Good morning. Here’s what’s happening this morning: Market moves: Bitcoin, ether traded steady over the weekend, while luna surged to near a record high. Technician’s take: Short-term BTC buying could be limited given negative momentum on the weekly chart. Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis. Prices Bitcoin (BTC): $46,888 -0.1% Ether (ETH): $3,938 -0.7% Markets S&P 500: $4,620 -1% DJIA: $35,365 -1.4% Nasdaq: $15,169 -0.07% Gold: $1,798 -0.03% Market Moves The crypto market was largely quiet over the weekend after…

Day: December 19, 2021

BIS Exec Says Defi Is a ‘Wake-up Call’ for Regulators, Global Crypto Policy Expected in 2022 – Regulation Bitcoin News

A Bank of International Settlements (BIS) executive, Benoît Cœuré, says that crypto is “growing very fast” and ”becoming mainstream in different ways.” Emphasizing that decentralized finance (defi) is a “wake-up call” for financial regulators, he said countries “are likely to agree on a global framework for crypto next year.” BIS Officer Sees Defi as a Wake-up Call for Regulators, Global Policy Expected Next Year Benoît Cœuré, a member of the BIS Executive Committee who is currently head of the BIS Innovation Hub, talked about cryptocurrency, global regulation, and decentralized finance (defi)…

Bank of Russia Has Tools to Restrict Crypto Investments, Governor Hints – Regulation Bitcoin News

The Central Bank of Russia has reaffirmed its opposition to cryptocurrency investments citing the volatility of the digital assets as a key motive for its conservative stance. Governor Elvira Nabiullina has recently indicated that the regulator has the means to restrict them. Nabiullina Insists Bank of Russia Can Limit Investments in Crypto Assets Russia’s monetary authority does not welcome investments of Russian citizens in cryptocurrencies, the head of the Central Bank of Russia (CBR), Elvira Nabiullina, said during an online press conference this week. She highlighted their volatility and potential…

Carbon-neutral Bitcoin? New approach aims to help investors offset BTC carbon emissions

Billion-dollar companies across the globe are betting big on Bitcoin (BTC). Recent analysis from European investment manager Nickel Digital Asset Management found that 20 publically listed companies with a market capitalization of over $1 trillion have about $9.6 billion invested in BTC. Individual investors are also taking an increasing interest in the asset. The “Third Annual Bitcoin Investor Study” from Grayscale Research found that demand for Bitcoin has risen tremendously. According to the study, 55% of current Bitcoin investors began buying the asset over just the last 12 months. Grayscale’s…

Celebrities that rode the crypto wave in 2021

Overshadowing its glory in previous years, the crypto ecosystem managed to maintain a year-long spotlight throughout 2021. Key catalysts include mainstream adoption of Bitcoin (BTC), a meme coin frenzy driven by Shiba Inu (SHIB) and Dogecoin (DOGE), and proactive participation from popular celebrities and authority figures. The year 2021 witnessed a greater inflow of influencers and celebrities to the space than ever before. All the way from mainstream tech entrepreneurs and presidents to rappers and reality TV stars, celebrities have gotten involved in crypto in their own unique ways. While…

DOGE and SHIB Led the Pack of Meme-Based Assets in 2021, Both Tokens Dominate 85% of the Meme-Coin Economy – Markets and Prices Bitcoin News

The end of 2021 is approaching and the market capitalization of meme-based digital currencies like dogecoin and shiba inu has been extremely prominent this year. In fact, the $46.9 billion worth of meme crypto-assets represents 2% of the $2.32 trillion crypto economy. Dogecoin and shiba inu alone capture roughly 85.28% of the meme crypto market valuation today. Meme-Based Crypto Economy Taps $46 Billion in 2021 It’s been a good year for meme-based crypto assets like dogecoin (DOGE), the OG of meme-based assets, which has seen its market valuation swell by…

The Jokes Wear Thin as Inflation Becomes Normal

This episode is sponsored by Nexo.io, KuCoin and DeFiHorse. Join hosts Adam B. Levine, Stephanie Murphy, Jonathan Mohan and Andreas M. Antonopoulos for a wide-ranging conversation about the current realities of inflation. They discuss the challenge inflation presents to policymakers, the growing likelihood of major disruption and what you can do to prepare. Credits Today’s show featured Andreas M. Antonopoulos, Jonathan Mohan, Stephanie Murphy and Adam B. Levine, with editing by Jonas. Music for this episode was provided by Jared Rubens and Gurtybeats.com. Our episode art is…

Inside the blockchain developer’s mind: Proof-of-burn blockchain consensus

Cointelegraph is following the development of an entirely new blockchain from inception to mainnet and beyond through its series, Inside the Blockchain Developer’s Mind. In previous parts, Andrew Levine of Koinos Group discussed some of the challenges the team has faced since identifying the key issues they intend to solve, and outlined three of the “crises” that are holding back blockchain adoption: upgradeability, scalability and governance. This series is focused on the consensus algorithm: Part one is about proof-of-work, part two is about proof-of-stake and part three is about proof-of-burn. …

