On Dec. 15, Genius Yield, a decentralized automated market maker and liquidity management protocol built on the Cardano (ADA) blockchain, announced the launch of its initial stake pool offering, or ISPO. The fundraising will continue for six months until June 15, 2022. At the time of publication, more than 95.8 million ADA, worth approximately $118 million at the time of writing, have been delegated to the stake pools. In an ISPO, blockchain enthusiasts stake their cryptos in a protocol and receive tokens of the new project they fund as rewards.…

Day: December 17, 2021

Financial Stability Group Warns of Stablecoin, DeFi Risks in Annual Report

“The reserves of these stablecoins, however, may not be subject to rigorous audits and the quality and quantity of collateral may not, in some cases, correspond to the issuer’s claims. Likewise, stablecoins that maintain their value through algorithmic mechanisms are potentially subject to failure due to market pressures, operational failures, and other risks,” the report said. Source

How NFTs Put Generative Artists on the Map

“Did I make over a million dollars this year? Yes I did.” Joshua Davis is among hundreds, maybe thousands, of creators who have made life-changing amounts of money from the non-fungible token (NFT) boom. But he didn’t make his mil selling profile jpegs of zombie gophers wearing polo shirts. This feature is part of CoinDesk’s Culture Week. Davis founded Praystation.com in 1995 to display his art, part of a new wave of creativity then being unleashed by home computers and the World Wide Web. His works, at first composed largely…

SEC Delays Decision on Grayscale and Bitwise Spot Bitcoin ETFs

The Securities and Exchange Commission (SEC) is pushing out its review of proposals by Grayscale and Bitwise for their spot bitcoin ETFs by 45 days, according to filings around both products. Grayscale is owned by Digital Currency Group, which is the parent company of CoinDesk. Source

Supply Chain Problems? Bitcoin Don’t Care

Every 2,016 blocks, the Bitcoin protocol alters the algorithm’s difficulty, adjusting it up or down depending on how long it took, on average, for the network to find the previous 2016 blocks. If the hashrate has fallen, difficulty declines, which speeds up block creation. That brings it back to the average 10 minutes per block that the system is designed to sustain over time and ends the squeeze on fees. The opposite occurs when the hashrate has risen. Original

