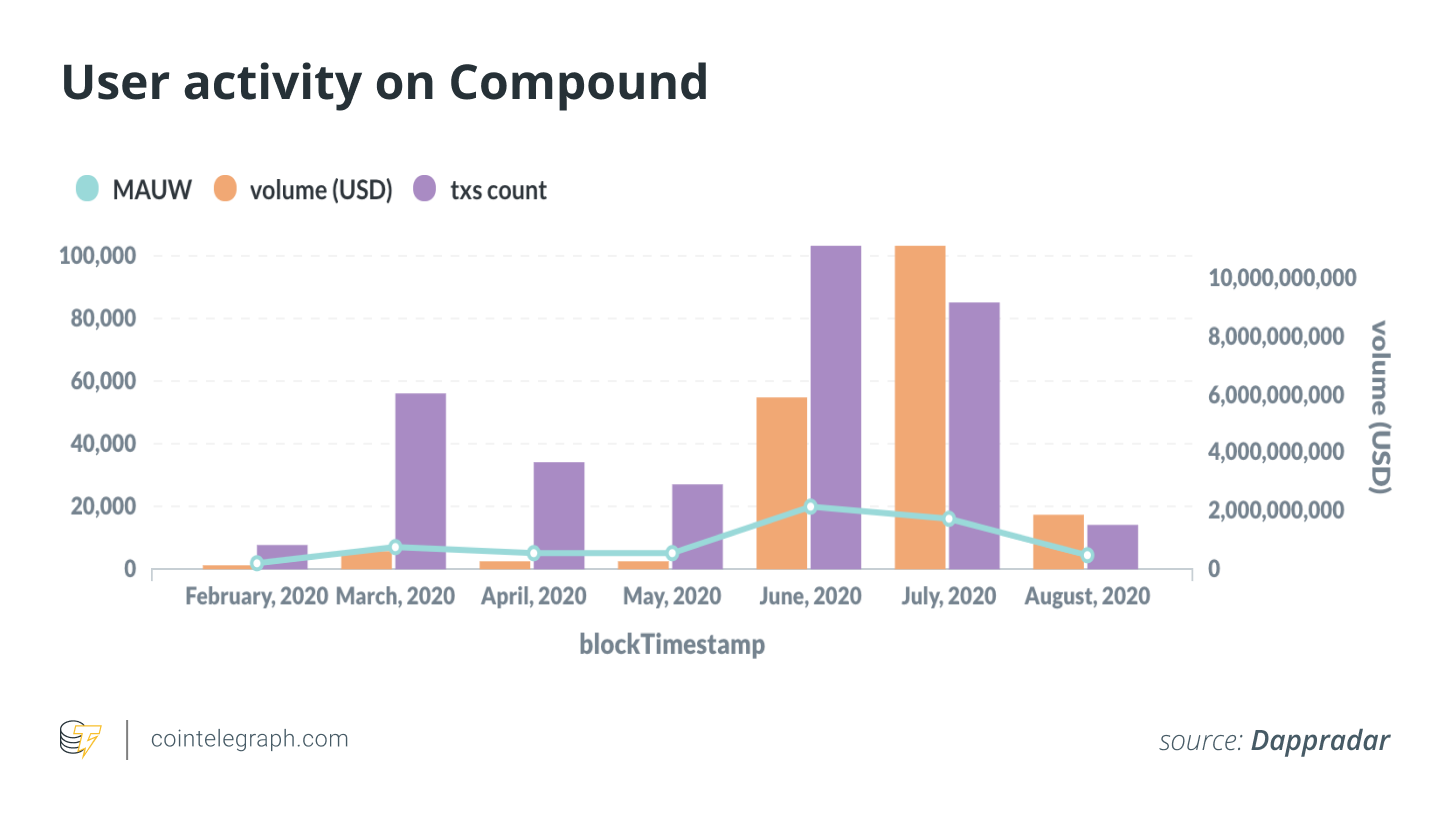

In terms of user volume, Compound saw the number of monthly average unique wallets using it quadruple to 20,000 in June, though that number has since been decreasing. Also worth noting is that more than 80% of recent activity has been from just 30 wallets, according to DappRadar data.

