Bitmain, the largest manufacturer of mining equipment, recently revealed the Antminer Z11 device for mining Zcash and other cryptocurrencies based on the Equihash algorithm, as reported by Cointelegraph on March 19. The company claims that the new chip is three times more powerful than its predecessor, the Antminer Z9, which was released nine months ago.

Introducing the #AntminerZ11 that packs 3X more hashing power than its predecessor! The Z11 mines #Zcash under the Equihash algorithm. Performing with a hash rate of 135 KSol/s and power consumption of 1418 W. Click here (https://t.co/woThhXNxjd) to learn more. pic.twitter.com/HzCLKR7dVc

— Antminer_main (@Antminer_main) March 19, 2019

Despite the fact that the Zcash team declined to comment on this news, the release of the Z11 produced mixed reactions among community members. Some of them believe that this is a new threat to network security, while others see the release as a potential for the growth of the coin’s price.

ASIC resistance campaign

In 2017, after Bitmain’s dominance of the ASIC market reached a peak with the release of Bitcoin (BTC) mining equipment, the Chinese giant set about developing specialized chips for mining other coins with large market capitalizations, such as Ethereum (ETH), SiaCoin (SIA), Monero (XMR) and Zcash (ZEC).

High-performance miners allowed their operators to quickly gain a significant amount of coins, while the owners of such farms could also launch 51 percent attacks that allow one to usurp control of the network and manipulate transactions.

