The U.S.-based exchange said on Friday that users should withdraw USD as soon as possible following the SEC’s “extremely aggressive and intimidating tactics” against the company. The platform has suspended U.S. dollar deposits and will delist USD trading pairs shortly, while it temporarily transitions to a crypto-only exchange. Source

Day: June 9, 2023

Robinhood will end support for 3 tokens named in SEC lawsuits

Cryptocurrency and stock trading app Robinhood announced it will be ending support for Cardano, Polygon and Solana — all tokens labeled as unregistered securities by the United States Securities and Exchange Commission (SEC) in its recent legal actions against crypto exchanges Binance and Coinbase. In a June 9 update, Robinhood said it will end support for the three tokens starting on June 27 following a review. In a Twitter thread, the firm specifically cited the SEC’s actions as reasons for the delisting, saying the Coinbase and Binance lawsuits “introduced a cloud…

CFTC Wins Lawsuit Against Crypto Derivatives Operator Ooki DAO

A federal judge has sided with the U.S. Commodity Futures Trading Commission (CFTC) in a lawsuit alleging decentralized autonomous organization (DAO) Ooki DAO offered unregistered commodities, quashing an industry-wide perception that decentralized finance (DeFi) actors are immune to regulatory scrutiny. Source

The SEC’s summer crackdown, Apple’s ‘spatial computing,’ and Mercado Bitcoin gears up

After a period of relative calm, the United States Securities and Exchange Commission (SEC) kicked off its summer crypto crackdown by targeting two major exchanges, Binance and Coinbase. A total of 13 charges have been filed against Binance. One of the allegations in the suit claims that funds from Binance and Binance.US were commingled into an account controlled by the Changpeng Zhao-associated company, Merit Peak. As for Coinbase, the SEC claims it has been offering unregistered securities and was never registered as a broker, securities exchange or clearing agency. Many…

DOJ unseals Mt. Gox charges targeting two Russian nationals

The U.S. Department of Justice (DOJ) has unsealed charges against two Russian nationals, Alexey Bilyuchenko and Aleksandr Verner, in connection with the 2011 hacking incident involving Mt. Gox, a prominent bitcoin exchange at the time. The charges accuse Bilyuchenko and Verner of engaging in a conspiracy to commit money laundering. Old charges brought to light Court documents reveal that two Russian nationals, Alexey Bilyuchenko, 43, and Aleksandr Verner, 29, have been charged with conspiracy to launder around 647,000 bitcoins following their involvement in the Mt. Gox hack. In addition, Bilyuchenko…

US Justice Department charges two men in Mt. Gox Hack

The United States Justice Department has unsealed charges against two men it says are responsible for the $400 million hack of former Bitcoin (BTC) exchange Mt. Gox. According to the announcement, 43-year-old Alexey Bilyuchenko and 29 year old Aleksandr Verner allegedly conspired to launder 647,000 BTC they stole from Mt. Gox through a hack of the exchange’s servers. Bilyuchenko is also charged with conspiring to operate the BTC-e exchange, which was shut down in 2017 due to money laundering allegations. The DOJ unsealed charges related to the 2011 hack of…

New Details in the BTC-e Exchange Case

Fully 300,000 of those coins went to BTC-e, another now-defunct crypto exchange. BTC-e was shut down by the FBI in 2017, and the exchange’s alleged operator, Russian national Alexander Vinnik, was arrested in Greece and later extradited to the U.S. to face charges for “computer intrusions and hacking incidents, ransomware scams, identity theft schemes, corrupt public officials and narcotics distribution rings.” Source