As Interest in Decentralized Finance Peaks, This Project May Have the Full DeFi 2.0 Package

With native cross-chain trading and very attractive Bitcoin APYs, Thorwallet offers a user-friendly UI with all the trimmings this Christmas As we near the end of a spectacularly explosive year for the growth of DeFi and blockchain technology in general, both interest and investment in the industry are at an all time high. Institutions continue to explore the likes of Bitcoin and Ethereum as major investment assets, but decentralized finance solutions have also becoming major forces to be reckoned with; offering financial inclusion to millions of unbanked people around the…

How to Be a Crypto ‘SAMURAI’

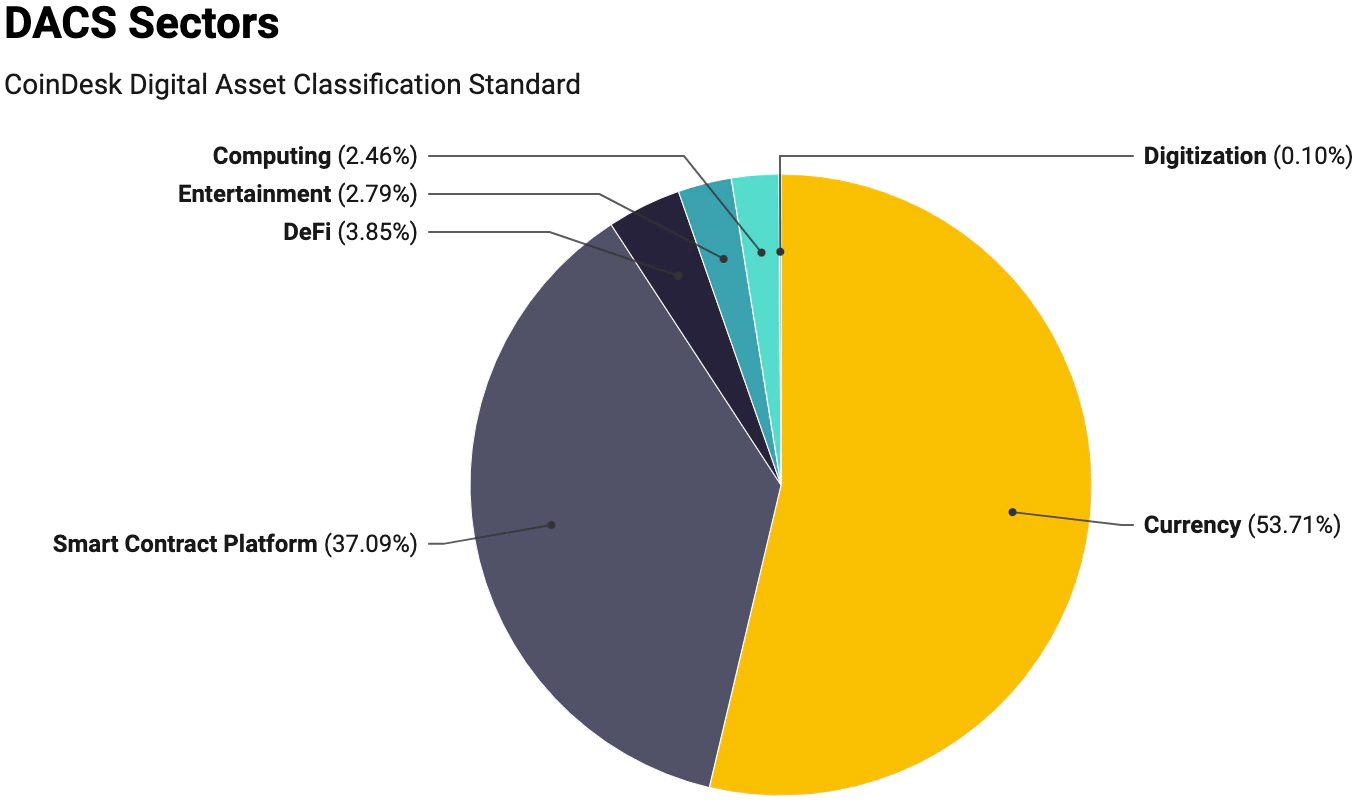

Contrary to Hollywood portrayals, it’s not all “models and bottles” for portfolio managers, unless those bottles solely contain aspirin and the models they are chasing can be found in a spreadsheet. At the end of the day (or, more likely, quarter), portfolio managers must show they can add value or else clients will find someone who can or even just buy an index fund. Those same institutions that measured themselves against such benchmarks are now turning to bitcoin. Along with it comes interest in alternative cryptocurrencies (altcoins). Five years ago,…