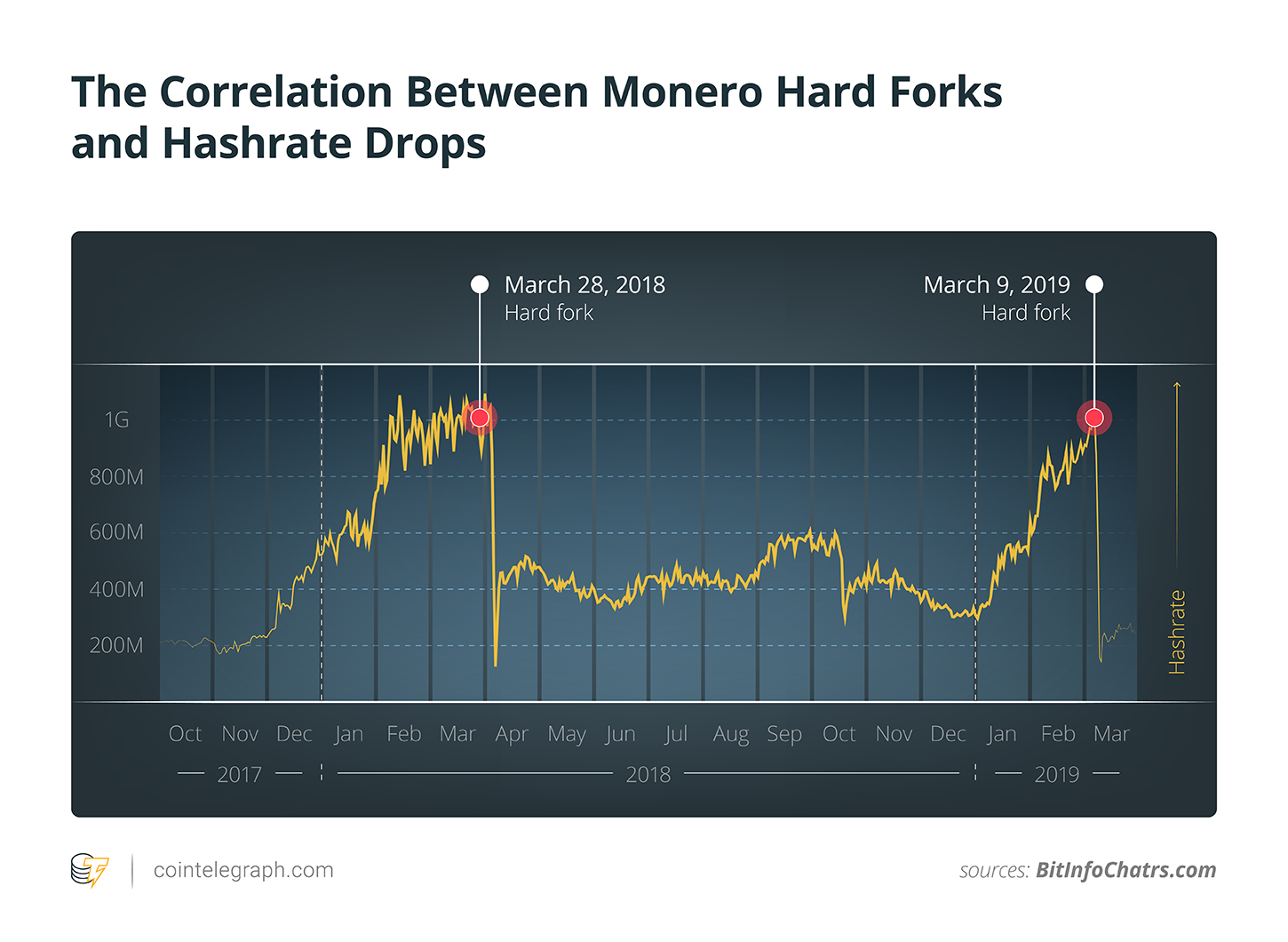

Some developers decided to go along the path of changing their algorithms in order to make the network ASIC-resistant. Take, for example, Monero, which hard forked their network on April 6, 2018, after Bitmain announced the release of Antminer X3. The same path was chosen by Bitcoin Gold (BTG), which forked its network on July 3 after the Antminer Z9 was released.

After a lengthy debate, the Ethereum team made partial modifications to the network on the way to its transition from proof-of-work (PoW) to programmatic proof-of-work (ProgPoW). The hard fork was implemented on Feb. 28 this year.

Other projects abandoned the idea of ASIC resistance, and among them was Zcash. On May 3, 2018, Bitmain announced the release of the Z9 mini model for mining Zcash and other coins based on the Equihash algorithm.

Zooko Wilcox, co-founder and CEO of the company, took a neutral position on the issue of ASIC resistance, saying that no changes to the network were planned.

Later, a survey was conducted among members of the Zcash community, and the results showed that the majority of respondents voted against prioritizing ASIC resistance policy.

Meet Z11

Typically, Bitmain announces its new models shortly before the start of sales, and this is exactly what they did with the Antminer Z11. On March 19, Bitmain announced the release of a new model for mining Equihash-powered coins, and the firm explained that the chip would be three times more powerful than the previous generation Z9 device.

This time, Bitmain decided not to limit itself to the technical description of the product and made a special announcement paying specific attention to the Zcash community. The company promised to provide real-time updates on the volumes of supplies and its own equipment stocks, as well as to fight “hidden” mining:

“To preserve the Zcash community’s values around security, reliability and accessibility, Bitmain had previously Tweeted real-time updates to ensure more transparency and will continue to provide shipping updates of the first batch of the Antminer Z11. These commitments to transparency will continue to provide the Zcash foundation and community with the security, reliability and accessibility they desire of manufacturers.”

According to the manufacturer, the computing power of Antminer Z11 is 135 kilo solutions (135,000) per second (KSol/s). At the same time, energy efficiency of the device reaches 10.50 joules per kilo solutions J/KSol. The miner is based on a 12-nanometer chip developed using Bare Die casting technology for the best heat dissipation. This allows for a decrease in the cost of electricity by 60 percent in comparison with the Antminer Z9.

Sold out in 20 minutes

According to the manufacturer, the first batch of new miners was sold out just 20 minutes after the presale started, and some users believe this could be an orchestrated strategy designed to increase the price.

It is noteworthy that, even after the tag “Sold Out” appeared, the price continued to increase. On the official forum, Zcash moderators raised an entire discussion to find out who managed to buy new ASICs and for how much. Users replied with numbers ranging from $1,048 to $1,366, and at the moment, Bitmain’s website has the Antminer Z11 listed for $1,384.

Buyers will receive their first devices between April 20 and 30, as stated on Bitmain’s site. Despite the fact that the main sales are oriented to those who want to mine Zcash — the most liquid coin using the Equihash algorithm — it will be possible to use the Antminer Z11 to get other assets working on the same principle. According to WhatToMine, miners will be able to switch powers for mining coins such as Komodo (KMD), Zcash Classic (ZCL) or Horizen (ZEN), although the solution will not be as profitable.

