Wallet infrastructure provider and digital asset custodian BitGo have signed a non-binding letter of intent to acquire fintech infrastructure provider Prime Trust, according to an announcement on June 8. The terms of the agreement were not disclosed. If the deal goes through, BitGo will acquire Prime Trust’s payment rails and cryptocurrency IRA fund and increase its wealth management offerings. Prime Trust’s Nevada Trust Company will also join BitGo’s network of regulated trust companies in South Dakota, New York, Germany, and Switzerland. Prime Trust’s API infrastructure and exchange network will “map over 1:1”…

Day: June 8, 2023

Mizar review: impact on automated trading

Thanks to cryptocurrencies, smart contracts and smart trading, traders can gain access to a multi-billion dollar industry and even profit from trading cryptocurrencies. This review aims to provide a comprehensive understanding of the Mizar trading platform, highlighting its capabilities in facilitating trade execution and position management across multiple connected exchanges from a centralized interface. It will also explore additional features such as DCA bots, copy trading, and smart trading available on the platform. What Is Mizar? Mizar is a platform that simplifies crypto trading and makes it accessible to all…

FTX Bankruptcy Judge Says U.S. Courts Should Have Full Control Over Exchange’s $7.3B in Assets

While liquidators based in the Bahamas argued that a Bahamian judge should preside over part of the bankruptcy case, FTX’s restructuring advisors, who took over the exchange after the company’s founder Sam Bankman-Fried was arrested on fraud charges last December, argued against the request. Source

Crypto market is like 1920s stock market, full of ‘fraudsters’

In a June 8 speech at the Piper Sandler Global Exchange & Fintech Conference, United States Securities and Exchange Commission (SEC) Chair Gary Gensler compared the current crypto market to the 1920s U.S. stock market, saying that it is full of “hucksters,” “fraudsters” and “Ponzi schemes.” Just as Congress cleaned up the stock market by enacting securities laws, the current SEC can also clean up the crypto market by applying these laws, he argued. JUST IN: SEC Chair Gary Gensler says crypto is all “hucksters, fraudsters, scam artists.” pic.twitter.com/1xRWUMzbel —…

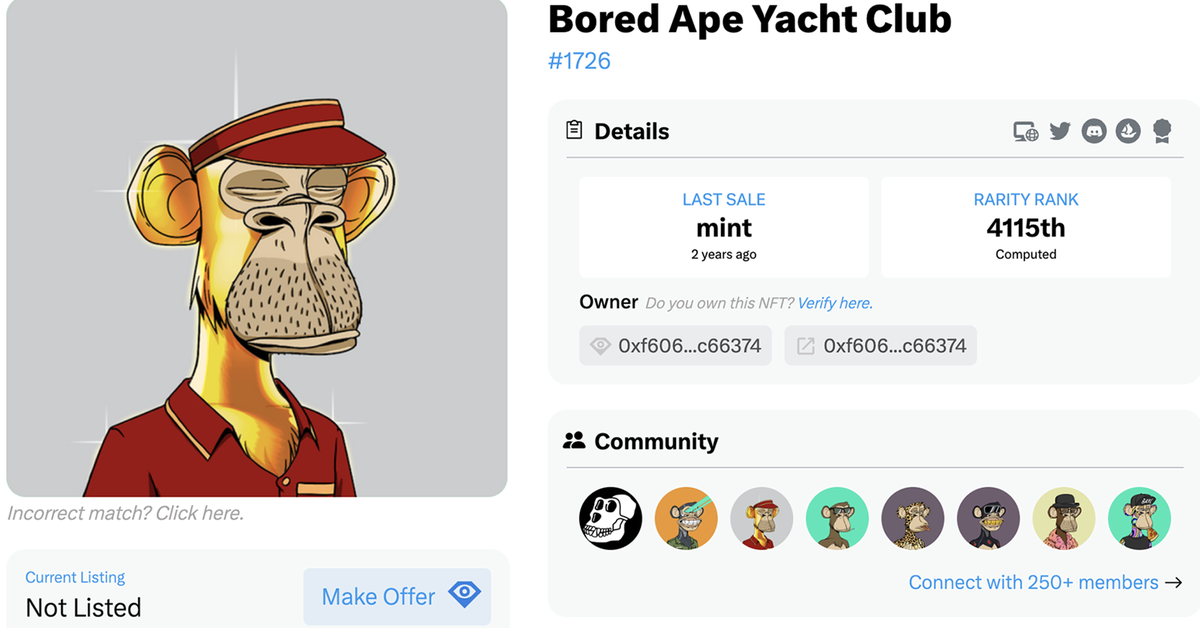

NFT Inspect Releases NFT Chrome Browser Extension

“Twitter has emerged as the central communication platform for all things crypto and NFTs, where industry news, project updates and community discussions take place in real-time,” president of NFT Inspect Oliver Cohen told CoinDesk. “However, we noticed a lack of comprehensive tools that could harness the power of Twitter and provide users with a complete solution for tracking, analyzing and engaging with the crypto and NFT ecosystem.” Source