User activity on Compound. Source: DappRadar

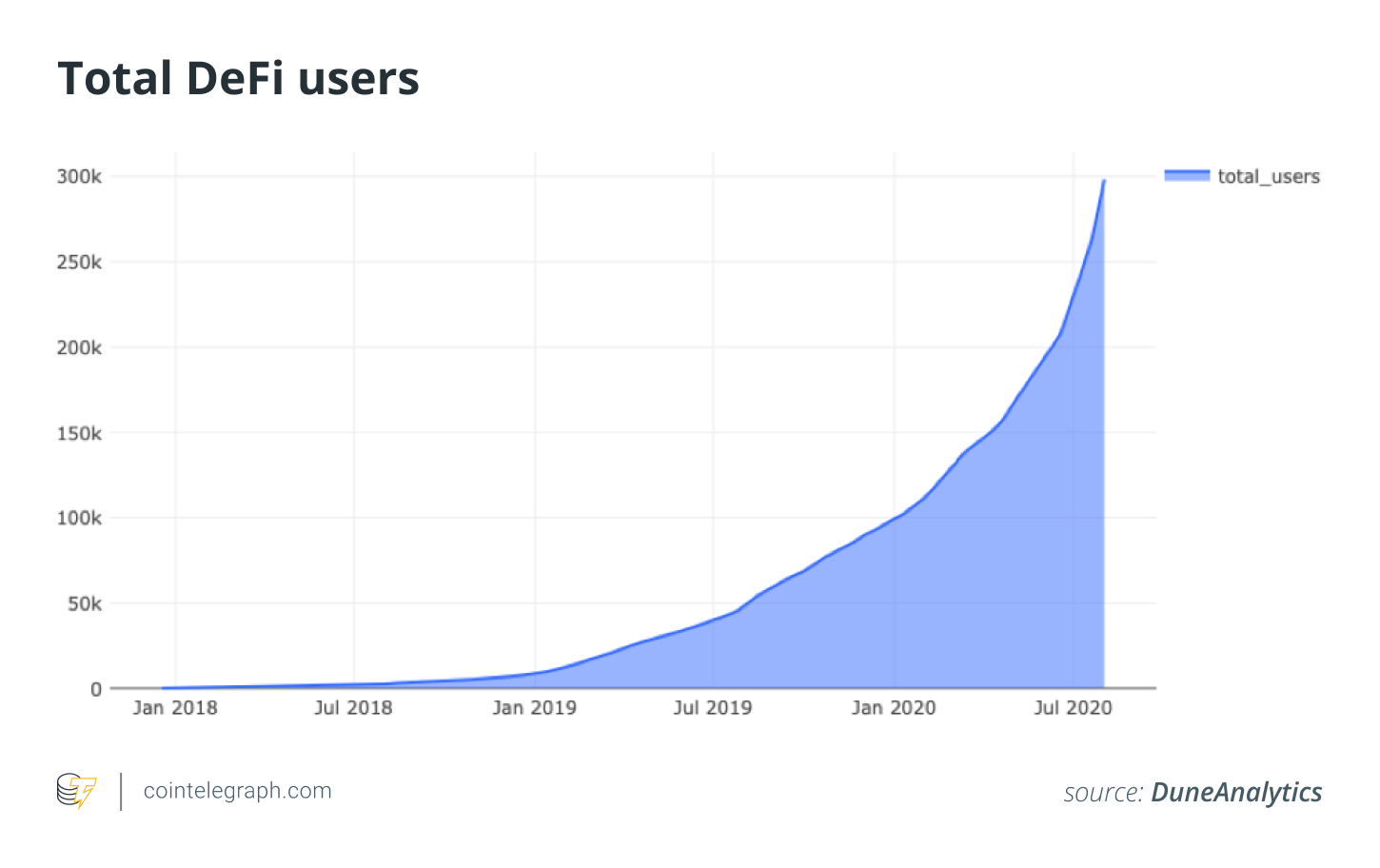

The overall number of DeFi users, according to a DuneAnalytics visualization, increased by about 50% from June 1 to Aug. 1. This is in contrast to the previous two-month period from April 1 to May 31, which saw a 30% growth.

The majority of new users are coming from decentralized exchanges, with Uniswap having doubled its total user base since June to 150,000. However, this metric shows all the users who have interacted with the protocols, not only those who are active at any given moment.

Total DeFi users. Source: DuneAnalytics

What will remain?

In summary, the DeFi growth in the last two months is multi-faceted. While the liquidity mining hype and subsequent price gains have likely contributed to attracting additional attention, fundamental metrics became highly distorted due to the speculation.

Decentralized exchanges appear to have benefited the most from the hype, both in terms of new users and volumes, but that appears to be an acceleration of an already positive trend. Whether the growth will stick remains an important question. Kain Warwick, a co-founder of Synthetix — a crypto-backed asset issuer — told Cointelegraph:

“It’s always possible that people will farm the yield and then find a fresh field, so bootstrapping liquidity is not a guarantee that your protocol will retain users. […] But bootstrapping liquidity with some sort of incentive is a great way to attract newcomers because if you have anything resembling product-market fit, then there is likely to be some stickiness.”

Cronje was somewhat more negative, using a farming analogy to describe what could happen, saying: “All the yield chasers just running in to farm yield and then leaving,” which is a negative thing according to him, acting like a swarm of locusts, adding: “But after they have ruined the crops, sometimes, a stronger crop can grow, and some locusts remain, and they end up being symbiotic instead of the initial parasitic.”

Cronje believes that the initial effects of yield farming are unsustainable, creating a false perception among newcomers that 1,000% yields are the norm. Once that is no longer the case, users will be left with a bad taste in their mouths, he argues: “Right now, it’s overhyped; soon, it will be hated; and what remains after that, I think, will be pretty cool.”

Distributing tokens in a new way

Warwick described the purpose of liquidity mining as incentivizing early participation with partial ownership. Cronje was much more skeptical, saying: “All liquidity mining currently is, is getting paid for propped up TVL.” Still, he ran a liquidity mining program himself, though he stressed that it was just a way of distributing tokens.

“My goal was to get an active and engaged community. And I think yEarn managed to accomplish that,” Cronje concluded. By contrast, yEarn forks like YFFI and YFII were “pure liquidity mines, and all that happened was people sold,” he said. The price of YFII has collapsed by 90% since its high on July 30.

Warwick noted that “there possibly is a better way to distribute ownership while bootstrapping growth,” though he does not know how. He still finds it preferable to initial coin offerings, as users only need to temporarily commit their liquidity: “They’re obviously taking on some platform risk, but it’s preferable still to losing their capital by using it to buy tokens.” But while the risks for the liquidity miners may be low, the example of YFII clearly shows that the effects of dilution and speculative demand can turn catastrophic for the buyers of these tokens.