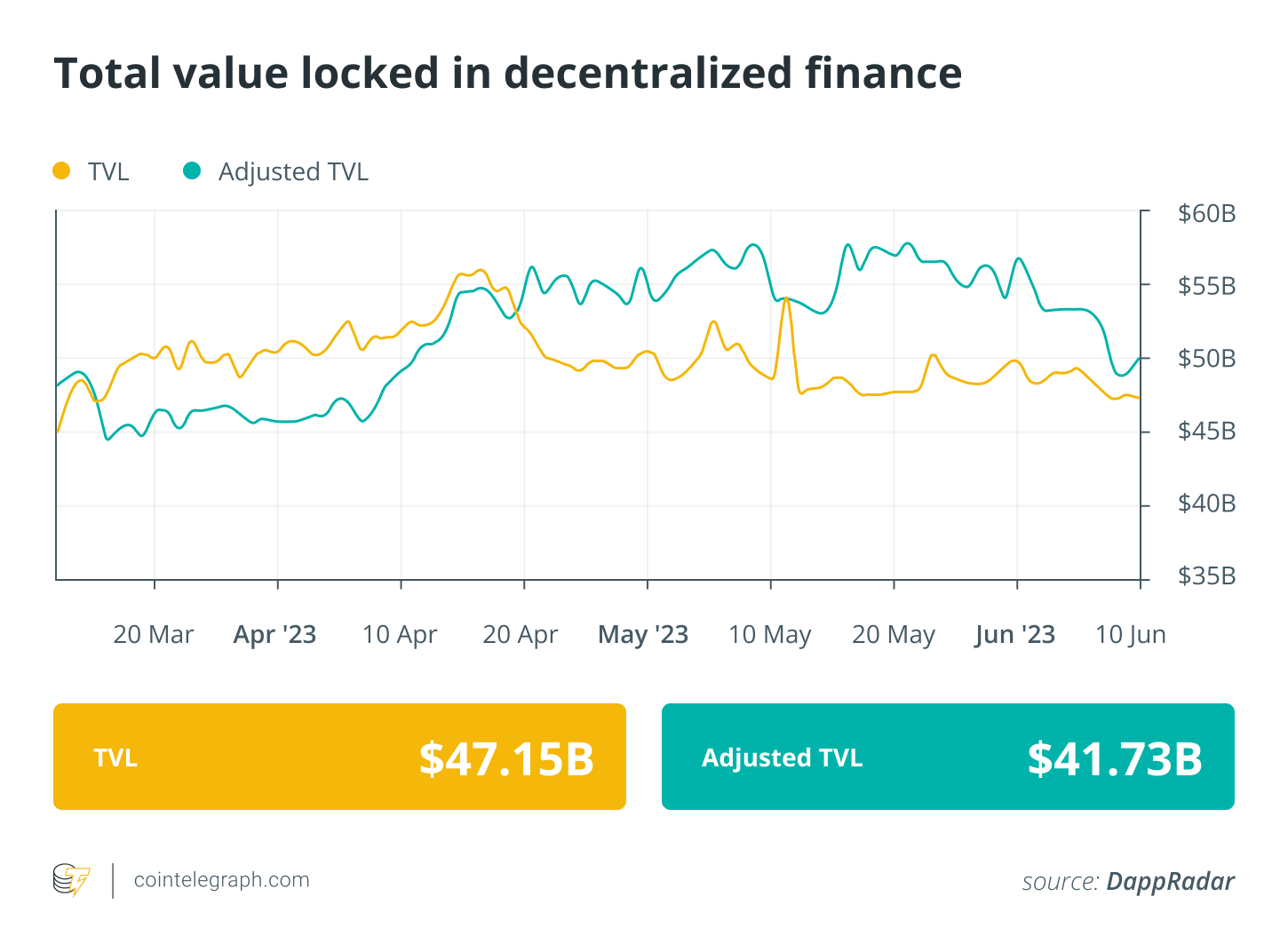

Real-world asset protocols outperform DeFi blue chips due to tokenization wave

Real-world asset (RWA) protocols have become a hot trend within decentralized finance (DeFi) circles. An RWA protocol is a decentralized application that allows entities to tokenize and trade real-world assets. These assets range from stocks and government bonds to real estate and commodities. They are also known as asset tokenization protocols. DeFi provides certain advantages over TradFi by making the smart contracts transparent and enabling a wide degree of financialization of assets by making them divisible, transferable and tradable on decentralized platforms. The top uncollateralized lending protocols for institutions, TrueFi…

DeFi volumes surge 444% after Binance, Coinbase lawsuits: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you the most significant developments from the past week. The United States Securities and Exchange Commission’s (SEC) lawsuits against two leading centralized crypto exchanges — Binance.US and Coinbase — have led to a surge in DeFi trading volume over the past week. While SEC’s enforcement action against centralized exchanges has hogged the headlines, the securities regulator is actively pursuing cases against the decentralized exchange (DEX) ecosystem as well. Crypto venture capital…

Binance’s BNB Token Saw Millions in Sell Orders Right Before SEC Lawsuits

BNB’s open interest, the total number of outstanding derivative contracts held by investors, also increased in the first nine hours of June 5 by nearly $30 million, according to Coinalyze, which also occurred before the 11:15 am news of the SEC alleging Binance commingled customer funds and operated an unregistered securities exchange. Source