Community’s reaction

While some users are calculating the return generated by the new model and rejoicing at the coin’s price growth, others are still concerned about the “fact” that the first batch sold out so quickly. Some suggest that this could be a specific group of people — or even a country — in whose hands the network’s hash rate could now be concentrated. In general, in the community, as well as in the Zcash headquarters, few seem to be concerned about the potential threat from Bitmain.

However, there are those who are worried about the possibility of centralization, and users are perplexed by the fact that, from their point of view, developers have been inactive.

“why do devs keep on with asics? earlier it was a disaster. what have changed? why noone doing nothing, while zcash being destroyed?”

Some users suggested a variety of solutions, including switching to proof-of-stake (PoS) and incorporating new modifications.

“Maybe devs should include a new attack vector, (mass) infected Asics …”

There are also users who refer to the recent hard fork Monero implemented on March 9 as part of the roadmap for preventing manipulations associated with ASIC miners.

This is the second time the Monero developers forked the network to fight new Antminers by Bitmain. The first fork was held on April 6, 2018 after the release of Antminer A3. At the same time, in both cases, immediately after the network upgrade, the network’s hash rate fell by 80 percent.

Despite the lack of drastic action on the part of Zcash developers, the team began to explore the potential and possible danger of new ASIC devices immediately after the release of Antminer Z9.

On May 8, 2018, Zcash CEO Josh Cincinnati announced a plan for prioritizing ASIC resistance, and he indicated that the team considered the implementation of these measures as one of the methods in combating ASIC hardware. One of the factors complicating such work, as stated by Cincinnati, was Wilcox’s ambivalence to ASIC resistance. To decide which side to take on the issue of ASIC devices, users were offered a vote. The results showed that community members put other areas of the company’s development above the fight against ASICs.

However, Zcash creators announced the beginning of a study to examine the possibilities of new miners, as well as the development of a strategy to combat them.

Among the measures discussed were independent, consensus-compatible implementation of full-node software, and hiring developers to work on Zcash Improvement Proposals (ZIPs) in order to minimize the impact of such devices on the network.

Another ASIC resistance strategy appeared in the course of the annual grant program for Zcash developers. As a result, founders selected projects that offered a modification of the current Equihash algorithm or a transition to more ASIC-stable ProgPoW. In particular, one of the teams began to work on the transition to a more ASIC-resistant, but GPU-friendly ProgPoW algorithm.

How soon the results of such work will appear is so far unknown.