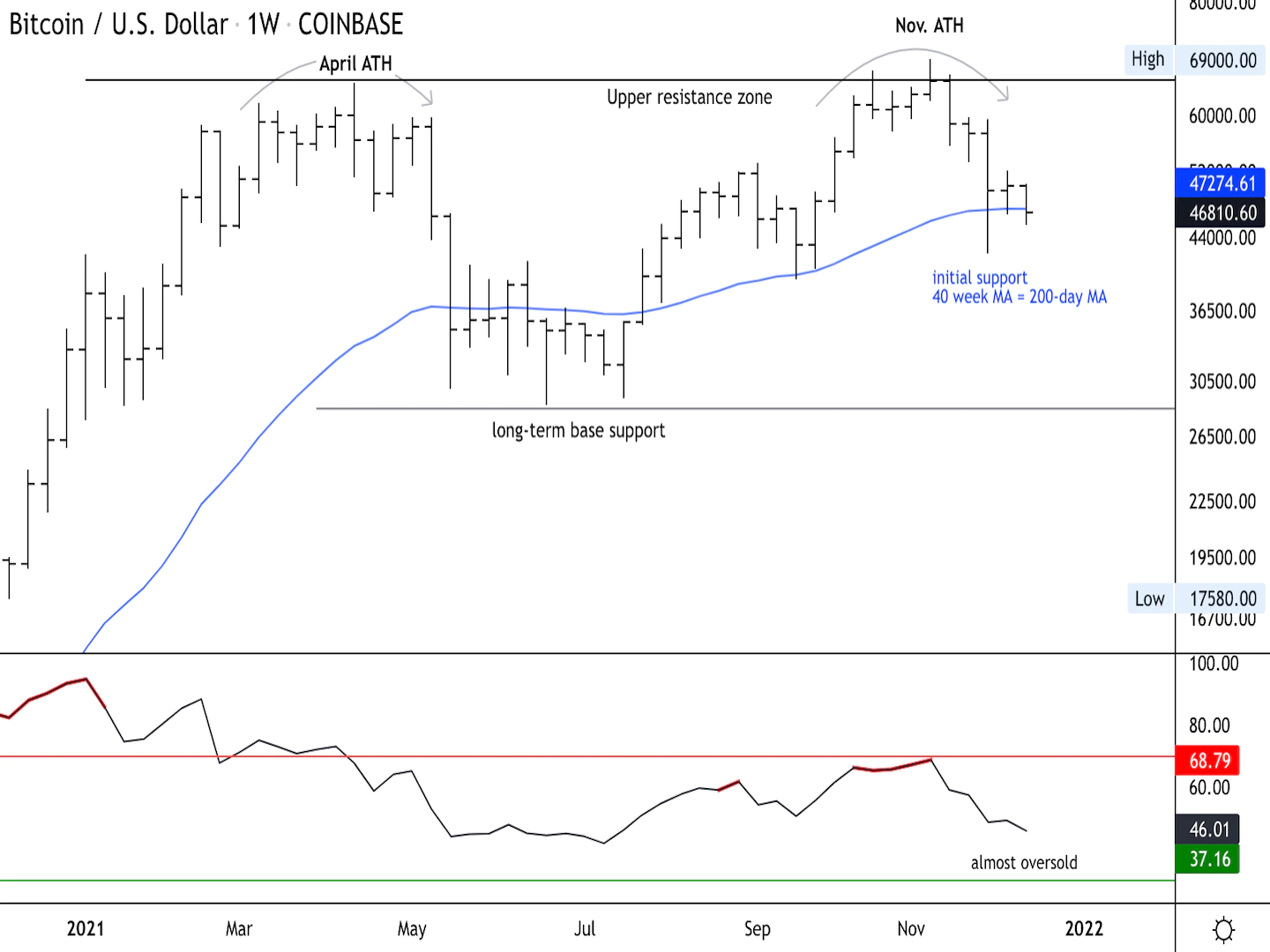

Bitcoin Limited to $50K-$55K Resistance as Momentum Slows

Bitcoin (BTC) sellers remain active despite signs of short-term support on the charts. The cryptocurrency was trading around its 200-day moving average, currently at $46,000, and is roughly flat over the past week. Upside appears to be limited given strong resistance between $50,000-$55,000. On the daily chart, bitcoin registered a downside exhaustion signal, which suggests a short-term price bounce is likely. The relative strength index (RSI) is also oversold, which typically preceded price rises similar to what occurred in late September. Still, the…

What Is Flickto ISPO And Why You Should Stake Your ADA To FLICK

Flickto is the decentralized launchpad that is bringing media financing to the Cardano blockchain. This first-of-its-kind project is giving users the ability to fund media projects while making massive returns in the process. Less than two months in, Flickto has recorded tremendous success with over 4.5 million ADA already staked in its ISPO across over 530 delegators. The project brings the average person closer to the financing process of media projects and puts the power in their hands for which projects get funded. So instead of a few people calling…

Bitcoin Hints Bullish, But Why It’s Far From Fresh Rally

Bitcoin continues with its crab-like price action as it moves around $45,000, and $50,000. As of press time, BTC’s price trades at $46,854 with 4.2% losses in the last day. Related Reading | TA: Bitcoin Fails Again, Can Bulls Save The Day? BTC is on a downtrend in the 4-hour chart. Source: BTCUSD Tradingview Operators seem to expect more profits in the short term as Bitcoin has historically seen gains at the end of every year. However, BTC’s price could remain rangebound for at least early 2022. After December 3rd…

83% of 7-figure Millennials own crypto, Sen. Warren criticizes DeFi, Dec. 10–17

Welcome to the latest edition of Cointelegraph’s decentralized finance newsletter. As the market attempted to recover from last week’s pummeling, decentralized finance (DeFi) was once again the topic of discussion in high-profile U.S. governmental offices. Read on to learn more about this news and much more from the world of decentralized finance. What you’re about to read is the smaller version of this newsletter designed for brevity. For the full version of DeFi’s developments over the last week, drop your email below. Senator Warren warns about supposed DeFi dangers Senator Elizabeth Warren…

3 reasons why Solana (SOL) price could see additional upside in 2022

Solana (SOL) has become a top contender in the smart contract industry and in the past year the network’s total value locked (TVL) grew by $660 million and stretches across more than 40 decentralized applications to hit an all-time high above $11 billion. Even with this growth, investors have reason to question whether the current $56 billion market capitalization is justified and how it compares to competing networks like binance smart chain (BNB), Avalanche (AVAX) and Polygon (MATIC). Avalanche, Solana, Binance Coin, and Polygon, priced in USD. Source: TradingView By…