MetaMask and Fireblocks join forces to offer institutional investors secure defi

MetaMask Institutional and Fireblocks have joined forces to offer institutional investors and blockchain developers a solution for secure defi and web3 access, combining wallet security, portfolio management, and connectivity to thousands of decentralized applications. Enabling secure web3 access MetaMask Institutional (MMI), a leading web3 wallet for organizations, and Fireblocks, a platform for secure DeFi access and crypto operations, have announced a partnership deal aimed at providing institutional investors and builders with an unparalleled suite of services. Through the collaboration, the team will combine the best-in-class wallet security offered by Fireblocks,…

Solana Foundation: SOL is 'Not a Security'

SOL, the native token of the Solana blockchain, was declared an unregistered security in this week’s SEC lawsuits against crypto exchanges Binance.US and Coinbase. Source

Bitcoin price races toward $27K, but a swift recovery is not confirmed by market data

Bitcoin might have displayed strength by quickly recovering from the $25,500 support level on June 6, but that doesn’t mean that breaking above $27,500 will be an easy task. Investors still expect stricter regulatory scrutiny after FTX’s bankruptcy in November 2022, including the recent suits against Coinbase and Binance. A total of eight cryptocurrency-related enforcement actions have been undertaken by the United States Securities and Exchange Commission (SEC) over the past six months. Some analysts suggested the SEC is attempting to redeem itself for failing to police FTX by taking action against the…

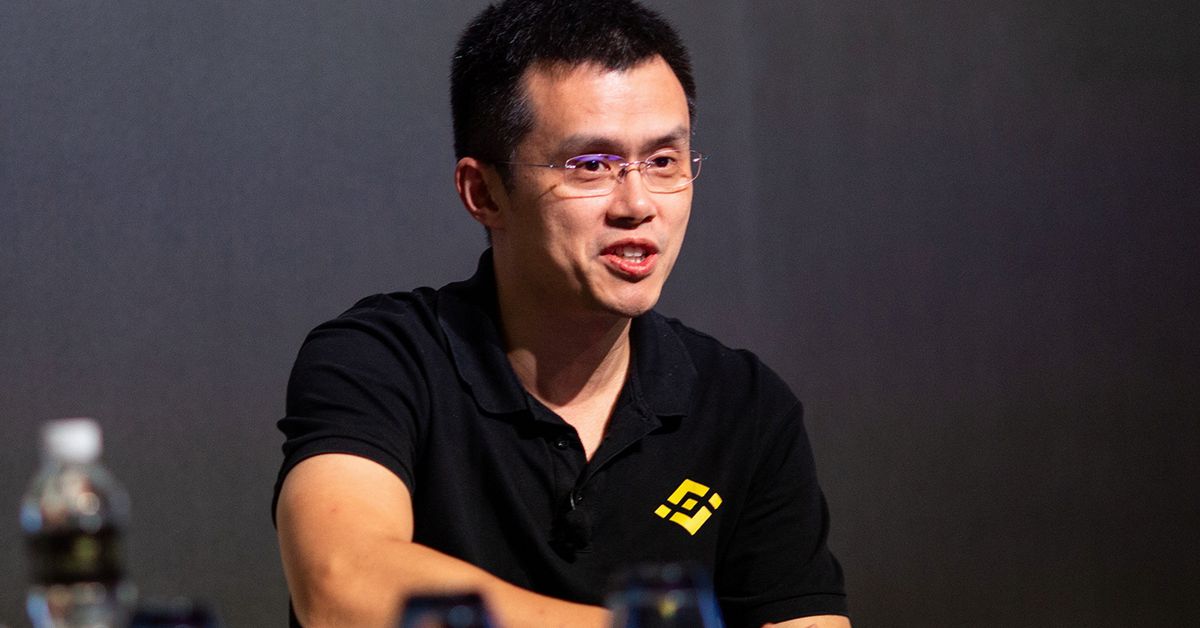

Can Binance Survive the SEC’s Charges?

And so, the question is whether Binance can continue business as usual, and whether it can really be – in the long term – a going concern. It’s an odd question, in a way, at least in my limited perspective, given the seriousness of the allegations in the SEC’s suit. Over-and-above the bog-standard “you didn’t get the appropriate license to operate, sir” complaints that Coinbase also faces, Binance and CZ have been accused of endangering customer funds, enabling if not facilitating wash trading on Binance.US, improperly moving customer funds without…

Coinbase CEO’s stock sale was probably not planned to occur a day ahead of SEC suit

Coinbase CEO and co-founder Brian Armstrong sold company shares the day before the United States Securities and Exchange Commission (SEC) filed a complaint against the exchange for securities law violations. The transaction caused a minor stir in the Twitter cryptoverse, as Armstrong avoided a sharp loss by doing so. SEC records show that Armstrong sold 29,730 shares of the company on June 5, the day before the SEC suit. Coinbase’s share price plummeted the day of the suit, with an initial dip of 20%. Armstrong has been selling Coinbase stock…