LSP0, which turns ERC-725 into a smart-contract-based profile, tackles the functionality and makes profiles more user-friendly on the blockchain. It combines a crypto type wallet, similar to an Ethereum account, with smart contract storage. In addition to having a regular crypto account attached to these profiles, users can link to any public information they want, like their Twitter account or NFTs. Source

Day: April 5, 2023

Crypto-Focused Menai Financial Group Shuttering Market-Making Business in London and Tokyo

The firm said that it continues to invest in and expand its asset-management business and that it remained a strong believer in the “disruptive promise of blockchain technology, especially as it relates to the tokenization of financial and real-world assets. Source

Crypto firms need to be ‘supervisable,’ says ECB board member

Elizabeth McCaul, a supervisory board member of the European Central Bank (ECB), has called for additional oversight of crypto firms operating in a borderless state outside typical attempts at supervision. In an April 5 blog post, McCaul said there was currently no adequate regulatory or supervisory framework for crypto firms but that the collapse of the FTX exchange helped shed light on the problem. She called on policymakers to address potential gaps in existing frameworks that could lead to bank failures, citing the collapses of Silicon Valley Bank and Signature…

MicroStrategy Bets Bigger On Bitcoin With $29 Million BTC Scoop

Summary: MicroStrategy added to its Bitcoin coffers with a $29.3 million BTC purchase, per SEC filing from April 4. The business intelligence firm accumulated 1,045 at an average price of $28,016 per BTC since March 24. Michael Saylor’s firm is the single largest corporate BTC holder with 140,000 tokens, around 0.66% of Bitcoin’s total supply of 21 million coins. Business software firm MicroStrategy accumulated more Bitcoin since March, spending tens of millions of dollars to stack satoshis as crypto’s top coin eyes $30,000. A filing with the U.S. Securities and…

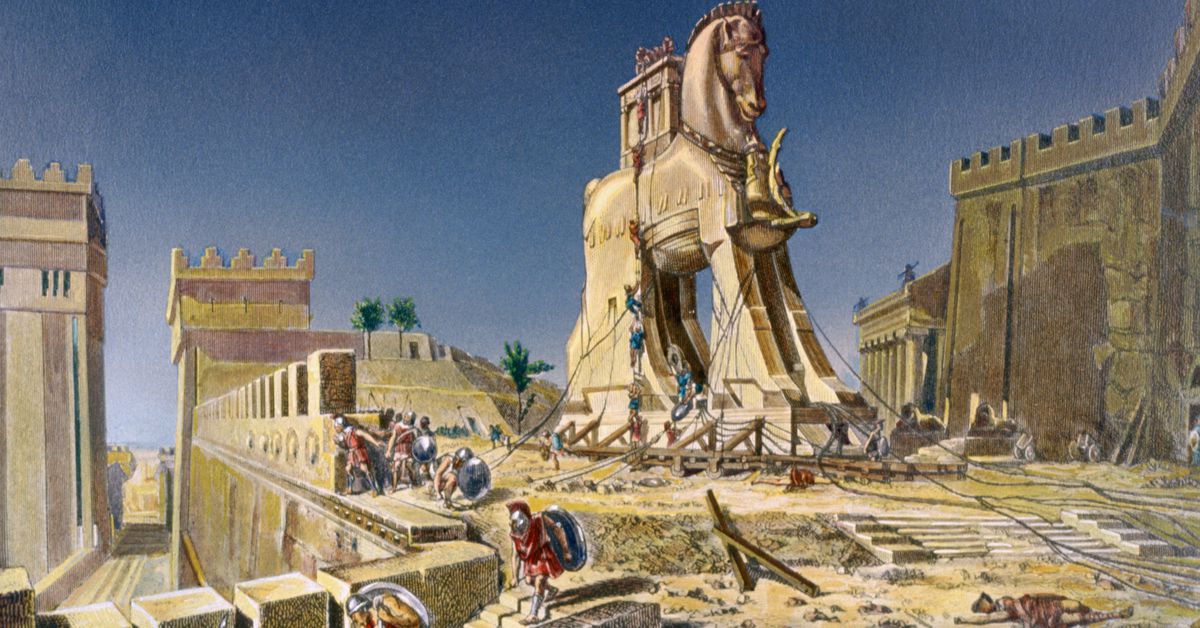

CBDCs Will Be a ‘Trojan Horse’ for Blockchain Adoption

That, however, could hinge on whether the use of CBDCs globally becomes a reality. By 2030, according to the Citi report, up to $5 trillion worth of CBDCs could be circulating in major economies across the world, half of which would be tied to distributed ledger technology. Source link

Binance Rejected Justin Sun’s Offer to Buy His Huobi Stake: Source

Binance wasn’t interested because of rumors that Huobi has ties to mainland China, which Binance wants nothing to do with, according to the person, who requested anonymity. In an interview last month with CoinDesk TV, Sun said Huobi wants to attain a license in Hong Kong and launch a new exchange there called Huobi Hong Kong. Source

Why You Need to Understand Layer 1 Protocols

It appears regulators don’t care about the functionality or reliability of blockchains, especially as some of the loudest opponents of crypto are in favor of central bank digital currencies – a type of digital currency issued by a central bank. The animosity feels more related to the decentralized nature of crypto – the ability to take fiat currency and exchange it for another asset of value, without the need for a central body (central banks, regulators, politicians, conventional banks, etc.). Source LayerProtocolsUnderstand CryptoX Portal

Web3 Experiential Tokens and Asset Pricing

(i)immature and rapidly developing technology underlying Digital Assets, (ii) security vulnerabilities of this technology, (iii) credit risk of Digital Asset exchanges that may hold an Account’s Digital Assets in custody, (iv) regulatory uncertainty around the rules governing Digital Assets, Digital Asset exchanges and other aspects and parties involved with Digital Asset transactions, (v) high volatility in the value/price of Digital Assets, (vi) unclear acceptance of some or all Digital Assets by users and global marketplaces, and (vii) manipulation or fraud resulting from the pseudo-anonymous manner in which ownership of Digital…

NFTs unlock physical biodegradable vinyl records

Hype around nonfungible tokens (NFTs) has cooled down, however innovative use cases for these digital assets continue to appear on the scene. Particularly in the music industry, which has been fertile soil for use cases of emerging Web3 tools in recent years. On April 5th the DJ, producer and eco-warrior BLOND:ISH announced a new NFT project, which once purchased unlocks physical copies of her latest album on vinyl record. Cointelegraph reached out to BLOND:ISH for more details on the usage of NFTs as a gateway to unlocking physical items as…

Cryptocurrency Exchange Hacks and Insurance: Risks, Coverage, and Limitations

Individuals and institutions are increasingly using cryptocurrency exchanges to purchase, sell, and trade cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. However, the rise of cryptocurrency exchanges has also resulted in an increase in security risks and hacks, with several high-profile exchanges falling prey to cyberattacks resulting in the loss of millions of dollars in cryptocurrency. We will look at the risks, coverage, and limitations of cryptocurrency exchange insurance in this piece. The Dangers of Cryptocurrency Exchange Hacks The possibility of cyberattacks and hacks is one of the most serious risks…