Positive changes

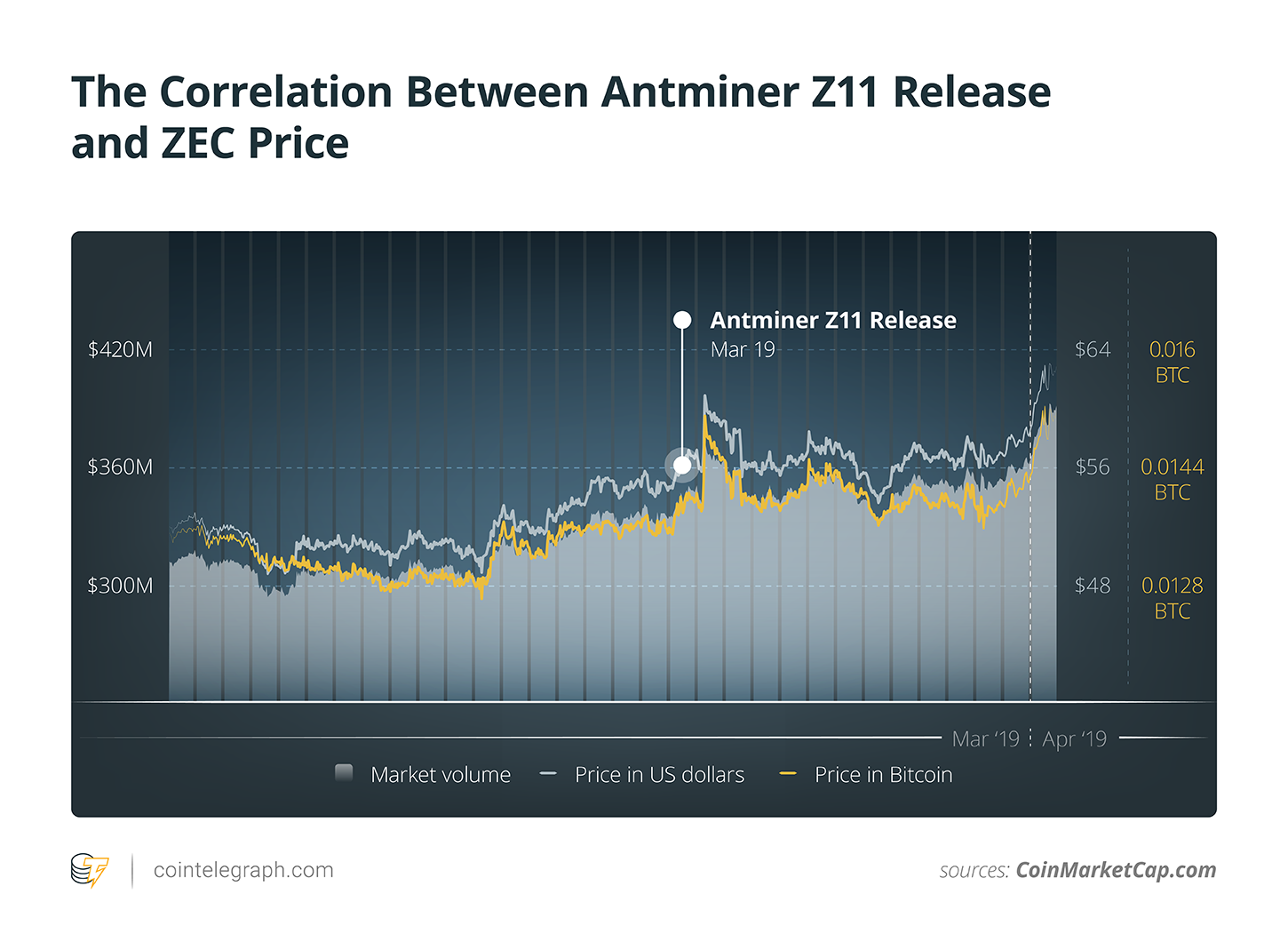

After the announcement of the Antminer Z11’s release, ZEC’s price surged from $49.03 by 5 percent in 24 hours and by 20 percent in 11 days.

In addition, over the past two weeks, the coin has appeared on new exchanges, and Binance has added new currencies paired with ZEC.

Some of the users suggested that the coin owes its popularity to Bitmain and its high-performance ASICs.

The Zcash hashrate support is largely due to its ASIC is the most profitability miners among all. The strong support of hashrate for $DASH might be also related to this (before is ranking of mining profitability)

Another point supports why ASIC is a better security model for PoW pic.twitter.com/Hg9JKHr2o9

— Dovey Wan 🦖 (@DoveyWan) March 24, 2019

In addition, launching a 51 percent attack on the Zcash network, which in January would have cost $12,000, now costs a potential attacker $28,920.

Progress does not stand still

Earlier, Equihash was considered one of the most robust algorithms for ASIC miners. However, the release of the Antminer Z9 and Z11 are proof that blockchain is not an obstacle to the development of such devices.

According to Ethereum developer David Vorik, the implementation of ProgPoW can contribute to the distinct advantage for particular major manufacturers of mining equipment, as the need for more complex devices will exacerbate the effect of scale. At the same time, a tough fight against ASIC devices may force producers to carry out hidden manufacturing, which can lead to an even greater concentration of power in one hand.

Another Ethereum developer, Alexey Akhunov, said in a reply message:

“If we want to obsolete the current EtHash mining devices, but at the same time not to induce more secretive behaviour on the part of ASIC manufacturers, we need to ‘embrace’ it and switch to an ASIC-friendly algorithm now instead of an ASIC-unfriendly algorithm. Which [is] the opposite of what we are doing.”

He added that the best method forward might be a diplomatic strategy and transparent dialogue for dealing with manufacturers of ASIC equipment.

It would actually be great to establish a transparent dialog of developers with an ASIC manufacturer like Linzhi. Ethereum Core devs lack this kind of expertise, and more open info about ASIC capabilities would help a lot! https://t.co/mDdAK5T7Iq

— Alexey Akhunov (@realLedgerwatch) January 8, 2019