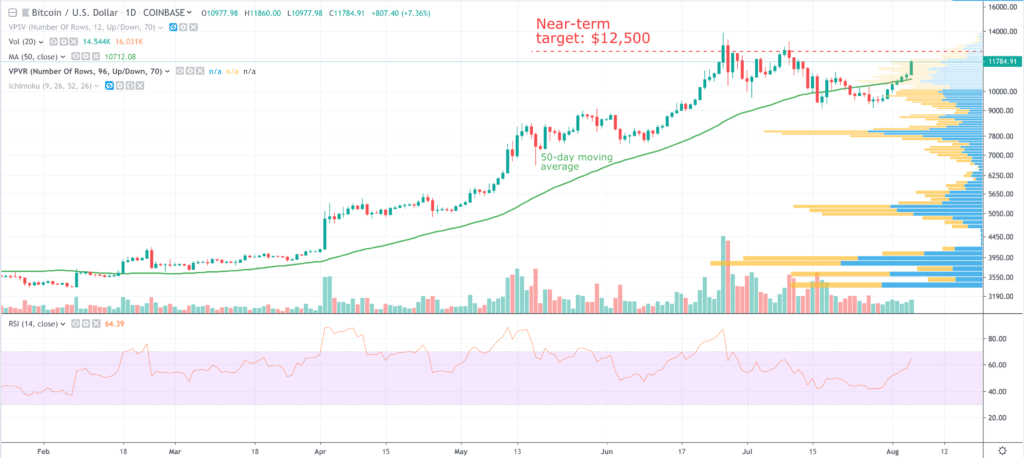

Bitcoin (BTC) is currently trading up 8% at $11,787 on Coinbase on the back of a yuan devaluation that dramatically escalates the US-China trade war.

It is difficult not to ponder that a nightmare scenario for

stocks might be opening up.

A background of spreading trade protectionism and slowing

global growth, capped off with a zero-sum currency war, is the last thing a

frothy equity markets needed.

And this all comes as the US Federal Reserve’s 0.25% interest

rate cut was greeted poorly by the cheap money-addicted stock market, even as

interest rate cuts around the world are shown to have weakening effect.

$7-plus yuan triggers stock meltdown, gold, bonds and bitcoin rally

Gold and bonds are benefiting and so too is bitcoin, as we

predicted in

our previous report looking at Trump, China and the trade war.

Our suggestion to closely watch the yuan v US dollar

exchange rate for a move above $7 as a trigger for bitcoin buying has been

borne out.

The equity markets’ suffering in response to the devaluation of the yuan could worsen over the coming days. Bitcoin’s price rise as equities fall is an example of the much-vaunted negative correlation between the two asset classes, seen as one of the digital currency’s attractions.

As all economic historians know, a trade war is characterised

by its tit-for-tat nature.

China has just bitten back against the US in a big way.

By allowing its currency to slip to the lowest level in 11

years against the dollar, the Chinese policymakers at a stroke have helped the

country’s exporters to weather the tariff storm.

Much depends on how will the US respond. The obvious reflex

is to increase tariffs further. But it could also designate China to be a “currency

manipulator” which brings with it a whole world of pain for China.

Here’s the latest from US president Donald Trump:

One way to achieve this goal would be to weaken the dollar

by reducing interest rates, but that’s what the Fed has just done and it hasn’t

stopped the dollar strengthening.

The dollar is a safe haven asset and despite the financial

firepower of the US, trying to turn back the flight to safety homing in on

Uncle Sam is a thankless task.

Hong Kong in eye of the storm – bitcoin a major player

From the Chinese side of the bargain yuan devaluation means

capital loss. Capital preservation through diversification away from the yuan

is the order of the day for Chinese investors. In that light, bitcoin comes

into play as a store of value, hedge against the devaluating currency, general

economic uncertainty and geopolitical strife.

Simon Peters, an analyst at global investment platform eToro,

makes similar points regarding the yuan: “The yuan has fallen against the

dollar to levels not seen since the 2008 financial crisis, and Chinese

investors are casting around for alternative assets for their wealth.”

He continued by email: “Gold, the traditional haven asset,

has been a beneficiary of some of this investor uncertainty. Yet Bitcoin also

seems to have served a similar purpose. Given that Chinese investors make up a

large proportion of crypto investors, there’s a strong possibility some are

backing Bitcoin’s chances against the yuan.”

Readers should also be aware that the crisis in Hong Kong is

not being adequately priced in by both the crypto and equity markets. Hong Kong

is where the Chinese rich park lots of dough and the implosion of China’s premiere

artery to the dollar world will driver more investors to consider holding some

bitcoin.

Bitcoin (BTC) block halving support

Possible market meltdowns and geopolitical uncertainties

aside, bitcoin block rewards are halving in May next year and that will support

prices as scarcity collides with rising FOMO.

The road to a return to the year’s high at $13,800 is open.

“If demand for

Bitcoin soars just as supply falls due to a halving in the block reward, we

could see prices increase significantly in the long term. In the short term,

the next major resistance level we’re keeping an eye on is $14,000 – if we see

Bitcoin break through that level, the cryptoasset will be at prices last seen

in the market highs of January 2018,” wrote Peters.

The $12,500 close on 5 July provides the near-term target at

the time of writing.

Bitcoin is currently trading healthily above its 50-day moving average.